Chennai ITAT has ruled that if a person from a Chinese resident earns a salary for work done in China, that income won’t be taxable in India, even if the money is deposited in an Indian bank account.

Manu Kumar Giri (Judicial Member) and S.R. Raghunatha (Accountant Member) said that “the AO has disallowed the exemption claimed concerning salary received in India for services rendered in China as taxable in India since the salary has been credited by BMW India Pvt Ltd into the assessee’s account at Chennai from the payroll account of Chennai……. The salary income for services rendered in China has been rightly offered tax by the assessee in China.”

Read Also: ITAT Chennai Deletes INR 12.14 Lakh Addition Under Section 69 of the IT Act

The taxpayer in this case, an employee of BMW India Private Limited, was on an assignment/secondment to BMW Brilliance Automotive Limited during the FY 2021-22 relevant to the AY 2022-23 and was rendering services/exercising employment with BMW China in China during this period.

The taxpayer was based in China and was physically present in China on an International assignment with BMW China, and was rendering services in China during the FY 2021-22.

For less than 60 days, the taxpayer was in India during the FY 2021-22 and qualified as a Non-Resident in India as per Explanation (b) to Section 6(1) of the Act. During the FY 2021-22, the Appellant was present in India for “Nil” days.

As the taxpayer entitled as a Non-resident of India during FY 2021-22 and a Resident of China for the Calendar year 2021 and exercised his employment/rendered services in China with BMW China, the taxpayer asserted exemption for the obtained salary in India for the services rendered in China, under Article 15(1) of the India- China DTAA r.w.s. 90 of the Income Tax Act.

AO has disallowed the exemption claimed in his Final Assessment Order, and the Dispute Resolution Panel (‘DRP’) issued directions.

The taxpayer who received a salary is exempt from Section 5(2) read with Section 9(1)(ii) of the Income Tax Act, as it does not accrue or arise to him in India since the services have been rendered outside India. The scope of the total income of an NR subject to tax in India has been specified under section 5(2) of the Act.

The Tribunal cited that “since the assessee qualified as a Non-resident of India during FY 2021-22 and a Resident of China for the Calendar year 2021 and exercised his employment/rendered services in China with BMW China, the assessee claimed exemption of Rs.1,53,65,359/- concerning salary received in India for services rendered in China, under Article 15(1) of the India- China DTAA r.w.s. 90 of the Act and accordingly filed his return of income for the A.Y. 2022-23 on 18.07.2022 and claimed a refund of Rs 52,22,590.”

Read Also: Alert for NRIs! Taxable Income with ITR Conditions in India

The bench mentioned that the income from salary for services rendered in China has been proposed to be taxed by the taxpayer in China.

The tribunal in the above permitted the appeal.

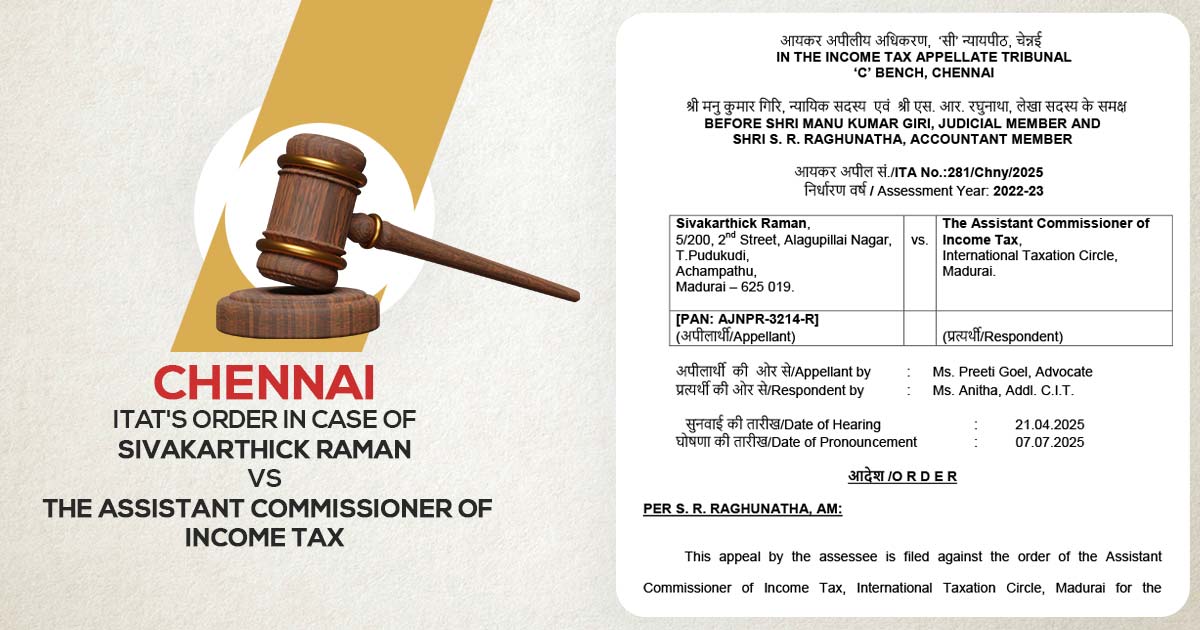

| Case Title | Sivakarthick Raman vs. The Assistant Commissioner of Income Tax |

| Case No. | ITA No.:281/Chny/2025 |

| Appellant by | Ms. Preeti Goel, Advocate |

| Respondent by | Ms. Anitha, Addl. C.I.T. |

| Chennai ITAT | Read Order |