In this detailed article, we have provided comprehensive information about the Corporate Identification Number (CIN), which is assigned to companies settled in India by the Registrar of Companies (ROC). We will be discussing what the CIN is, how to check it, and its significance in different business documents submitted to the Ministry of Corporate Affairs (MCA).

Define Corporate Identification Number (CIN)?

The Ministry of Corporate Affairs provides a 21-digit alphanumeric identifier known as the Corporate Identification Number (CIN) to businesses registered under the ROC in different Indian states.

All types of businesses in India are provided with a CIN, which are:

- One Person Company (OPC)

- Nidhi Company

- Limited Liability Company

- State-owned enterprises

- Companies under Section 8, and others

However, Limited Liability Partnerships (LLP) registered in India receive a 7-digit identifying number that is LLPIN (Limited Liability Partnership Identifying Number) from the ROC.

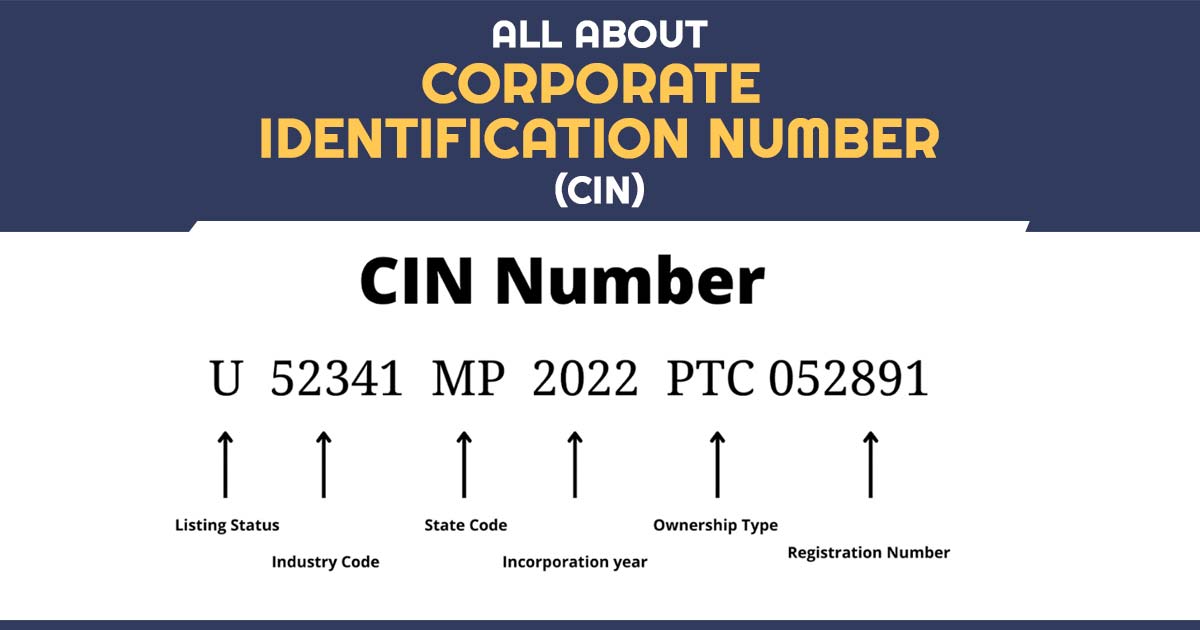

Easy Explanation of the CIN’s 21-Digits

The first character within a CIN indicates whether the company is “Listed” or “Unlisted” on the Indian stock exchange. Therefore, it serves to determine the company’s stock market status. A CIN begins with “L” if it’s listed and “U” if it’s not.

The following five numerical digits classify the company’s economic activity or industry affiliation. This classification is based on the specific economic activities carried out by the company. The Ministry of Corporate Affairs (MCA) has assigned unique numbers to each industry category.

The following two letters represent the Indian state where the company is registered. For example, “GJ” represents Gujarat, “MH” represents Maharashtra, and “KA” represents Karnataka, following a pattern akin to vehicle registration numbers.

