The Calcutta High Court recently issued a ruling regarding the treatment of voluntary tax payments under the Goods and Services Tax (GST) framework.

The court determined that the GST department acted improperly by considering a voluntary GST payment made under Section 73(5) of the CGST Act as a reaction to a show cause notice under Section 74. The court emphasised that the department should have sought clarification from the taxpayer before making such an assumption.

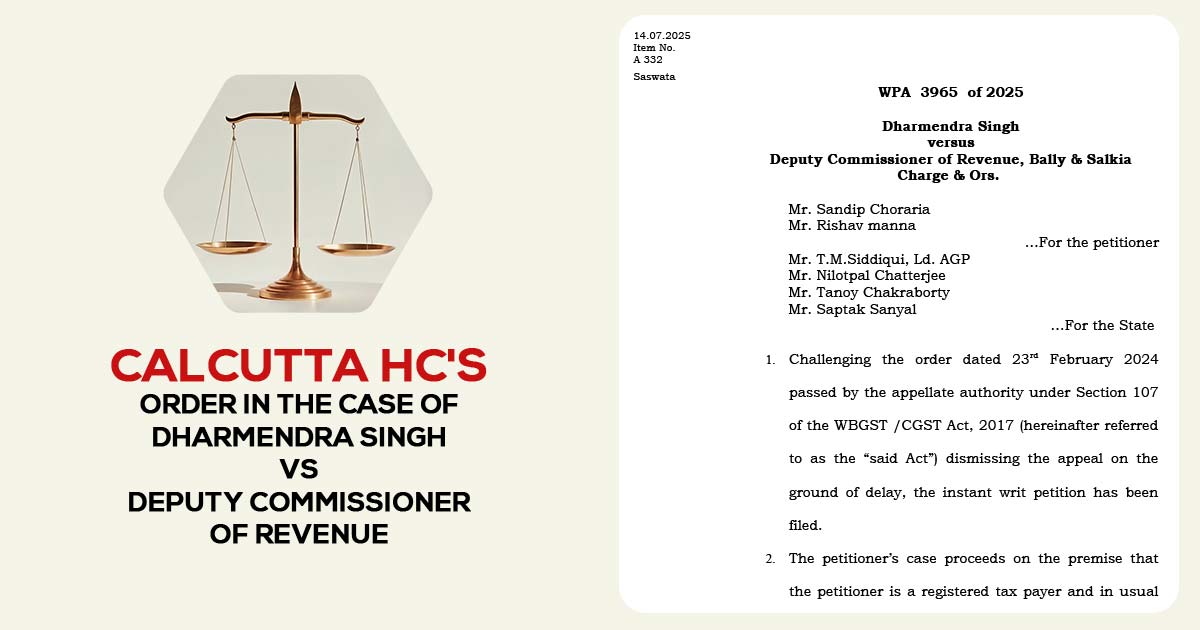

A writ petition has been submitted by Dharmendra Singh challenging the order dated 23 February 2024, passed by the appellate authority, rejecting his appeal on the ground of delay. The original adjudication order on 17 February 2023, also contested by him, held him liable for incorrectly taking the input tax credit (ITC) based on transactions with a deregistered supplier.

The petitioner’s attorney contended that payments were made voluntarily through Form GST DRC-03 in March and May 2022, following Section 73(5) of the CGST Act. He emphasised that these payments were made independently and were not in reaction to the show-cause notice issued under Section 74 of the CGST Act.

The counsel, it was incorrectly assumed that such payments were admissions of the obligation and proceeded to recover the whole demand from the electronic credit ledger of the applicant before the appeal period had lapsed.

The counsel for the GST department stated that the applicant has neither responded to the Show Cause Notice (SCN) nor appeared for the personal hearing, despite being given an opportunity.

The counsel claimed that partial payments made with the use of form DRC-03 show partial compliance and that the department proceeded to pass the final order only after giving the applicant sufficient notice. Appeal was rejected since it was submitted after the allowable time limit u/s 107 of the CGST Act, they cited.

The department does not ensure the intent of the applicant for the voluntary payment before considering the same as compliance with the SCN u/s 74, the single-judge bench comprising Justice Raja Basu Chowdhury expressed.

The court said that before the adjudication, the applicant had made part payments; however does not specify that he accepted liability. Recovery of the whole disputed amount before the lapse of the regulatory appeal period was not appropriate, particularly when the applicant has no chance to challenge the demand.

Read Also: GST Penalty Blocked: Calcutta HC Restrains Action Without Prior Approval

The court discovered that in the lack of a functioning appellate tribunal, the applicant does not hold any remedy and therefore, the writ petition was maintainable. A mistake was made by the department in the law by considering the voluntary payment u/s 73(5) as a reply to the section 74 notice without asking for clarification, the court ruled.

Both the adjudication and appellate orders have been set aside by the court, and the case has been remanded to the proper officer for a fresh decision. The applicant was asked to provide a response to the SCN in 2 weeks. The proper officer was asked to pass a fresh order post, furnishing the applicant a chance to be heard. The writ petition was disposed of.

Calcutta High Court Remands Matter- The department made a mistake in treating Voluntary GST Payment u/s 73(5) as a Response to S. 74 SCN.

| Case Title | Dharmendra Singh vs Deputy Commissioner of Revenue |

| Case No. | WPA 3965 of 2025 |

| For the Appellant | Mr. Sandip Choraria and Mr. Rishav Manna |

| For Respondents | Mr. T.M.Siddiqui, Mr. Nilotpal Chatterjee, Mr. Tanoy Chakraborty, Mr. Saptak Sanyal |

| Calcutta High Court | Read Order |