The delay of 145 days in filing an appeal by the taxpayer on the ground that the taxpayers inadvertently did not get the orders sent via email, as many of these orders are going to spam folders, has been condoned by the Cuttack Bench of Income Tax Appellate Tribunal (ITAT).

It has been noted by the bench of George Mathan (Judicial Member) and Manish Agarwal (Accountant Member) that we are seized of many cases where the taxpayer inadvertently did not get the orders sent via email, as many of these orders are going to spam folders. In any matters, there is a delay of 145 days. It is because, regarding the explanation given by the taxpayer, we opined that the explanation is likely, and therefore, we condone the delay of 145 days in filing the appeal to the CIT (A).

The petitioners’ plea was delayed by 145 days before the CIT (A). The CIT(A) has acknowledged that there was confusion concerning citing the dates of the order as 22.7.2022 and 22.9.2022. The reason provided for the delay was that the taxpayer was not able to receive the order from the assessing officer in time.

It was considered by the CIT(A) that the ITBA system represents that the order u/s 154 of the Income Tax Act was on 27th September 2022 and was served via the taxpayer’s email.

It was argued by the taxpayer that the problem is concerned with the claim of depreciation. If in case the depreciation is not been claimed by the taxpayer then the depreciation is obligated to be permitted under the regulation, whether the taxpayer claims it or not. On technicality, on appeal to the CIT(A), significant justice must not be denied.

Read Also: Current Income Tax Return Filing Due Dates

As per the council, the problem might be restored to the file of the CIT(A) for the adjudication on the merits.

The problem has been restored by the tribunal in the petition to the file of the CIT(A) for the adjudication on merits post granting the taxpayer a fair chance of being heard.

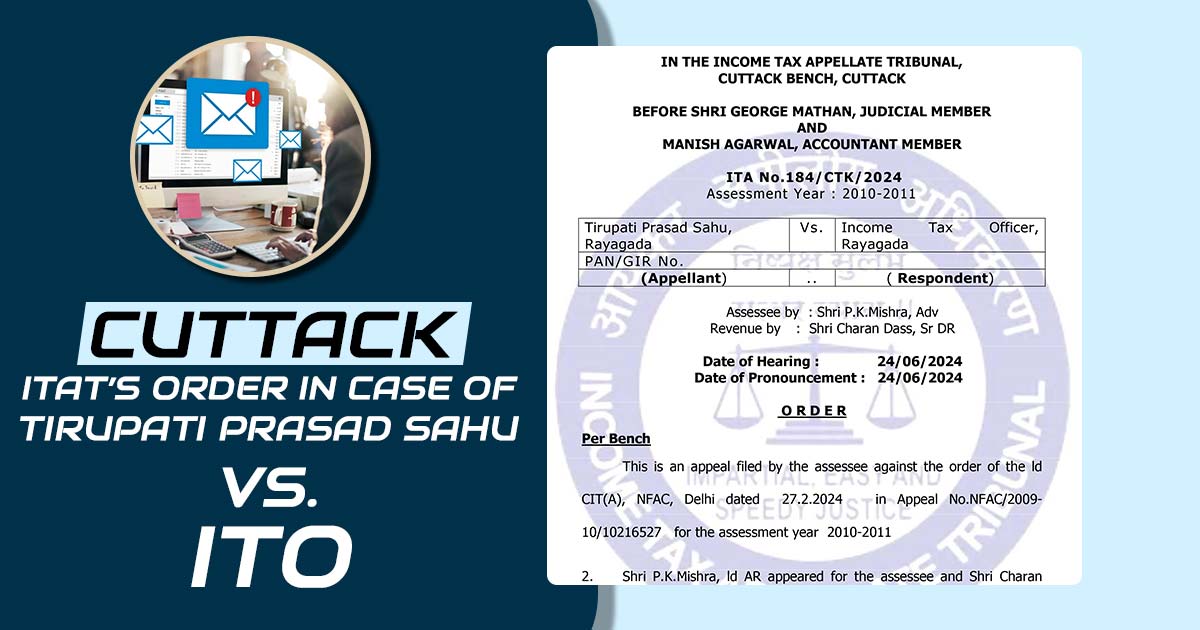

| Case Title | Tirupati Prasad Sahu Vs. Income Tax Officer |

| Case No. | ITA No.184/CTK/2024 |

| Date | 24.06.2024 |

| Assessee by | Shri P.K.Mishra |

| Respondent by | Shri Charan Dass |

| Cuttack ITAT | Read Order |