The Supreme Court’s decision in Union of India v. Rajeev Bansal has been interpreted by the Delhi High Court to explain the time duration surviving u/s 149 of the Income Tax Act, 1961 for issuing reassessment notices.

The period between 20 March 2020 to 30 June 2021 would not be included in the limitation, because of Section 3(1) of the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020, a division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar concluded.

Additionally, the period between the issuance date of the impugned reassessment notices (if coming between 20 March 2020 to 30 June 2021) up to the date of the decision rendered by the Supreme Court in the Ashish Agarwal case (04 May 2022), shall also not included under the third proviso to Section 149(1).

As per the bench, the third period is obligated to be not included in the time for filing the objections via the taxpayer.

“It is the aforenoted three periods which are thus liable to be added to the date when the notice for reassessment was issued to answer the question as to whether the reassessment notices could be said to be barred by the timelines as prescribed by Section 149 of the Act,” it carried.

The development arrives in a batch of petitions arguing that a reassessment measure stated in the breach of time durations listed in section 149 before the revisions introduced by the Finance Act, 2021 would be obligated to be struck down on that score.

It claimed that the first proviso to Section 149(1) drives the department to regard the stipulations of time that control the start of reassessment measures grounded in the limitation specified in that provision, as it was before its amendment in 2021.

In the batch, various additional questions raised were responded to as follows:

It was claimed by the applicant that by section 151A which introduced faceless assessment, the jurisdictional Assessing Officer does not have any authority to perform a reassessment.

The bench cited its ruling in T.K.S. Builders (P) Ltd. v. Income Tax Officer (2024) where it was mentioned that both the Faceless Assessment Officer and Jurisdictional Assessment Officer have concurrent jurisdiction as far as assessment, re-assessment or re-computation u/s 147 of the Income Tax Act.

Read Also: What is Faceless Income Tax Assessment & How it Works for Taxpayers?

Also, it denied the applicant’s claim that once reassessments are initiated via investigation it shall be incumbent on the respondents to move merely as per Sections 153A or 153C as the case may be, and to the exclusion of Section 148 of the Act.

It mentioned Pr. Commissioner of Income Tax-7 v. Naveen Kumar Gupta (2024) where the High Court had ruled that Section 153C does not by itself prevent an Assessing Officer from reopening assessments under Section 147/148 of the Act, based on info discovered during a search conducted u/s 132 or requisition made under Section 132A of Act concerning another person.

The contention was thrown to section 148 notices that have been furnished excluding a DIN as obligated by Circular No. 19/2019 issued by the CBDT.

Recommended: Steps to Verify an Income Tax Notice Using DIN with Benefits

But the HC does not reply citing that Commissioner of Income Tax v. Brandix Mauritius Holdings Ltd. (2023) where it was carried that assessments, appeals, and orders issued without a Document Identification Number (DIN) can have no standing in law, is presently developing subject matter of a challenge before the Apex Court and interim order is functioning therein.

Till now the challenge to CBDT Instruction No. 1/2022 dated 22 May 2022 is related to being opposite to the Apex courts decision in Union of India vs Ashish Agarwal (2023), High Court articulated the issue would no longer endure under the following decision handed down by the Apex Court in Rajeev Bansal case.

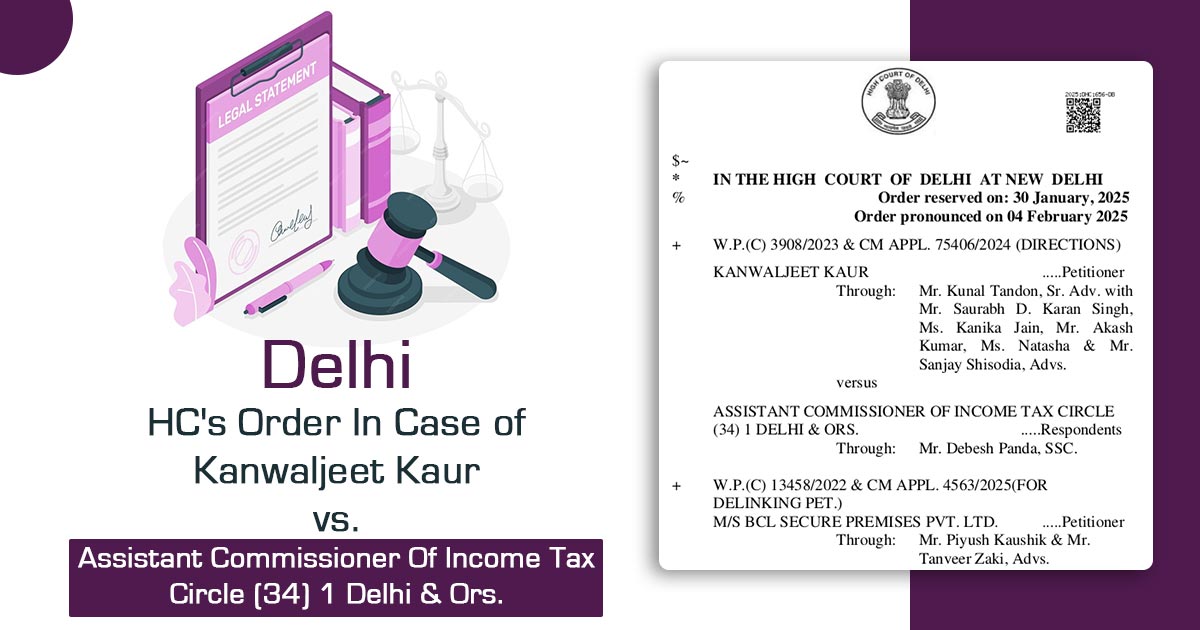

| Case Title | Kanwaljeet Kaur vs. Assistant Commissioner Of Income Tax Circle (34) 1 Delhi & Ors. |

| Citation | W.P.(C) 3908/2023 & CM APPL. 75406/2024 |

| Date | 30.09.2022 |

| Counsel For Appellant | Mr. Kunal Tandon, Sr. Adv. with Mr. Saurabh D. Karan Singh, Ms. Kanika Jain, Mr. Akash Kumar, Ms. Natasha & Mr. Sanjay Shisodia, Advs |

| Counsel For Respondent | Mr. Debesh Panda, SSC |

| Delhi High Court | Read Order |