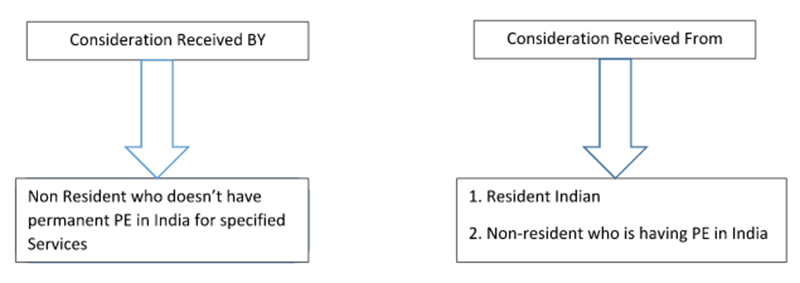

A new chapter viii titled ‘Equalisation levy’ is inserted in the finance bill which will take effect from the 1st of June 2016 to provide for an equalization levy of 6 % of the amount of consideration for specified services received or receivable by a non-resident not having a permanent establishment (‘PE’) in India, from a resident in India who carries out business or profession, or from a non-resident having a permanent establishment in India.

With the introduction of the equalization levy, the Govt has been indirectly able to tax global advertising companies and has set more services that may be added to the list of specified services in the future.

Latest Update

- The government has proposed the abolition of the 6% Equalisation Levy on online advertising in the Finance Bill of 2025.

- The scheme in respect of the processing of the Equalisation Levy Statements has been notified by the Central Board of Direct Taxes (CBDT), i.e. Centralised Processing of Equalisation Levy Statement Scheme, 2023

Important Knowledge About India-US Pact on Equalization Levy

India’s Ministry of Finance provided a statement in which the terms of the October joint statement would indeed apply to India’s 2% equalization levy applicable on e-commerce supply or services and USTR’s trade action concerning the equalization levy. As per the statement, the final terms of the agreement would be finalized dated 1st Feb 2022.

Equalization Levy Withdrawal

India needs to withdraw its 2% equalization levy, which is subject to being applied to e-commerce supply or services until the OECD pillar one provision begins in the country, predicted to be in 2013.

The Furnishing of Credit Excess Equalization of Levy

Surplus paid by the multinational companies determined by pillar one would be available as credit for set-off concerning their corporate tax liability, which is below pillar one.

Credit Availability in a Year

The credit of surplus equalization levy furnished would be subjected to apply in the 1st taxable year where the assessee would be liable for the tax liability post to the interim duration.

Towards the concern of the Pillar, one would not be subjected to apply on the assessee in the execution year on the grounds of the first year the credits have been revealed, where pillar one is applicable for these assessee and would become available at these times.

However, the credit would not be available for the assessee who first applied to pillar one exceeding 4 years post pillar one would be applicable in India.

Credit Carry Forward

The credit that is revealed would be carried forward for set off opposite to pillar one corporate tax liability unless it gets exhausted.

USTR Execution Under Equalization Levy

The US would eliminate USTR action in India for the levied trade tariffs coordination towards the 2% equalization levy till the end of the interim/transitional period.

Currently, this Equalisation Levy is levied only on advertisements.

Equalisation Levy: 6% on the Amount of Consideration

The Salient Features of this Equalisation Levy are as Under

- Equalisation Levy as introduced by Finance Bill 2016 in Union Budget 2016-17, here are some features of the same:

- It is to tax the e-commerce transaction/digital business that is conducted without regard to national boundaries.

- The equalization levy would be 6% of the amount of consideration for specified services received or receivable by a non-resident not having a permanent establishment (‘PE’) in India, from a resident in India who carries out business or profession, or from a non-resident having a permanent establishment in India.

- Specified services mean online advertisement, any provision for digital advertising space or any other facility or service for the purpose of online advertisement and include any other service as may be notified by the Central Government.

- No levy if the aggregate amount of consideration does not exceed Rs.1 lac in any previous year.

Equalisation Levy will not be Charged

- If the service provider is a non-resident having PE in India.

- The service provider is a resident of India.

- The amount of consideration is less than Rs 1 lakh

Applicability and Manner of Deduction of Equalisation Levy

- This levy of equalization would be in the same manner as TDS, like the person making the payment for advertisement will be required to deduct the Equalisation levy @ 6% on the total amount of consideration and deposit the same to the account of the Central Government.

- In case of failure to do so, these expenditures will not be allowed to be claimed for Income Tax purposes.

Reason for the Introduction of Equalisation Levy

- Many companies who are providing services in cyberspace register themselves in a country wherein the Tax rates are low and pay very low taxes on their global income.

