The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) mentioned that the manpower supply to 5 hotels for nearly 3 years draws service tax under the head of “manpower recruitment or supply agency service”.

The Bench of Dilip Gupta (President) and P.V. Subba Rao (Technical) has noted that, “In relation to manpower supply to five units on cost recovery basis, the Commissioner noticed that ITC had deputed employees to other hotels to operate and maintain those hotels in line with ITC Welcome group standards and run those hotels in a smooth and efficient manner. Thus, supply of manpower to five hotels for a period of nearly three years would clearly attract service tax under the head of “manpower recruitment or supply agency service”.

The taxpayer/ITC for handling the hotels has taken it from the owners as independent business units. The agreements for managing the hotels are made between the owners and the owners of these hotels. The operation of the hotels as business units is the major aspect, not the manpower supply.

The show cause notice has proposed to recover service tax on “manpower recruitment or supply agency services” provided by ITC to the service recipient.” The demand has been validated by the Adjudicating Authority.

Read Also:- Difference Between GST and SST (Sales & Service Tax)

When aggrieved by the adjudicating authority’s decision, the taxpayer submits an appeal to the Commissioner (Appeals), who upholds the order of the Additional Commissioner. The order of the commissioner (appeals) to the Tribunal has been contested by the taxpayer.

The taxpayer does not operate in the business of supplying manpower. As per ITC bona fide, it was not obligated to file service tax, therefore, no intent was there concerning ITC to evade payment of service tax.

ITC shows the staff is of ITC as it was recovering staff charges, namely, gross salary including provident fund, pension, gratuity of the employees, and it was recovering these costs from the owners of the 5 hotels, the department claimed.

The department mentioned that the taxpayer should reveal all the facts, and any deviation shall be deemed as an intention to evade payments of service tax.

Tribunal, even in a case of self-assessment, the department can call the taxpayer and ask for details, and the proper officer must investigate the accuracy of the duty computed by the taxpayer. Officers must scrutinise the returns as cited under the departmental instructions issued to officers.

The department’s claim does not get accepted since no need for the taxpayer is there to ask for clarification from the department, the tribunal discovered.

Read Also: New Delhi CESTAT: Additional Transportation Fees Charged to Buyers Not Subject to Service Tax

The Tribunal said that “Service Tax Appeal filed by ITC to assail that part of the order passed by the Commissioner which denies relief to ITC relates to the demand of service tax proposed on “manpower recruitment or supply agency service”.

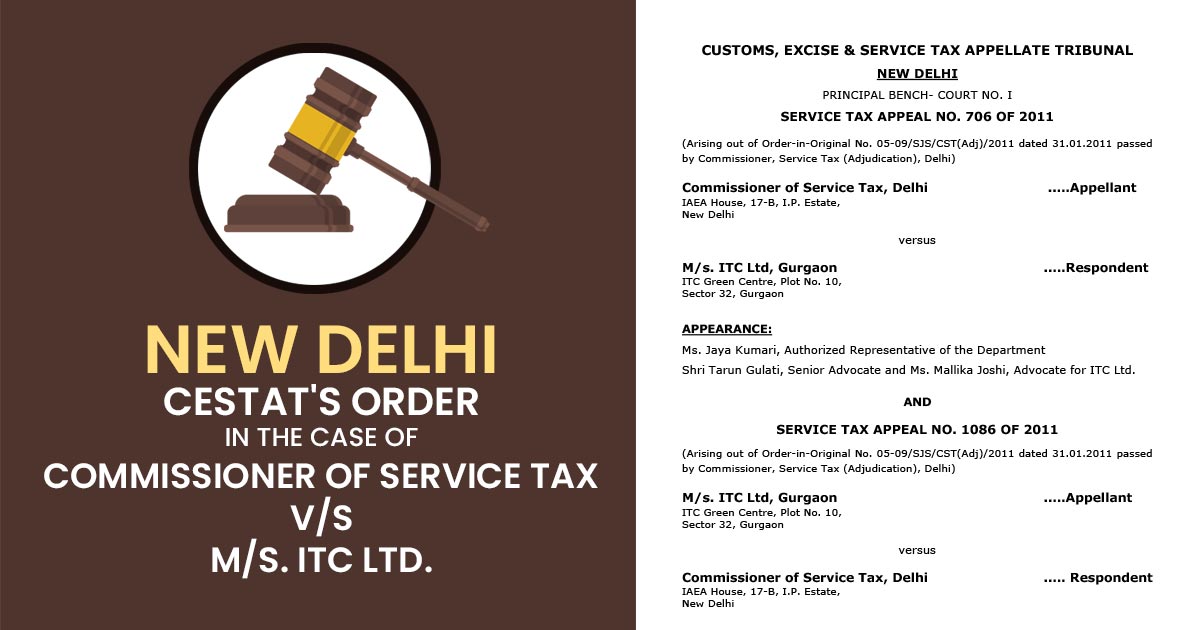

| Case Title | Commissioner of Service Tax V/S M/S. ITC Ltd. |

| Appeal No. | 1086 OF 2011 |

| Counsel For Appellant | Ms. Jaya Kumari |

| Counsel For Respondent | Shri Tarun Gulati, Senior Advocate and Ms. Mallika Joshi, Advocate for ITC Ltd. |

| Delhi CESTAT | Read Order |