The Invoice Management System (IMS), effective from October 1, 2024, has been introduced to simplify and standardize the process of claiming Input Tax Credit (ITC) in GSTR-3B returns.

Previously, taxpayers would often claim ITC based solely on GSTR-2B without thorough reconciliation, which they used to file for the ITC in their 3B filings. With the Invoice Management System (IMS) under GST, taxpayers must now reconcile ITC at the invoice level to ensure accurate reporting in GSTR-3B.

What’s The Process?

Taxpayers are now required to perform 2 levels of reconciliation, the first reconciliation is to match ITC from the books with ITC reflected in GSTR-2B. The second reconciliation is to align the ITC from the first reconciliation with the data available on the IMS dashboard.

The ITC calculated in the initial reconciliation must be matched with the figures shown on the IMS dashboard. This first reconciliation is conducted to determine the total eligible ITC.

Read Also: Why Was My GSTR-2B Not Generated for October 2024? Find Reasons

For instance, consider an invoice from July 2024, where the ITC was recorded in GSTR 2B for July but claimed in OCT. 2024 due to the receipt of goods that month. In this scenario, the ITC will not appear in the October 2B, necessitating a first-level reconciliation.

ITC Claiming Procedure Using GST IMS

To claim ITC, taxpayers should:

- Access the Services (Returns) tab on the GST portal

- Accept invoices that taxpayers are allowed to claim ITC

- Mark invoices that do not meet the conditions of Section 16 of the CGST Act and are eligible for ITC as Pending

- Avoid rejecting invoices, as rejection renders their ITC invalid for future claims

How to File GSTR-3B Using GST IMS?

After completing the reconciliation process:

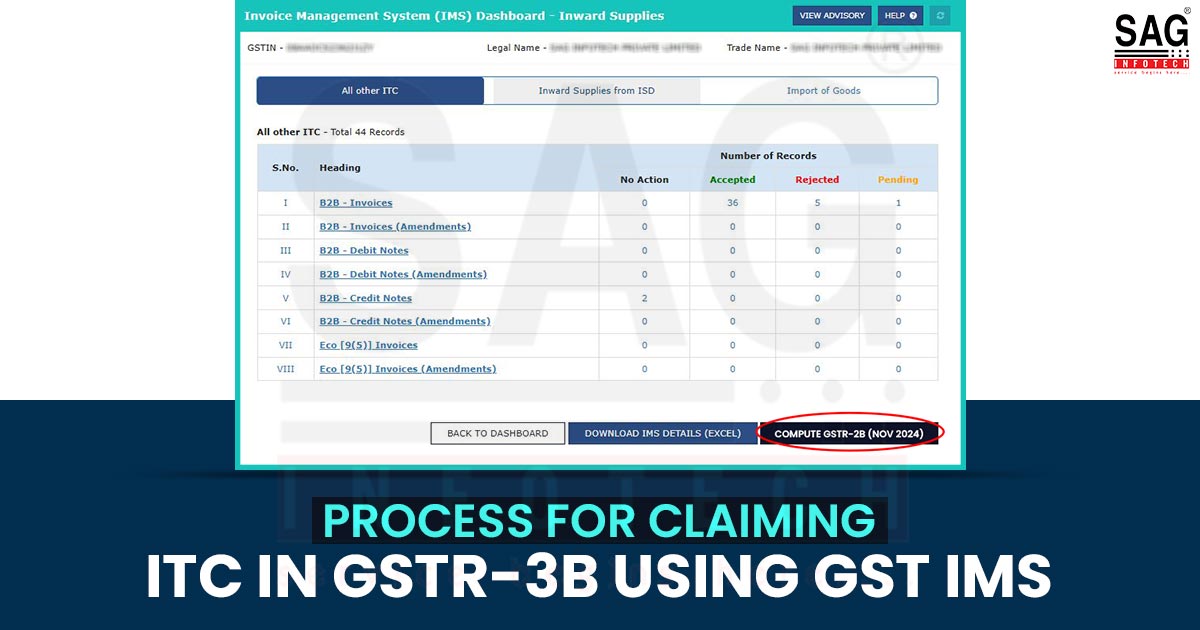

- On the IMS dashboard, click Compute GSTR-2B, which transfers the taxpayer’s invoice data into the GSTR-3B return.

Note: Debit and credit notes must be either accepted or rejected; they cannot be marked as pending. - Navigate to the Return Dashboard, select the filing period, and input the relevant figures.

- Follow the usual steps to file GSTR-3B.

Important Precautions to Keep in Mind

- Avoid rejecting invoices, instead, keep them marked as pending.

- Do not blindly accept all invoices because claiming ITC on ineligible invoices may attract penalties and interest.

- Take timely action on invoices otherwise, all ITC will be auto-populated in GSTR-3B.

- Use the Communicate with Taxpayer feature on the portal to notify suppliers about missing invoices.

- Use IMS as a tool to facilitate thorough reconciliation.

While IMS increases the workload for taxpayers and professionals, its advantages outweigh the challenges. By enabling systematic ITC reconciliation, IMS helps reduce litigation and notices while streamlining the overall ITC process. This initiative by the government creates a mutually beneficial system for both taxpayers and authorities.