The Delhi High Court has affirmed the authority of the Directorate General of GST Intelligence (DGGI) to provisionally attach a taxpayer’s bank accounts, rejecting a petition that contested the provisional attachment of two accounts held at ICICI Bank by the Principal Additional Director General of the DGGI. This ruling reinforces the DGGI’s powers under the GST framework to take preemptive actions against financial assets in instances of suspected tax evasion or non-compliance.

M/S GMG Tradelink Pvt. Ltd., the applicant’s counsel, claimed that the DGGI officer was not duly authorised to pass the order, citing that u/s 83 of the CGS Tax Act, 2017, only a ‘Commissioner’ can exercise the power of provisional attachment.

Opposite to that, the court relied on Notification No. 14/2017 dated 1st July 2017, produced by the counsel of the respondent.

Section 83. “Provisional attachment to protect revenue in certain cases.[(1)Where, after the initiation of any proceeding under Chapter XII, Chapter XIV or Chapter XV, the Commissioner is of the opinion that for the purpose of protecting the interest of the Government revenue it is necessary so to do, he may, by order in writing, attach provisionally, any property, including bank account, belonging to the taxable person or any person specified in sub-section (1A) of section 122, in such manner as may be prescribed.

(2) Every such provisional attachment shall cease to have effect after the expiry of a period of one year from the date of the order made under sub-section (1).”

The division bench comprising Justice Prathiba M. Singh and Justice Shail Jain said that the notification equates the rank of Principal Additional Director General, GST Intelligence, with that of a Principal Commissioner of GST.

The court, concerning the same notification, discovered the applicant’s contention that the officer’s jurisdiction was unsustainable.

As per that, the court disposed of the writ petition. But it allowed the applicant to submit fresh objections against the attachment and asked the DGGI to communicate the causes for the provisional attachment within 2 weeks.

Read Also: Delhi High Court Rejects GST Writ Over Fraudulent ITC, Grants One Month for Appeal with Pre-Deposit

As per the court, all the legal remedies shall be available to the applicant subsequently.

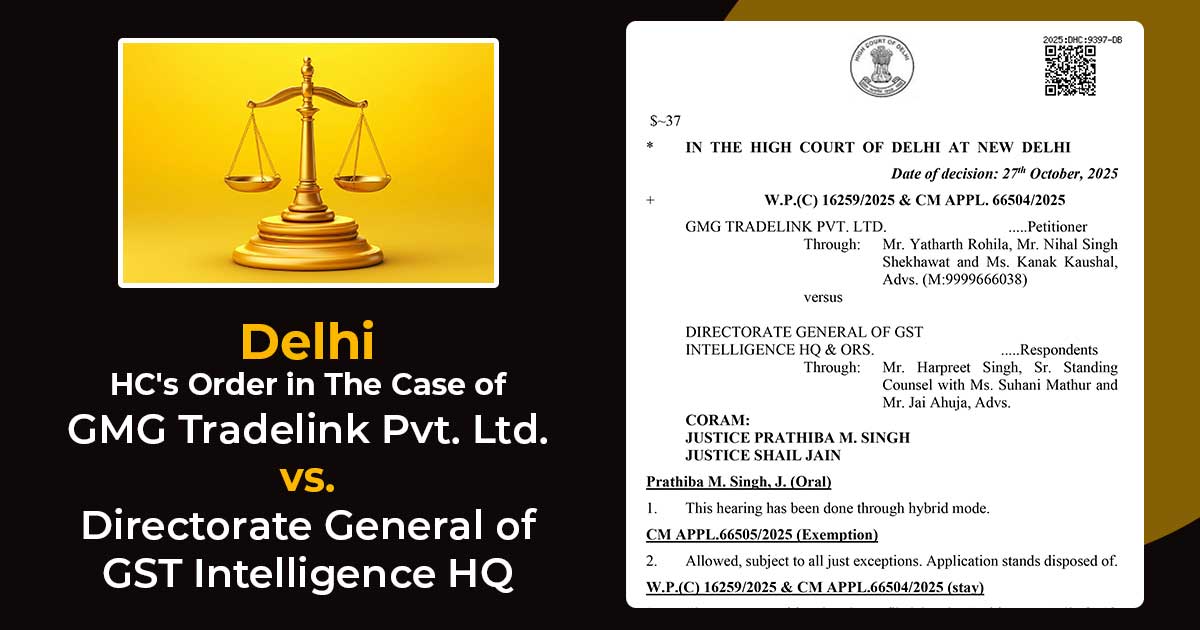

| Case Title | GMG Tradelink Pvt. Ltd. vs. Directorate General of GST Intelligence HQ |

| Case No. | W.P.(C) 16259/2025 & CM APPL. 66504/2025 |

| For the Petitioner | Mr Yatharth Rohila, Mr Nihal Singh Shekhawat and Ms Kanak Kaushal |

| For the Respondents | Mr Harpreet Singh, Ms Suhani Mathur and Mr Jai Ahuja |

| Delhi High Court | Read Order |