- Like in India The revenue of Google in FY 2014-15 was 4,108 Crores, hence the introduction of the Equalisation levy would fetch the Govt a lot of money which till now was not Taxed that’s why many people are calling the Equalisation levy Google Tax. Because a major share of online ads spent goes to Google.

Due Date of Depositing Equalisation Levy

Due Date of depositing Equalisation levy to the account of Central Govt by the 7th day of the Month immediately following the said calendar month.

Due Date of Furnishing Equalisation Levy Statement (Form-1)

The due date of the Furnishing Equalisation levy Statement is on or before 30th September of the Financial Year end. (after the end of the Financial Year, assessee has to submit Form-1 on or before 31st July or within the prescribed time as the case may be.)

Note: “The Equalization Levy Statement in Form No.1 for the Financial Year 2023-24, which was required to be filed on or before 30th June 2024”

Revision or Late Submission of Form-1

If the assessee failed to furnish the statement within time or had furnished it wrong and now wants to revise the same, he can upload a belated return or revise the TDS return at any time before the expiry of two years from the end of the financial year in which specified services were provided.

Interest on Default: If the amount of levy is not deposited within a specified time then the assessee shall have to pay 1% Interest on such levy for every month or part of the month by which such credit of the Tax or any part of Tax is delayed.

Penalty for Failure to Deduct or Pay Equalisation Levy

- Failed to deduct levy–: penalty amount will be equal to the amount of the Equalisation levy that the assessee failed to deduct.

- Levy has been deducted but not deposited: The penalty amount, in this case, will be 1,000 Rs. per Day till the default continues, but the total penalty shall not exceed the amount of the equalization levy.

Penalty for Default in Furnishing Statement

If the assessee fails to furnish the Equalisation levy statement within the prescribed time, he has to pay a penalty of 100 Rs. Per day till the default continues.

Whether 15 CB is required to be issued in case of remitting amount to NR after deducting equalization levy u/s 165.

If the amount of consideration is Rs. 1,00,000/-, equalisation levy @6% would be Rs.6,000/- (1,00,000*6/100) or Rs.6,383(1,00,000*6/94 – i.e. based on grossing up)?

The amount paid as equalisation levy shall be leviable on taxable value not invoice value.

Hello Sir,

Could you please help to understand if we are taking any platform of finding, contacting and hiring through any vendor who is not registered in India i.e. link din etc. are we liable to deduct the equalization levy?

Hello Sir,

Could you please help to understand if we are taking any platform of finding, contacting and hiring through any vendor who is not registered in India i.e. link din etc. are we liable to deduct the equalization levy?

Hi,

i have a question,

Nil, Equalisation Levy Return (Form-1) can be file or not??

Hi,

Need help on EL applicability, We pay to online advertisement platforms like Linkedin and Twitter on behalf of our clients, do we need to pay EL or our Clients are liable to Pay EL?

Do we need to pay Equalization Levy even if we run ads from Indian FB/Google/Bing ads account and incur GST in the invoice from their Indian Address.

As per various Internet sources, Its mentioned that FB /Google/Bing doesn’t have a permanent establishment (PE) in India and are subsidiaries in India. So we are paying to these subsidiaries directly.

The billing is done by Facebook India private limited, Google India Private Limited, and the invoices from google and Facebook also factor in GST. We deposit payment to Facebook India private limited and Google India Private limited and not their parent company.

Why should we pay equalization levy in this case?

Also, How will the taxpayer know the constitution of the Indian arm of the Foreign Non-Resident about whether this is a permanent establishment or not when there is no mention of the same even in the invoice.

Many Internet sources also say if Indian offices of Google and Facebook are billing us then equalization levy is not applicable. I m not sure though.

Recently I saw a CA also mentioning the same in a webinar…I can share the webinar link with you as well in case you want to see it.

There is ambiguity in this case…would be great if you clarify.

Hello,

I have one question about challan Payment if it is paid excess can it be adjusted in Next Financial Year in Return ??

Thanks

In TDS we have unconsumed challan so we can adjust it with payment to be made and In ITR if we paid excess amount then we will get the refund of that amount

Hi, I Have a doubt.

my company is taking service for publishing one advertisement in one of the magazines in South Africa. The service provider is a non-resident. Do EL is applicable?

TIA

Joy

Equalisation levy will be applicable if payment exceeding Rs 100000 made to a non-resident for online advertisement in any FY.

Hi, JOY

I think this should not be a case of EL because, for the levy of EL, it is clearly specified that it is only for e-commerce transactions and you mentioned that your company is paying for the magazine which Not an e-commerce platform unless it’s an e-magazine

Hi,

We are deposit equalization levy in the month of May, June, July, and Aug’2019 by mistake. Can we claim a refund for the same if yes please tell me the processor?

