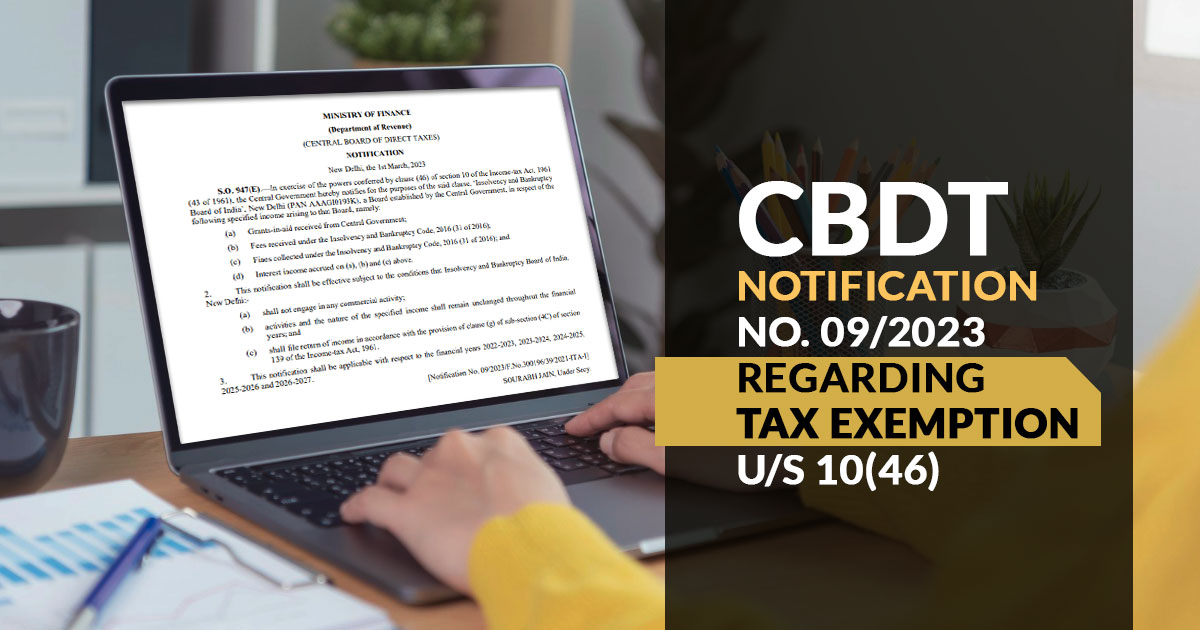

Under section 10(46) of the Income Tax Act, 1961, the Central Board of Direct Taxes (CBDT) notified the Income Tax exemption to the Insolvency and Bankruptcy Board of India (IBBI).

As per section 10(46), certain income accruing to anybody, authority, board, trust, commission (or a class thereof) that was established or created in accordance with a Central, State, or Provincial Act, or that was established by the Government or a State Government with the aim of governing or managing any activity for the benefit of the general public, is not engaged in any commercial activity, and is declared tax exemption by the Central Government in the Official Gazette for the purposes of this clause.

The IBBI, a board established by the central government, has been granted the exemption. It was informed of this for the purposes of the aforementioned paragraph in connection to the aforementioned defined revenue arising to that Board, specifically:

- Grants-in-aid received from Central Government;

- Fees received under the Insolvency and Bankruptcy Code, 2016 (31 of 2016);

- Fines collected under the Insolvency and Bankruptcy Code, 2016 (31 of 2016); and

- Interest income accrued on (a), (b), and (c) above.

Read Also: Donations by Trust for Charitable and Educational Purposes Deductible

Subject to the Insolvency and Bankruptcy Board of India, New Delhi, fulfilling the conditions listed below:

- Shall not be involved in any activity related to commercials.

- The actions and type of the stated revenue must be consistent throughout fiscal years; and

- Should submit an income tax return in line with the provisions of paragraph (g) of sub-section (4C) of section 139 of the Income-tax Act of 1961.