Due to the increasing number of GST-related cases being presented, and to ensure that these cases, particularly those arising from procedural issues, are resolved quickly, the department has requested that at least two officials from its litigation section be assigned to handle these matters.

It was cited by the division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta that these officials can coordinate with distinct Commissionerates of the GST department and give instructions to the Department’s counsels, in an expedited way.

“There are a large number of GST related matters, which are being filed before this Court on a daily basis. The issues, which are raised by the Petitioners, are both procedural and substantive,” the bench mentioned.

The procedural issues include a lack of communication regarding replies, failure to send personal hearing notices and non-receipt of emails and other notifications from the Department.

Read Also: Delhi HC: DGGI and State GST Authorities Cannot Conduct Parallel Probes on the Same Issue

Apart from some of the problems that are raised, comprises that the applications for the refund are not being processed.

The court expressed, “such cases can be disposed of on the first date itself subject to the concerned Department giving instructions to its Counsels.”

It urged the Principal Chief Commissioner of CGST & Central Excise (Delhi Zone) to consider assigning at least two officials for this purpose.

The direction arrived with the petition furnished via a trader contesting an adverse order found that the written submissions furnished via it were not acknowledged by the department, and no notice for a personal hearing was issued.

Now, the court has asked the department to place on record the proof of the GST portal to depict the way in which the personal hearing notice has been shared with the applicant.

The Case is Listed Next on April 21

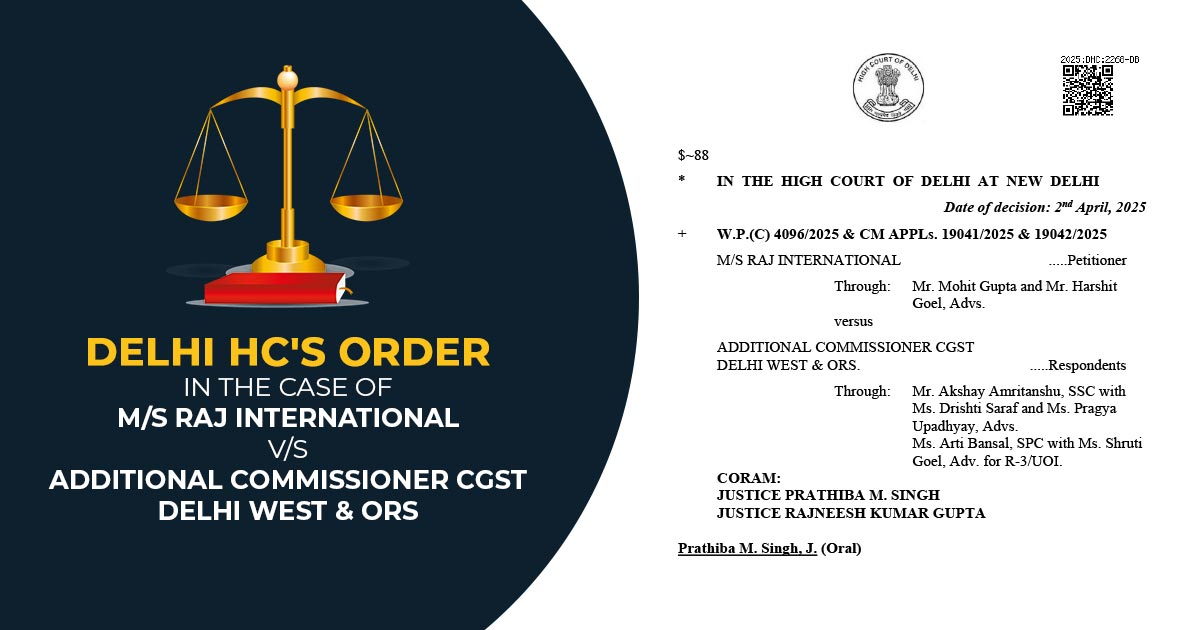

Appearance: Mr Mohit Gupta and Mr Harshit Goel, Advs for Petitioner; Mr Akshay Amritanshu, SSC with Ms Drishti Saraf and Ms Pragya Upadhyay, Advs. Ms. Arti Bansal, SPC with Ms. Shruti Goel, Adv. for R-3/UOI.

| Case Title | M/S Raj International vs. Additional Commissioner CGST Delhi West & ORS |

| Citation | W.P.(C) 4096/2025 & CM APPLs. 19041/2025 & 19042/2025 |

| Date | 02.04.2025 |

| Petitioner by | Mr. Mohit Gupta and Mr. Harshit Goel |

| Respondents by | Mr. Akshay Amritanshu, Ms. Drishti Saraf, Ms. Pragya Upadhyay, Ms. Arti Bansal, and Ms. Shruti Goel |

| Delhi High Court | Read Order |