The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has cited that two or more bills of entry or shipping bills cannot be taken together and evaluated.

“Two or more Bills of Entry or Shipping Bills cannot be taken together and assessed. The only exception made in the law is the Project Imports under Project Import Regulations, 1986,” The Bench of Dilip Gupta (President) and P. V. Subba Rao (Technical) noted.

The Bench said “If the importer claims and is allowed imports under these regulations, all goods imported under various Bills of Entry under the project are assessed together under a single tariff heading 98.01. All assessments are kept provisional and at the end, all assessments are finalised together.”

The taxpayer in this matter had exported iron ore fines under distinct shipping bills. After it was processed, consignments covered by two or more Shipping Bills were loaded in the same hatch of the Vessel without any distinction as to the quality of the cargo.

In those Bills, where Fe content was less than 58%, the taxpayer claimed exemption and did not file duty. But paid export duty in other Bills.

DRI issued the SCN which proposed the re-determination of the export duty on exported iron ore fines. The taxpayers sought to Show cause concerning the respective shipping bills, where the Commissioner (Adjudication) decided the proposals through the impugned order. The order passed by the Commissioner (Adjudication) before the Tribunal has been contested by the taxpayer.

The taxpayer claimed that they had exported iron ore fines whose Fe content was less than 58% under some shipping bills and iron ore fines whose Fe content was more than 58% under some other shipping bills.

Revenue argued that the taxpayer had evaded duty by splitting the consignment into distinct shipping bills and taking advantage of waving on certain shipping bills. Also, the Fe content of the exported iron ore fines should be determined on a dry weight basis.

The tribunal noted that the DRI who furnished the Show cause notice (SCN) and the commissioner (adjudication) who issued the impugned order misunderstood the provisions and supposed that they secured the authority to re-assess the goods exported under two or more Shipping Bills together. The Customs Act does not grant any officer the authority to exercise such power.

It was mentioned by the Tribunal that the shipping bill is not merely a declaration of the goods to be exported though is indeed the document via which the export duty if any is computed. Exported should self-assess the duty and it could be re-assessed via the proper officer u/s 17 of the Customs Act.

The tribunal also cited that if the exporter is qualified to the advantage of a notification in one shipping bill that advantage could not be taken away via integrating the goods exported under the shipping bill with the goods exported under another shipping bill attracting a sample of the mixture of the two goods and testing it for Fr content.

Bench said “The fact that the goods under both Shipping Bills were loaded in the same vessel or even in the same hatchet of the vessel or exported to the same party would make no difference. It does not give the department the power to re-determine the duty. Conversely, if after mixing the goods exported under different Shipping Bills and drawing a sample, the Fe content falls below the threshold, the exporter cannot claim exemption for all the Shipping Bills. Each Shipping Bill must be assessed individually.”

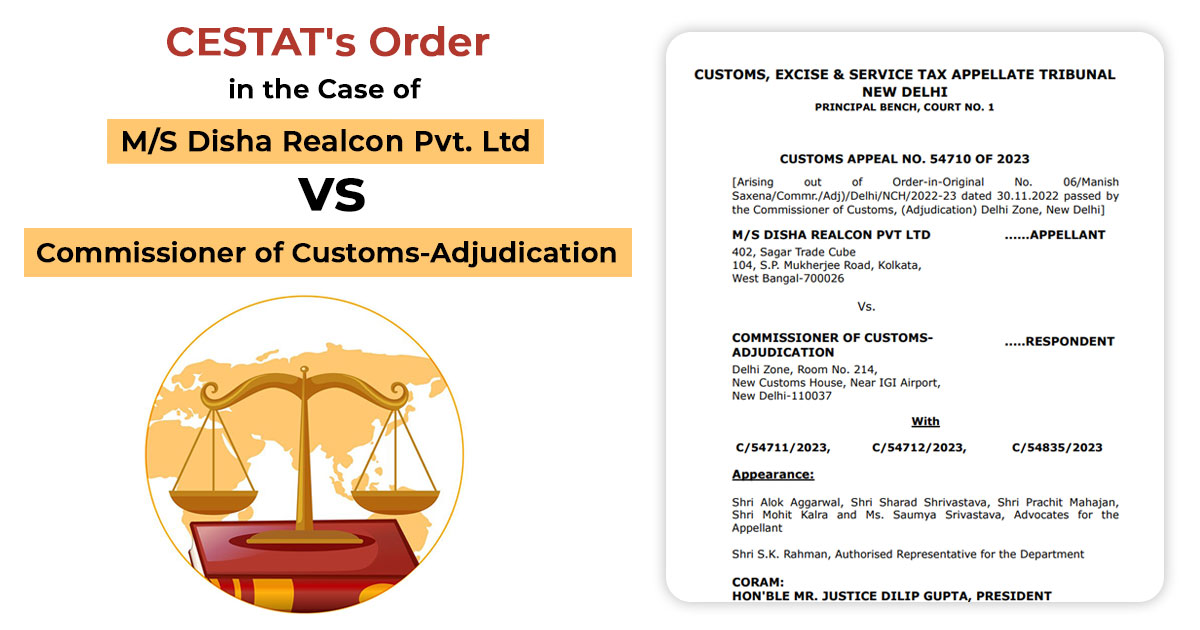

| Case Title | M/S Disha Realcon Pvt. Ltd. vs. Commissioner of Customs-Adjudication |

| Citation | Customs Appeal No. 54710 OF 2023 |

| Date | 07.02.2025 |

| For the Appellant | Shri Alok Aggarwal, Shri Sharad Shrivastava, Shri Prachit Mahajan, Shri Mohit Kalra and Ms Saumya Srivastava |

| Respondent by | Shri S.K. Rahman |

| CESTAT New Delhi | Read Order |