The next four digits in the CIN indicate the year of the company’s establishment.

The subsequent three letters indicate the company’s type, distinguishing between public limited or private limited status. For instance, “FTC” means the company is a foreign corporation subsidiary, while “Government of India” signifies that the business is owned by the Indian government.

The final six numerals determine the registration number assigned by the Registrar of Companies (ROC).

CIN Numbers and Their Importance

The 21-digit CIN holds great importance as it simplifies the identification of critical corporate data. It is used to access fundamental information about registered businesses in India through the MCA.

Read Also: Important Key Points to Know About LLP Registration India

A company’s CIN (Corporate Identification Number) must be included in all transactions with the relevant ROC (Registrar of Companies), allowing the tracking of its activities since its establishment by the ROC.

CIN numbers are required to identify and track organizations across various levels of information maintained by MCA/ROC. They provide details about the ROC and the company’s identification.

What is the Process for Obtaining your Company’s CIN number?

Once you’ve categorized your business type, follow these steps to obtain a CIN:

- Acquire a Digital Signature Certificate (DSC)

- Secure a Director Identification Number (DIN)

- Complete new user registration

- Proceed with the company incorporation process

- Incorporate the company

After receiving the incorporation documents, the Ministry of Corporate Affairs (MCA) will review and approve the application. After completing the validation, the CIN is assigned.

Corporate Incorporation Number Uses

Every company that is made in India is required to specify its Corporate Identification Number on different documents which possess:

Penalty for Failure to Mention CIN in Compliance

If the above-mentioned needs are not complied then a penalty of Rs 1000 per day will be there on the defaulting company and on its, every officer is in default, till such default continues. However, the maximum penalty for this default is confined to Rs 1,00,000.

Altering Corporate Identification Number

A CIN which is furnished to every registered company for the objective of identification could be altered in specific matters like-

- Any alteration in the listing status of a company

- Any alteration in the location or change of state where the registered office of the company is located

- Any modification in the industry/sector to which a company belongs

Conclusion

CIN, or Corporate Identification Number, is a unique code issued by the Registrar of Companies (ROC) that combines the company’s identification and operational details.

Important FQAs for CIN

Q.1 What is the method to apply for CIN?

A CIN is an alphanumeric number provided to the company on the registration date via the Registrar of Companies. The CIN of the company is cited in its certificate of incorporation.

Therefore a CIN number is provided to the company automatically when it is incorporated and approved via the Registrar of Companies.

Q.2 What is the method to find the CIN number of my company?

From the MCA website, you can find the CIN of the company via following the below procedure-

- Proceed to the MCA website

- Click on the ‘MCA Services’ tab on the home page

- Click on the ‘Check CIN’ option from the drop-down list under the ‘Company Services’ option

- Select the ‘Search Based on Existing Company / LLP Name’ option

- Type the company name under the ‘Existing Company’ option, enter the captcha code, and click on the ‘Search’ button

- The company’s CIN will be shown

Q.3 Is CIN allotted to LLP?

No. A CIN is allotted to a registered company, and LLPIN (LLP Identification Number) is allotted to a Limited Liability Partnership (LLP) via the Registrar of Companies. Therefore, CIN is allotted exclusively to companies registered under the Companies Act, 2013, not LLPs

Q.4 Are CIN and GST similar?

No. A CIN is the identification number provided to the registered companies via the Registrar of Companies during the issue of the company registration certificate. While GSTIN is the identification number furnished before the companies and the businesses registered under the GST law. Therefore both are not the same and pose distinct functionally

Q.5 Is it obligatory that CIN is mentioned on the invoices, bills, and receipts of the company?

Yes. according to section 12(3)(c) of the Companies Act, a company should print its name, the address of its registered office, and the CIN in all its business letters, billheads, letter papers, notices, and other official publications. Therefore, a company should mention its CIN on its bills, invoices, receipts, and e-mails sent to outside parties.