The Delhi High Court ordered the unblocking of an enterprise’s electronic credit ledger after one year since its initial blocking.

In doing so, a division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta mentioned Rule 86A of the CGST Rules, 2017, which specifies the conditions of use of the amount available in the electronic credit ledger. It specifies that the taxpayer’s credit ledger cannot be blocked after 1 year.

The Directorate General of GST Intelligence issued a show cause notice to the applicant on suspicion of it being a non-existent firm. Thereafter, refusing the GST input tax credit (ITC) to the tune of Rs 29,13,246, the impugned order was passed.

Applicant, blocking has arrived from the period 1st January, 2024 to 31st November, 2024, but even at present, i.e., as on April 2025, it has not been unblocked.

Under rule 86A the Commissioner or authorised officer holds the grounds to assume that the available credit of input tax in the electronic credit ledger has been bogusly taken or is not eligible, can be for the reasons to be recorded in writing, not permit the debit of an amount equivalent to such credit in electronic credit ledger.

However, sub-section (3) states that the restriction will cease to have effect one year after the restriction is imposed.

The High Court held that, “The blocking of the GST ITC shall be lifted because it has been more than one year.”

It then moved to grant liberty to the revenue to take action against the applicant if the allegation of operating a fake firm is verified.

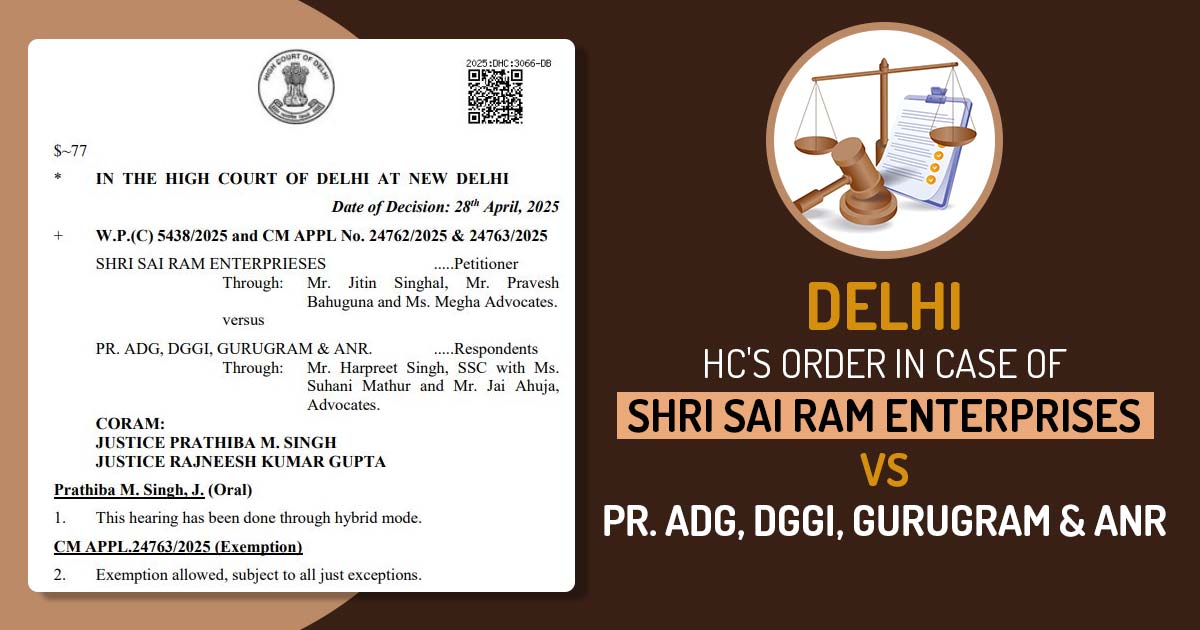

| Case Title | Shri Sai Ram Enterprises Vs. PR. ADG, DGGI, Gurugram & Anr |

| Case No. | W.P.(C) 5438/2025 |

| Counsel For Appellant | Mr. Jitin Singhal, Mr. Pravesh Bahuguna and Ms. Megha Advocates. |

| Counsel For Respondent | Mr Harpreet Singh, SSC with Ms Suhani Mathur and Mr. Jai Ahuja, Advocates. |

| Delhi High Court | Read Order |