Hi, We need to make payment to a CEO magazine published in Singapore (online print media). They have a liaison office in India. This payment is towards an interview content (3 pages). Is EL applicable in this case?

Yes, EL is applicable in this case because liaison office(permanent establishment) is established in India.

Do we need to deduct both equalization levy and tds for online marketing services

Hi There,

If we are making payment to Facebook towards online advertising. So, do we need to deduct EL on the amount which we are paying to Facebook?

Thanks

YES, EL IS APPLICABLE IN YOUR CASE.

Hello There,

I have gone through the different website and have done some basic research, I have a couple of doubts with this regards.

Findings:-

Queries:-

Please give me your thought on both the type the service we receive from Non-resident.

1) Equalisation levy needs to pay to the govt. till 7th of the next month in which the amount is paid

to non – resident.

2) For equalisation levy, you need to file Form 1 till 30th June of next financial year, but for sending

proceeds to outside India Form 15CA / 15 CB should be filed.

3) For professional services, you need to deduct TDS u/s 195 and need to file Form 27Q.

The worst of laws in terms of being through. Hurts max the small digital entrepreneurs in this industry. The googles and the big networks are not fine with any such deduction and it ends up just being an additional burden on the Indian entity. 6% that too – where agency commission is like 15%….50% of profits nearly.

Very sad.

Do I need to pay penalty on late deposit of equilisation levy @1000 per day during the period default continues?

Interest @ 1% per month would be applicable on the late deposition of equilisation levy.

Dear Team,

If we have deducted Levy of INR 20,000 in Sept’18 and deposited with Govt. on 9th October, then how much interest liability would be there? Whether it will be 1% for October month only or it would be 2%?

1.5% interest will be levied from the date of deduction to the date of deposition.

Amount paid as EL is again showing as credit in 26AS of deductor. Please guide should claim it.

If the credit is reflected in form 26as then credit can be claimed.

Sir i am dealing with Australian advertising company and they dont have any pan or vat number in india and they dont have any PE in india.

How much tax i have to pay as this will be on my expense and can i file the form if i don’t even have their pan or VAT Number?

Equalisation levy is charged at the rate of 6% from the consideration paid or payable for the services in the nature of online advertisement

service receiver is required to deduct the equalisation levy before making payment to the non-resident service provider.

And furnish Equalisation Levy Statement (Form-1) is on or before 30th June of Financial Year ended (unless the date is extended).

Hi, Do we need to charge GST on Equalization Levy?

Hi, Need help on equalisation levy, please share your email id.

Hi, It is clear that EL is not payable to Facebook since Facebook is non-resident having PE in India?

EL will be applicable on payment made (If exceeds 1 Lac/year) to Facebook as Facebook billing is from Ireland address and hasn’t any PE in India.

if I deducted (say Rs. 1lac) but paid with a delay of 28 days to the govt. I have to pay interest @ 1% p.m. for 28 days and penalty for 28 days @ 1000 INR per day i.e. penalty 28000.

2. if I did not deduct (say deductible was same Rs. 1lac) but paid (from own pocket) with a delay of same 28 days to the govt. I have to pay interest @ same 1% p.m. for 28 days and penalty equal to the amount not deducted, i.e. Rs. 1 lac (more than the earlier case).

Is it so? If yes, if I do not deduct but pay from my pocket, the penalty is harsher. A little unusual.

Hi

Whether we need to apply SBI TT rate while making EL payment?

A little confused. For example, if I deducted (say Rs. 1lac) but paid with a delay of 28 days to the govt. I have to pay interest @ 1% p.m. for 28 days and penalty for 28 days @ 1000 INR per day. Is it?

Interest is levied 1% per month and penalty of Rs 1000 per day.

If it is 1 lac the penalty amount will not be more than 6% of 1 lac. The Maximum amount of penalty cannot cross the equalisation levy.

“Levy has been deducted but not deposited: Penalty amount, in this case, will be 1,000 Rs. per Day till default continues but the total of a penalty shall not exceed the amount of equalisation levy.”

We pay the amount through credit card to facebook. So, we can’t hold any balance as equalization levy. EL became an extra burden on us. Please suggest how to overcome this situation.

hI,

For Mar 17 when is the due date to pay EL is it 30.4.2017 or 07.04.2017

The equalisation levy so deducted during any calendar month shall be paid by every assessee to the credit of the Central Government by the seventh day of the month immediately following the said calendar month. Nothing is mention for march month. Due date will be 7th of April only.

If full payment is made to non resident service provider, then EL to be deducted on which amount?

The amount which is paid to non resident assessee is liable for EL.

Very useful Information.

Very good presentation.

Thanks