The Central Board of Direct Taxes (CBDT), provided the conditions to process the returns furnished through the digital economy firms which would be obligated for the equalization levy, simplifying the administration of India’s digital economy tax.

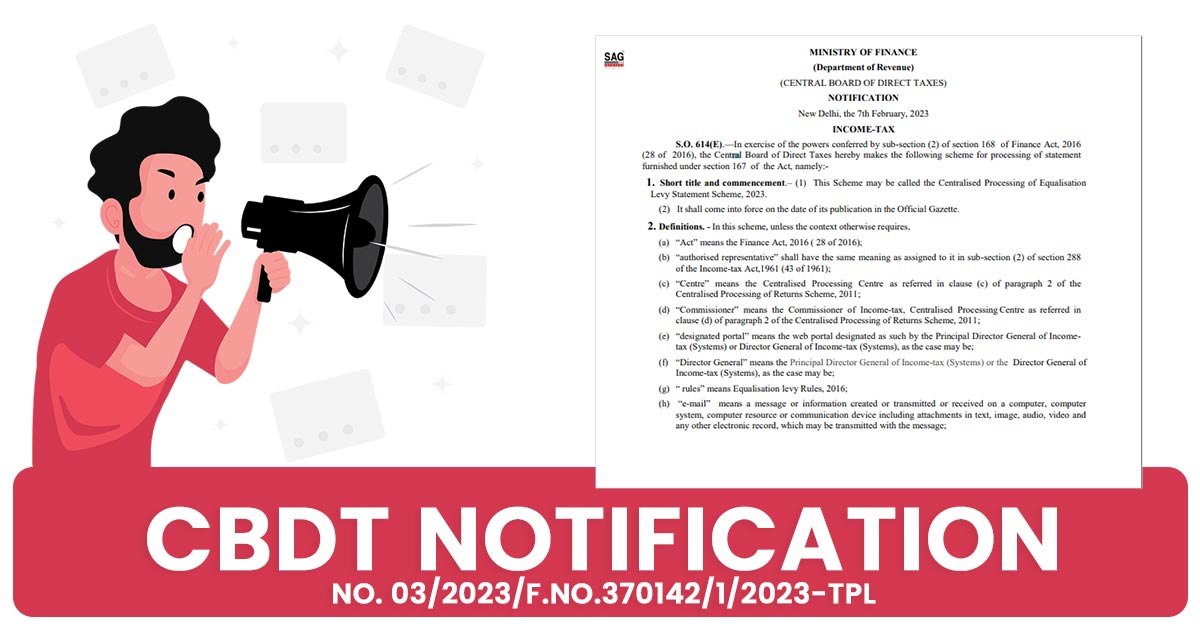

Scheme for the Centralized Processing Equalization Statements

The modalities have been set by the Centralized Processing of Equalization Levy Statement Scheme, 2023, to process the returns furnished through these entities and the same would come into force from Tuesday.

On online advertisements, an equalization levy was started in 2016 and after that, it gets expanded for taking into account the sale of goods and provision of services via e-platform.

A 6% tax shall be levied on the online advertising services that would have been induced via offshore entities while a 2% e-commerce supplies through non-resident firms shall get levied tax.

The experts stated since there was no method to process the equalization levy statements and therefore the scheme was awaited for a long time which creates certain issues, mainly during the claim of the refund.

The ITR which is presently functioned by the Centralised Processing Centre (CPC) of the Income Tax department shall indeed be processed the equalization levy statements electronically and all communication must be placed on the email or on the income tax portal prescribed under the same scheme.

For equalization levy statements, a consistent, uniform, positioned within a rule where CPC functions the income tax return is anticipated to be reproduced.

Providing the processing status updates on a real-time basis via email, text message, and the website of the income tax department makes the assessee informed, as per the latest rule.

This scheme also furnished towards the refund adjustment with demand due for the additional years. Tax experts anticipated watching the refunds claimed in the statement to get released and equalization levy statements to be in function.

Post to the finish of the fiscal year, the statement on the equalization levy would be needed to get provided via the businesses by 30th June.

Another tax expert elaborated that, the centralized scheme would have the goal to have transparency in the procedural process of the levy as there might be a possibility of a surge in the revenue of government.

In the law, it specified that for the case of the amended equalization levy statement, there shall be no more measure needed to opt for the original statement when the same does not get processed previously.