The Calcutta HC for a case asked to extend the advantage on the rectified GSTR 9. It was discovered that GSTR 9 did not permit an allegation of filing an incorrect export invoice and asked to extend the advantage on rectified GSTR 9.

Advocate Mr Chakrabarty emerged on behalf of Agnus Exim Private Limited. The applicant was directed to the refund sanction order on 8th December 2022 and furnished that the authority despite recognising the fact that the applicant had rectified its mistake by filing of GSTR 9 return has not permitted it as it was discovered that export invoices to the tune of Rs.1,70,61,224.07 were filed incorrectly in the GSTR1 as export with tax payment instead of export without payment of tax.

It was argued that once the authority had acknowledged that the aforementioned error had been rectified by filing GSTR9, the benefit of such rectification should have been extended to the petitioner.

Read Also: Rejecting GSTR-9 Filing Form Can Cause Prejudice to Assessee’s Rights

The single bench of Justice Raja Basu Chowdhury directed the State respondents to seek proper instructions in the matter and further asked to list this matter in the daily supplementary list on 27th August 2024 for further consideration.

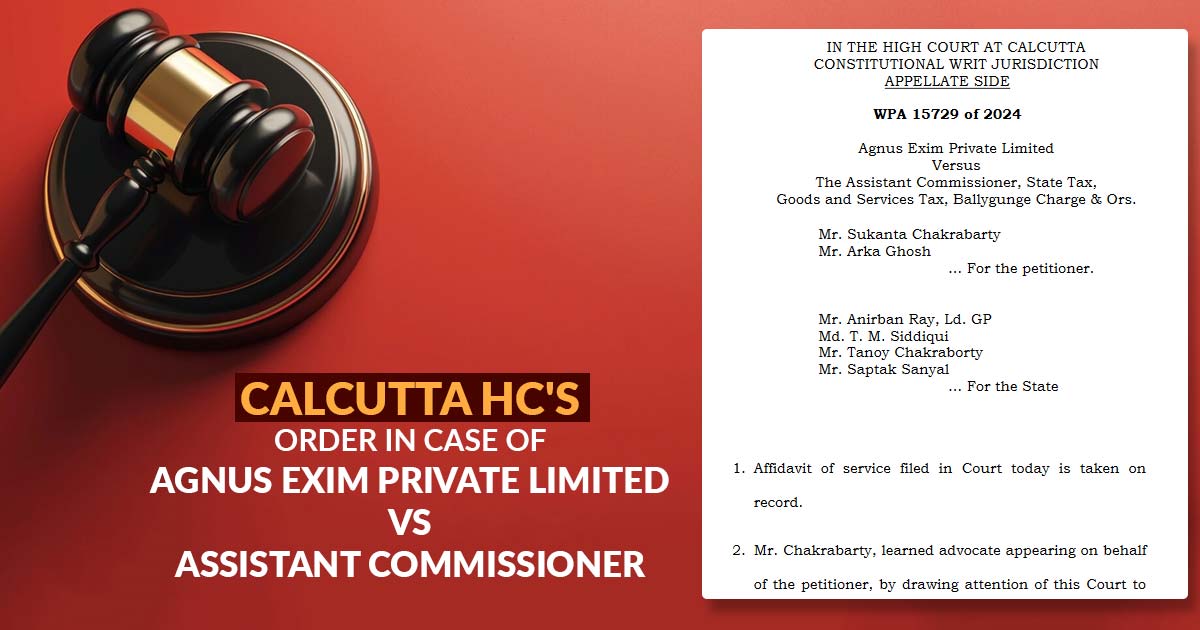

| Case Title | Agnus Exim Private Limited Vs Assistant Commissioner |

| Citation | WPA 15729 of 2024 |

| Date | 12.08.2024 |

| For the Petitioner | Mr Sukanta Chakrabarty, Mr Arka Ghosh |

| For the State | Mr Anirban Ray, Ld. GP, Md T. M. Siddiqui, Mr Tanoy Chakraborty, Mr Saptak Sanyal |

| Calcutta High Court | Read Order |