The Income Tax Appellate Tribunal (ITAT) in Chennai has sent a case back to the Assessing Officer (AO) for reassessment. The decision was made because a public charitable trust operating educational institutions filed its audit report under Form 10BB late.

Under sections 12AA and 10(23C)(vi) of the Income Tax Act, 1961, the trust, registered, had filed its income tax returns for the assessment year (AY) 2017-18, declaring ‘NIL’ income. At the time of the assessment, it was discovered that the trust had failed to file the needed audit report in Form 10BB within the stipulated time.

The trust had furnished the audit report in Form 10B dated March 29, 2018, which was beyond the deadline, and has not submitted Form 10BB, which is obligatory to claim the exemption u/s 10(23C)(vi) of the Act. Thereafter, the trust filed Form 10BB, electronically dated December 4, 2019, and asked for the condonation for the delay.

The claimed exemption has been refused by the assessing officer (AO), and the income of the trust was considered as levied to tax under the applicable rates to an Association of Persons (AOP).

The Assessing Officer (AO) disallowed a depreciation claim of ₹37,08,051 on fixed assets, reasoning that these assets had been previously accounted for as income application in earlier years. Consequently, the AO permitted only ₹1,040 in depreciation for assets acquired during the current year.

The taxpayer appealed to the Commissioner of Income Tax (Appeals) [CIT(A)], but there were no promising results, and therefore, the taxpayer appealed before the ITAT for relief.

The counsel of the taxpayer claimed that the delay in filing Form 10BB must not disqualify the trust from claiming the exemption since the form was available in the assessment proceedings. Also, the representative mentioned that the CIT(E) has not ruled on the condonation request till now.

ITAT set aside the impugned order and remanded the case back to the AO for a fresh assessment, asking the AO to regard the decision of the Commissioner of Income Tax (Appeals) (E) on the condonation petition once it is made. The taxpayer has been asked by the ITAT to notify the AO concerning the status of his condonation application.

The plea of the taxpayer for the statistical objectives has been permitted by the ITAT comprising Manoj Kumar Aggarwal (Accountant Member) and Manu Kumar Giri (Judicial Member).

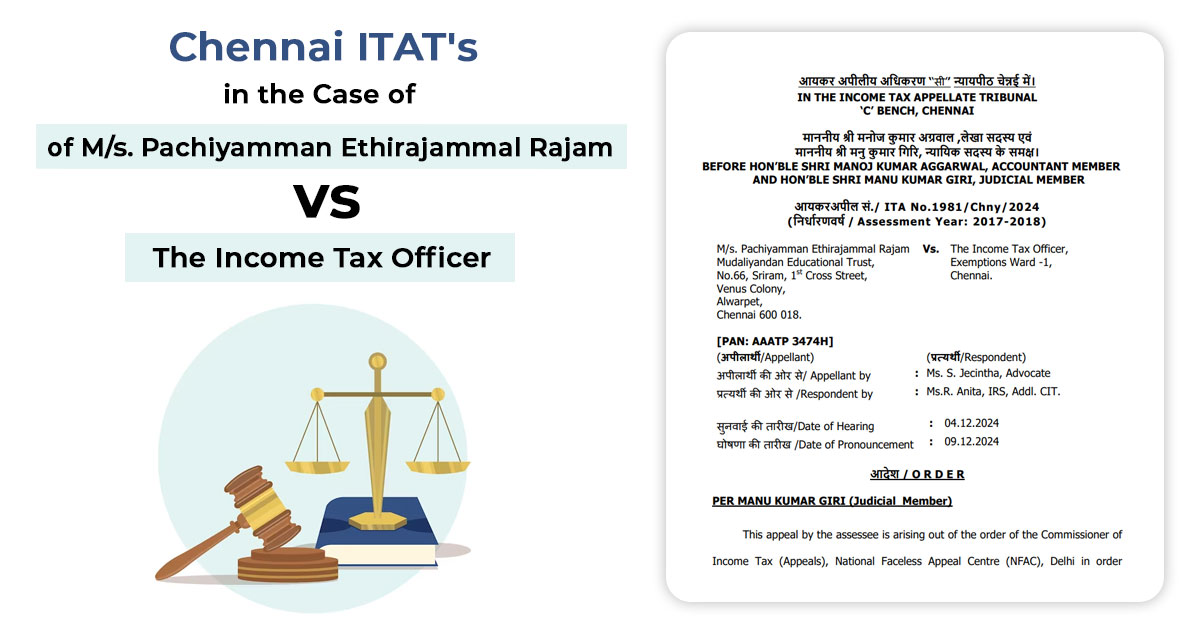

| Case Title | M/s. Pachiyamman Ethirajammal Rajam vs. The Income Tax Officer |

| Citation | ITA No.1981/Chny/2024 |

| Date | 09.12.2024 |

| Appellant by | Ms. S. Jecintha, Advocate |

| Respondent by | Ms.R. Anita |

| Chennai ITAT | Read Order |