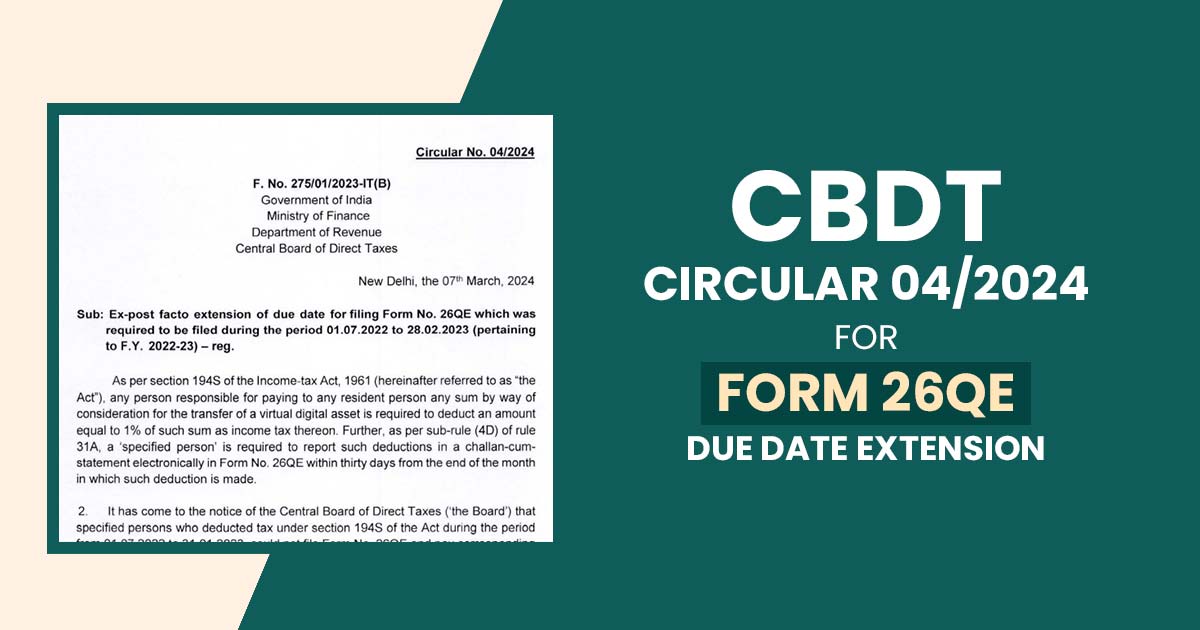

On 7th March 2024, Income Tax issued Circular No. 4/2024 for an Ex-post facto extension of the last date for filing TDS Return Form No. 26QE which was needed to be filed at the time of 01.07.2022 to 28.02.2023 (about F.Y. 2022-23).

The said individuals who deducted tax under section 1945 of the Act in the period from 01.07.2022 to 31.01.2023, can not file Form No. 26QE and pay the related TDS on or before the last date, because of the unavailability of Form No. 26QE.

It has resulted in a consequential imposition of fee under section 234E and interest under clause (ii) of sub-section (1A) of section 201 of the Act.

The persons who deducted tax under section 1945 from 01.02.2023 to 28.02.2023 needed more time to file Form No. 26QE and pay the corresponding TDS thereon.

To address issues for the said individual and in practice of the powers granted under section 119(2)(a) of the Act, the Central Board of Direct Taxes (CBDT) has chosen to, ex-post facto, extend the last date of filing of Form No. 26QE for specified persons who deducted tax under section 1945 but losses to file Form No. 26QE.

The last date is now extended to 30.05.2023 in the matter where the tax was deducted by defined persons under section 1945 of the Act in the period from 01.07.2022 to 28.02.2023.

Read Also: All About TDS Return Forms 24Q 26Q 27Q 27EQ with Due Dates

The fee imposed under section 234E and/or interest levied under section 201(1A)( ii) of the Act in these cases for the period up to 30.05.2023, will be exempted.