A reassessment case has been reinstated by the Ahmedabad Bench of the Income Tax Appellate Tribunal (ITAT). This decision highlights that the Assessing Officer (AO) did not consider the documentary evidence provided by the taxpayer regarding cash deposits totalling Rs 15.88 lakh.

The taxpayer, Amit Hasmukhbhai Shah, is involved in a case that has been reopened due to a cash deposit of ₹15.88 lakh. The Assessing Officer (AO) requested the taxpayer to provide information regarding the source of this cash deposit. The taxpayer explained that the funds were acquired from loans taken out from farmers, friends, and relatives.

In the reassessment proceedings, the AO, based on Sections 131 and 133(6) of the Act, relied on statements and reports received. The AO, despite getting confirmation letters and details of the farmer, stated that the taxpayer is not able to establish the creditworthiness of the depositors and made the addition.

The taxpayer, dissatisfied with the order of the AO, submitted an appeal to the Commissioner of Income Tax (Appeals) [CIT(A)], stating that the reassessment and the addition based on the related documents like land records, proof of agricultural activities, and crop sale receipts were not furnished.

Enough data to AO has been given by the taxpayer, which was disregarded, the two-member bench comprising Dr. B.R.R. Kumar (Vice President) and Siddhartha Nautiyal (Judicial Member) noted.

Read Also: No Proper Opportunity Given to Assessee to Explain Additions, ITAT Sends Case Back to CIT(A)

Confirmations like “Gram Namuno” are given by the taxpayer and even also provided one lender for examination, but the AO did not consider the merit of this documentation, the tribunal noted.

The CIT(A) has discarded the taxpayer’s appeal without discussing the merits and appreciating the nature. The case may be restored to the AO for justice, the Tribunal observed.

The case has been restored by the tribunal to the file of the Assessing Officer (AO), mentioning to allow the taxpayer a fresh chance of hearing and to re-examine the proof furnished before passing a reasoned order.

The taxpayer’s plea has been permitted for statistical objectives.

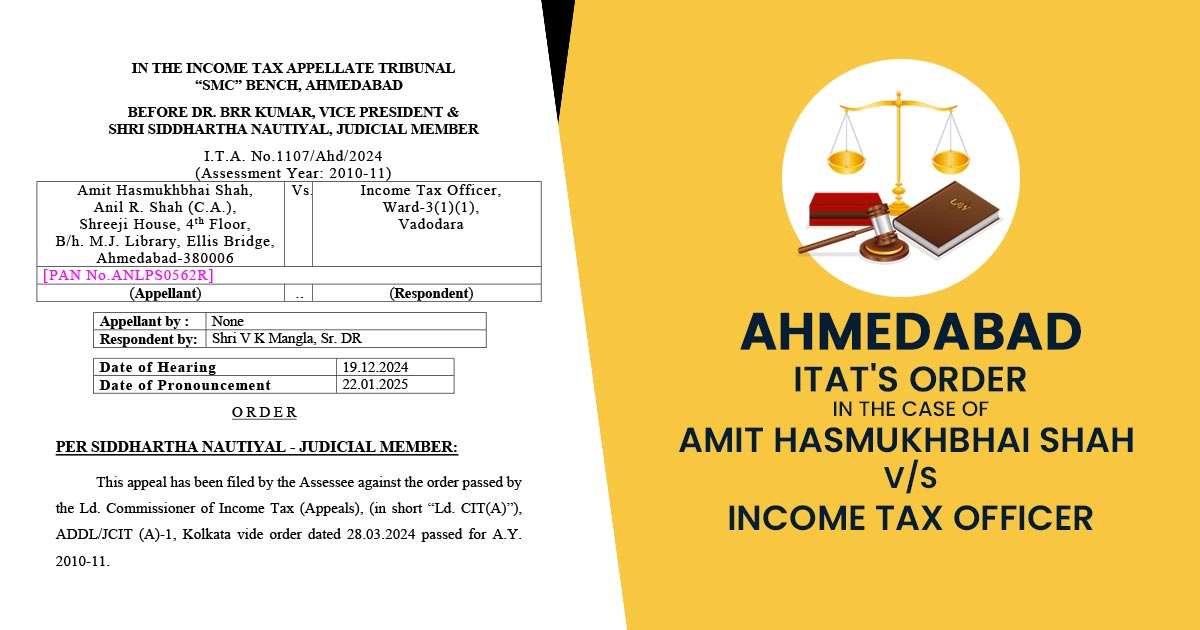

| Case Title | Amit Hasmukhbhai Shah vs. Income Tax Officer |

| Case No. | I.T.A. No.1107/Ahd/2024 |

| Appellant by | None |

| Respondent by | Shri V K Mangla |

| Ahmedabad ITAT | Read Order |