The issuance of the process has been quashed by the Bombay High Court which is served on the directors of the company, M/s. Hubtown Ltd., for offences punishable u/s 276B and 278B of the Income Tax Act for the delay in depositing the TDS as the TDS deducted by the company had already been deposited with interest as given u/s 201(1A).

The bench of Justice Prithviraj K. Chavan has marked that the department has chosen not to invoke the provisions of Section 221 read with Section 201 (1) of the Income Tax Act to levy penalties against the company or the principal officer of the company for “failure to pay the whole or any part of the tax, as required by or under this Act.

The department cannot be allowed to prosecute the applicant for the identical substantive act, which is also categorized as an “offence” u/s 276B of the Income Tax Act. Also trial of the petitioners by the criminal court cannot be acceptable, which would be equivalent to misuse of the process by the court.

U/s 279(1) of the Income Tax Act, the income tax officer has filed complaints along with sanction to prosecute the applicants for the violations referred to hereinabove. The complaints alleged that the taxpayer was incorporated under the Companies Act, 1956.

It was brought to the notice of the department by the taxpayer that it had deducted amounts of Rs. 13,11,35,617 in the FY 2011–2012 but delayed paying it before the government Treasury within the stipulated time limit.

An SCN has been issued before the taxpayer and its directors. The applicants and the directors tendered their explanations to the respondent department.

But the department concluded that the taxpayer and its directors are liable to pay the tax as per section 204 of the Income Tax Act and hence, committed default u/s 200 of the Income Tax Act r/w Rule 30 of the Income Tax Rules without reasonable cause or to pay the deducted tax under the various sections of the Income Tax Act from payments made to various parties, which amounts to an offence punishable u/s 276B read with Section 278B of the Income Tax Act.

It was argued by the directors that they are not the principal officers and they can be held vicariously obligated to furnish that they satisfy the legal needs of section 278B, which are more or less analogous with the provisions of Section 141 of the Negotiable Instruments Act, 1881, Section 34 of the Drugs and Cosmetics Act, as well as Section 10 of the Essential Commodities Act.

The complaint lacks necessary elements, as the individual being pursued through a proxy must hold both managerial authority and accountability for the company’s operations. It could not presumed from only being the director that the person has the charge to conduct the business of the company. No automatic presumption of vicarious obligation.

Read Also: Bombay HC Quashes Jurisdictional AO’s Exercise U/S 148A Conducted Outside Faceless Mechanism

It was claimed by the directors that no order as contemplated u/s 201(1) r/w 201(3) of the Income Tax Act has been passed treating any of the petitioners as “Principal Officer” of the company and by which such principal officer is “considered to be a taxpayer in default.”

No notice u/s 2 (35)(b) of the Income Tax Act has been issued by the “Assessing Officer” to any of the applicants to treat any of them as the “Principal Officer” of the company. It is a fact that the TDS deducted by the company has already been deposited with interest as furnished u/s 201(A) of the Income Tax Act.

It was argued by the department that as per section 204 of the Income Tax Act, the applicants are responsible as directors of the company to Tax Deducted at Source (TDS). Only because the demand was made before the show, notice would not dismiss the offence.

While permitting the petition of the directors the court ruled that it is incumbent on the department to prove that the offence in question has been conducted with the consent or connivance of or is attributable to any neglect on the part of any director, manager, secretary, or other officer of the company. The same director, manager, secretary, or other officer of the company would considered to be guilty of that offence and would be accountable to be proceeded against and punished.

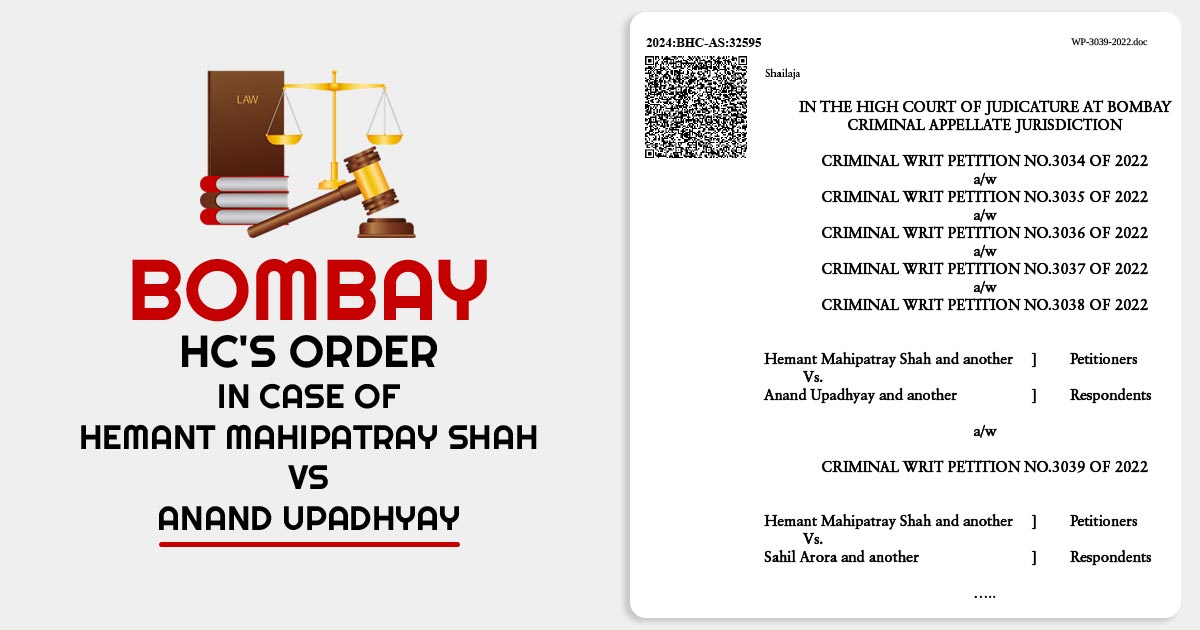

| Case Title | Hemant Mahipatray Shah Vs Anand Upadhyay |

| Petitions No. | 3034 of 2022, 3035 of 2022, 3036 of 2022, 3037 of 2022, 3038 of 2022 and 3039 of 2022 |

| Date | 12.08.2024 |

| Counsel For Petitioner | Puneet Jain, Pawan Ved, Sajal Yadav, Aishwarya Kantawala, Diya Jayan i/b Mr. Meghashyam Kocharekar |

| Counsel For Respondents | Suresh Kumar |

| Bombay High Court | Read Order |