The taxpayer’s consultancy services to the foreign university/foreign group entity do not fall under the category of “intermediary services”, and the taxpayer is qualified for the advantage of “export of services,” New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT).

The Bench of Binu Tamta (Judicial Member) and (Technical Member) has said that “it may also be appreciated that the final decision of admitting a student is that of the foreign university. The assessee, on the other hand, is acting in its independent capacity as a business promoter and does not act as an agent of the university. The fact that the assessee is rendering services on its account, it cannot be treated as an “intermediary”. On the conclusion that assessee is not an “intermediary”, Rule 9 of POPS Rules will not be applicable and consequently Rule 3 would apply.”

Applying Rule 3 of POPS Rules, the foreign universities, being the service receiver located outside the taxable territory does not comes within the service tax on the simple principle as furnished in section 66B of the Finance Act, 1994 that for service tax to be charged in terms of Chapter V of the Act, the service would required to be given within the taxable territory, added the Tribunal.

The taxpayer/appellant is involved in furnishing a range of consultancy services, along with exploring development opportunities in the Indian market for international educational organisations.

Taxpayers agree with their group entities located outside India, who has the arrangement or agreements with foreign universities, and these foreign group entities have subcontracted their whole exercise to the taxpayer.

The taxpayer was categorising its activities as export of services in its ST-3 Returns and not paying any service tax.

On the allegation that the taxpayer is acting in a representative capacity for its customers, i.e., the foreign universities, while dealing with the students and was, thus, acting as an agent or broker, a Show Cause Notice (SCN) was issued.

The taxpayer is involved in arranging /facilitating of enrolment of students in foreign universities and was actually operating as an “intermediary” within the definition of 2(f)of POPS Rules, as per the department.

Therefore, as per Rule 9(c) of the POPS Rules, the place of provision of service is in India, and therefore, the amount obtained in place of the services of arranging/facilitation was liable to service tax under the Act.

The demand was validated on adjudication, keeping that the taxpayer is functioning as an “intermediary” in terms of Rule 2(f) of POPS Rules and as the taxpayer’s location is in India, the provision of service is in the taxable territory, which shall be levied to tax in the taxpayers hands. The taxpayer, being dissatisfied, had filed a plea to the Tribunal.

The Tribunal cited that “the assessee has agreed with the foreign universities/foreign group entities, whereby it is evident that the services rendered by the assessee are for the promotion and marketing of foreign universities among the Indian students. Therefore, the foreign universities or group entities are service recipients that are located outside India. The consideration is received by the assessee from the foreign universities or group entities in convertible foreign exchange”

Also Read: CESTAT New Delhi: Multiple Bills of Entry or Shipping Bills Cannot Be Consolidated for Assessment

The bench for the Indian students has cited that the taxpayer has no agreement with them and no acknowledgement is obtained from the Indian students, and no taxable services are provided without any consideration. Hence, the Indian students could not be termed as service receivers of the services furnished via the taxpayer.

The tribunal for the above permitted the appeal.

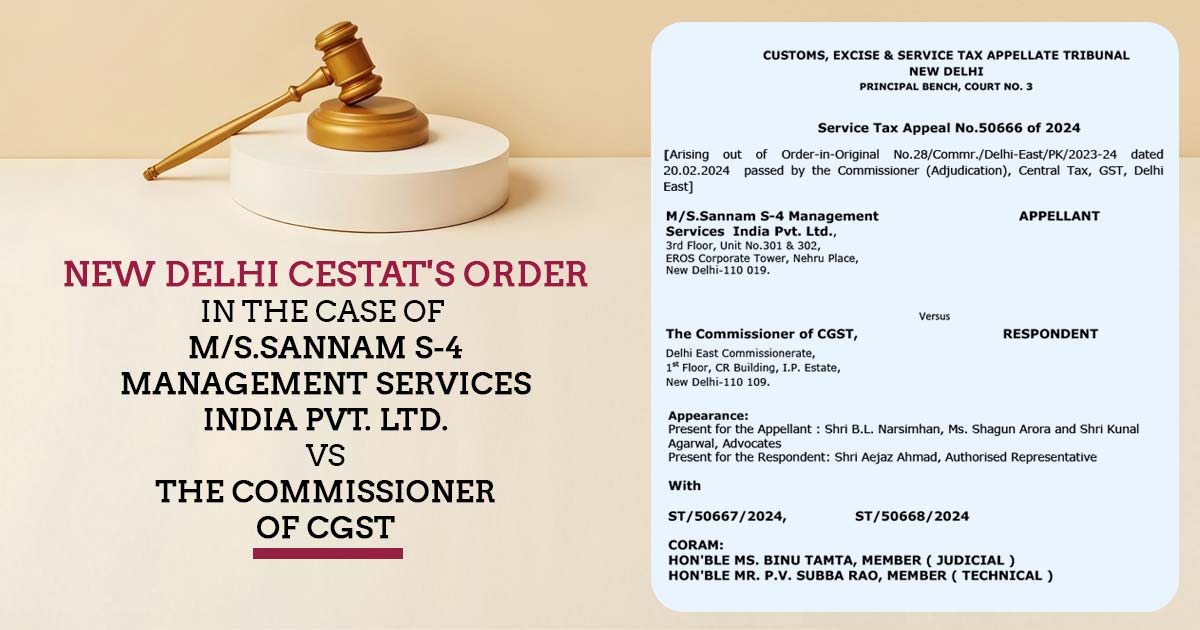

| Case Title | M/S.Sannam S-4 Management Services India Pvt. Ltd. vs. The Commissioner of CGST |

| Case No.: | Service Tax Appeal No.50666 of 2024 |

| For The Petitioner | Shri B.L. Narsimhan, Ms. Shagun Arora, Shri Kunal Agarwal |

| For The Respondents | Shri Aejaz Ahmad |

| New Delhi CESTAT | Read Order |