The Delhi High Court has stated that individuals accused alongside a company or a Hindu Undivided Family can independently request to resolve the legal issues or offences related to taxes under the Income Tax Act of 1961.

A division bench of Acting Chief Justice Vibhu Bakhru and Justice Tushar Rao Gedela ruled that the co-accused is not required to await the filing of an application for compounding by the company or the HUF.

Undergoing the same, it laid on the norms furnished via the Central Board of Direct Taxes, stipulating that where an offence is executed by a Company or HUF as described in section 278B or 278C of the Act, an application for compounding may be filed separately or conjointly via the main accused and any persons regarded to be guilty of the offence.

The applicant for the matter was the company’s director and under sections 276B and 278B of the IT Act it hauled up for not depositing TDS for the pertinent period. His application towards compounding of the offences was denied based on the reason that the company has not submitted any such application.

It was ruled by the Magistrate Court that the application of the applicant for compounding cannot be regarded on a stand-alone basis.

Pertinent to note that the proceedings against the company were stayed as per the moratorium under the Insolvency and Bankruptcy Code, 2016.

According to the High Court paragraph 11 of the CBDT guidelines dated 17.10.2024 was evident that “the co-accused are now entitled to apply separately for compounding of the offences.”

The guideline reads- in cases of offences by a company or HUF, the main accused or coaccused may apply separately or conjointly. On compounding charges payment for the offence as defined under these procedures, by any one of them separately or jointly, the Competent Authority shall compound the offences of the main accused along with all the co-accused, vide an order under section 279(2) of the Act.

The Delhi High Court under the aforesaid has set aside the impugned order and remanded the compounding application to the competent authority to decide afresh.

Appearance: Mr. Tanmay Nagar, Mr. Surinder Sinha & Ms. Shamli Verma, Advocates for Petitioner; Ms Saroj Bidawat, SPC for UOI. Mr Ruchir Bhatia, SSC, Mr Anant Mann, JSC and Mr Abhishek Anand, Advocate for Respondents

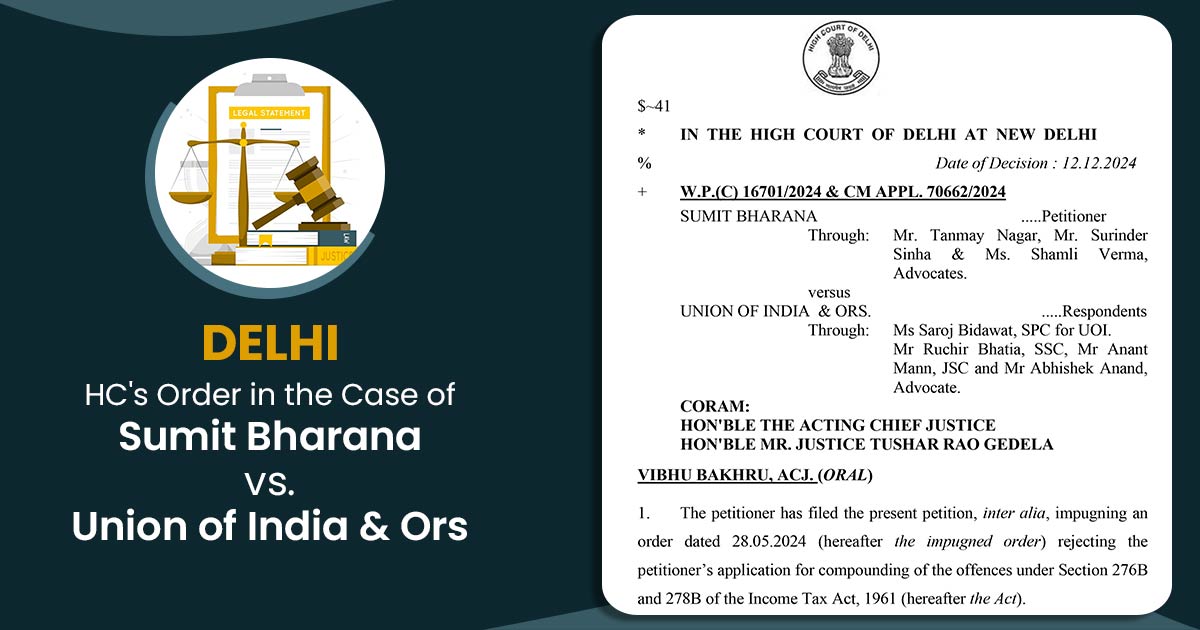

| Case Title | Sumit Bharana vs. Union of India & Ors |

| Citation | W.P.(C) 16701/2024 & CM APPL. 70662/2024 |

| Date | 12.12.2024 |

| Counsel For Appellant | Mr. Tanmay Nagar, Mr. Surinder Sinha & Ms. Shamli Verma |

| Counsel For Respondent | Ms Saroj Bidawat, Mr Ruchir Bhatia, SSC, Mr Anant Mann, JSC and Mr Abhishek Anand |

| Delhi High Court | Read Order |