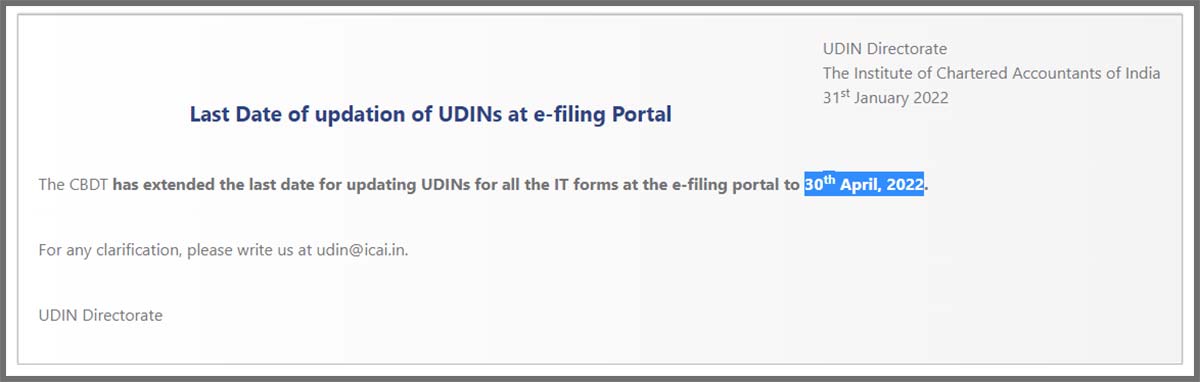

The Central Board of Direct Taxes (CBDT) has again extended the last date of updating the Unique Document Identification Number (UDIN) at the e-filing web portal of the Income Tax Department from 31st January 2022 to 30th April 2022.

“The CBDT has extended the last date for updating UDINs for all the IT forms at the e-filing portal to 30th April 2022,” the ICAI notified

The CBDT has mandated that all the members shall be required to first generate the Unique Document Identification Number (UDIN) and thereafter provide the same detail while uploading the Income Tax forms. If the updation is delayed later than 30th April 2022, it shall result in invalidation.

The UDIN is an important identification number mandated by the government for the registration and another compliance process to be done via filing. The government is extending the due date to generate UDIN for the betterment of the business community as the favorable conditions of business are sliding off due to international inflations as well as covid protocols.

For any issues, please send an email to us at udin@icai.in.

st, sir, last date of updating udin on the income tax site is 31st August but on the new site, there is no link on which UDIN is updated