The Delhi High Court underlined that the Goods & Services Tax (GST) regime intents to facilitate the assessees and not to make them suffer due to technical failures & faults so the software system should be maintained & regularly updated with the amendments in rules & regulations.

Delhi HC said that the rights of individuals registered under GST ‘cannot be subjugated’ to the incompetent and inadequate software systems taken up by the tax authorities. The court’s ruling is anticipated to be beneficial for the GST registered assessees who are facing hardship due to technical problems.

The court ruled, “The software systems adopted by the respondents have to be in tune with the law, and not vice-versa. The system limitations cannot be a justification to deny the relief, to which the petitioner is legally entitled,” in an issue associated with the repudiation of the use of unutilized Input Tax Credit (ITC)

Harpreet Singh, Partner at KPMG, appreciated this ruling and said that the order seems to give long-term positive domino results under GST. As the people’s dependence on technology is increasing, it is quite obvious that technical insufficiencies and outdated software would adversely affect the statutory filings or the ideal balances at the portal.

He said, “Post this order, dealers should be able to claim their rightful benefits/ dues without worrying about technological handicaps, so long as other statutory conditions are satisfied.”

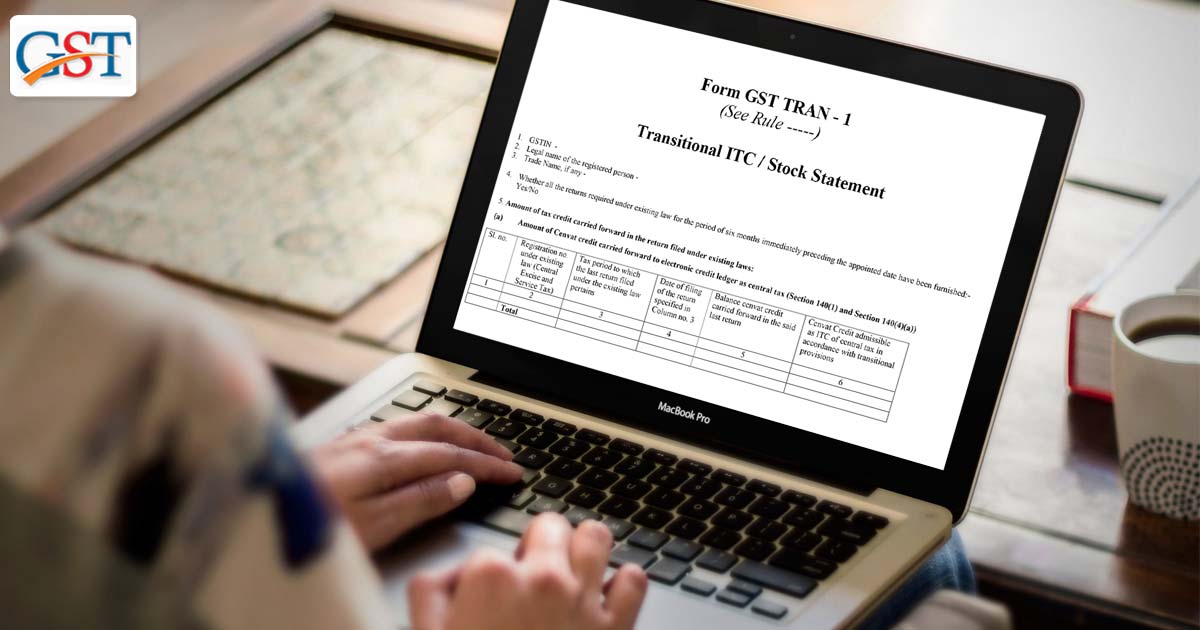

The rollout of the Goods & Services Tax regime was followed by the introduction of a special provision that allows the transition of credit amassed under VAT, service tax or excise duty to GST. This opportunity to claim transitional credit is available for all the assessees other than the registered dealer who opted for the GST Composition Scheme

However, transitional credit was subject to some conditions. The first condition limit the availability of the credit to the condition when the returns for the last six months, i.e., from January 2017 to June 2017 were filed under the VAT regime.

The second condition mandates the filing of Form TRAN 1

The third condition restricts the rectification of Form TRAN 1 to only one chance.

Respondents’ Stagnation

The petitioner appealed HC to file the grievance of the inactivity of the respondents i.e. the GST authority at the state level and their inability to allow the flawless transfer of the credit available by dint of unutilized input tax.

The petitioner filed the petition as he was unable to use and employ the ITC while exporting in the months of July and August 2017. As a result of which, the petitioner had to give away INR1.37 crore which could have been saved or invested if he had been allowed to use ITC that had accumulated even before the introduction of the GST regime.

The court, after taking hearing both sides, concluded that the petitioner cannot be made at disadvantage due to incompetencies of the respondents in designing glitch-free transition from pre-GST regime to GST mechanism w.e.f. July 1, 2017.

“The business activity in the country cannot be expected to come to a standstill, only to await the respondents making the GST system workable,” it said.

“Unfortunately, even after the passage of over two years, the respondents have not remedied their omissions and failures by taking corrective steps. They continue to take shelter in the limitations in, and the inability of their software systems to grant a refund, despite the same being justified,” the court stated.