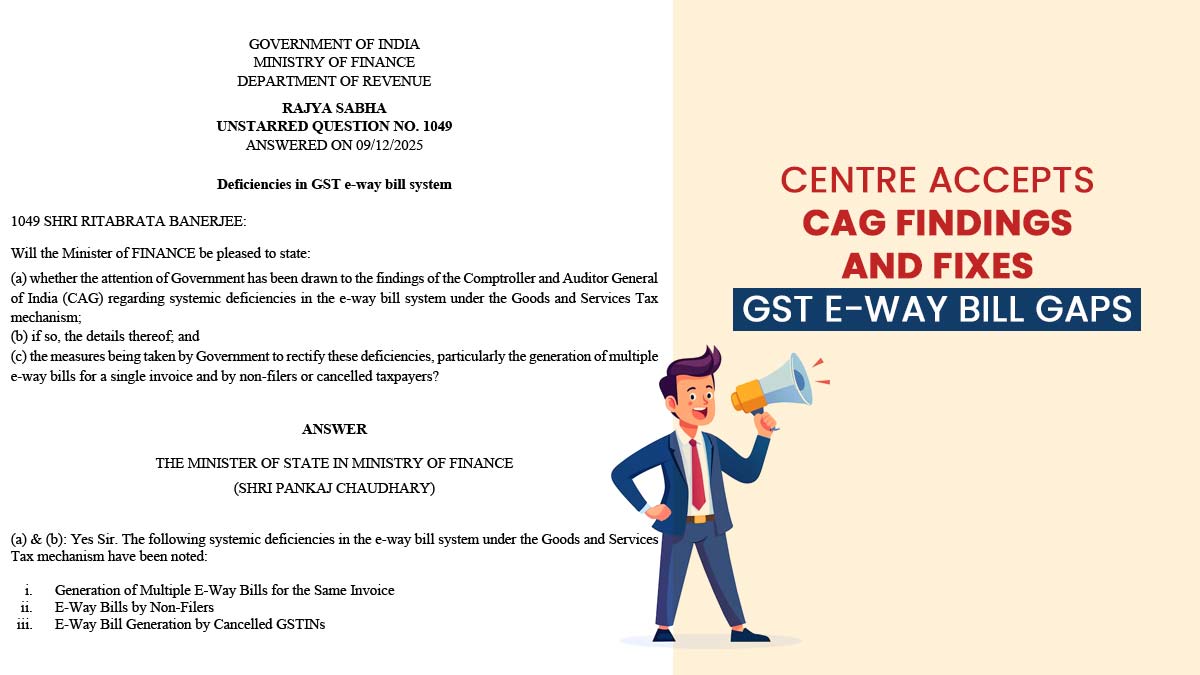

The Government of India has considered the systemic issues determined by the Comptroller and Auditor General (CAG) in the GST e-way bill system and specified corrective measures to make compliance stronger and prevent misuse. The details were shared in a written reply by Minister of State for Finance Pankaj Chaudhary in the Rajya Sabha.

As per the Government, the CAG emphasised three major vulnerabilities in the current e-way bill mechanism:

- Numerous GST E-way bills were generated for the same invoice

- Generation of GST E-way bill by non-filers of tax returns

- E-way bill allocation using cancelled GSTIN

The Finance Ministry, in answer, cited that various technical controls had been deployed earlier. The system averts duplicate e-way bills for the same invoice by legislating robust validation of document number and date, and it limits the use of documents older than 180 days.

For taxpayers, the e-way bill generation remained blocked who did not submit their earlier three Online GST returns, which ensures that habitual non-filers cannot transport goods without compliance.

Also, the portal automatically checks the GSTIN status in real time, which does not permit any e-way bill to be generated by or against cancelled GSTINs.

Important: GST E Way Bill Preparation Guide for Transport Companies & Suppliers

The government stated that such measures have the motive to strengthen the GST framework, curb revenue leakage, and improve clarity in the movement of goods across the nation.

Read More