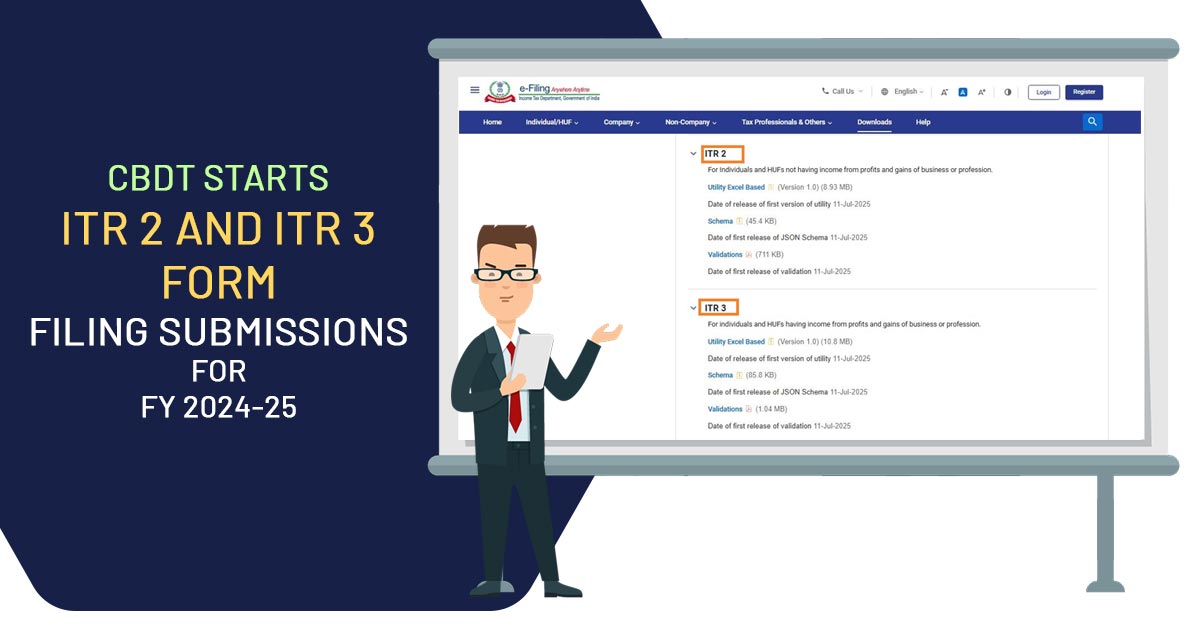

The Excel-based offline filing tools for ITR-2 and ITR-3 for AY 2025-26 have been launched by the Income Tax Department, indicating that the return filing process for the financial year 2024-25 is underway.

The Excel utilities downloadable tools are designed for offline use, allowing taxpayers to fill out their income tax returns in Microsoft Excel, validate entries, and generate a .json file for upload to the official e-filing portal.

Who Needs to Learn?

ITR-2 is for individuals and Hindu Undivided Families (HUFs) earning income from salary, multiple properties, capital gains, foreign assets, or as company directors, except from business or professional activity.

The ITR-3 Form is applicable for those who have business or professional income, along with freelancers, sole proprietors, and partners in firms.

The same rollout is important as it enables the taxpayers to start preparing their returns as of the coming September 15, 2025, filing deadline. For the users, the offline tools are assistive, who choose to work outside the browser, proposing features such as auto-validation and saving the offline progress.

It is updated to show the latest tax law amendments for the existing assessment year; as such, utilities have the objective to lessen the errors in filing and rectify the compliance.

Steps to Use these Utilities

- From the official Income Tax e-filing portal, download the Excel utility for your applicable form (ITR-2 or ITR-3)

- Fill in personal, income, deduction, and tax details.

- Use the built-in checks to validate the data.

- Generate the .json file and upload it to the portal to file your return.

- Taxpayers are advised to confirm their eligibility and ensure precision to avoid last-minute problems.