Simple to Understand TDS Interest

You would be required to file the interest Under Section 201(1A), in case of a late deposit of TDS after deduction. A 1.5% per month interest would be computed from the date on which the TDS was deducted to the actual date of deposit. The same would be computed on the monthly grounds and not on the number of days i.e. part of the month would be acknowledged as a whole month.

What are Late Filing Fees in TDS?

An individual who would be needed to deduct/collect TDS/TCS would be obligated to file a fine of Rs 200 per day unless the TDS return would get filed, under Section 234E. TDS deductor will be obligated to file the same for every day of delay unless the fine amount would be identical to the amount that you are needed to pay as TDS.

Understand Why Gen TDS Software is Good for Tax Professionals

Only for filing TDS or TCS returns online as per the requirements of TRACES and the CPC portal, in India, Gen TDS software is the most trustworthy and flexible software. Indeed it pre-determined TDS amounts, prepares the TDS returns, and calculates interest and penalties, including late filing fees, you can too use the same innovative tool.

As per the Tax Information Network website, it is an authorized TDS return filing software. Apart from that the same was authorized by the Indian government to list TDS filing software in the FY 2012-13. You are enabled to directly log in to TRACES CPC and NSDL through this TDS software, so you would not be required to generate the User ID every time.

Under the Finance Bill, 2021, new sections were been introduced in order to deduct TDS (tax deducted at source) /collect TCS (tax collected at source) at high rates if the amount would get paid to the said individual who does not have furnished their ITR. After Section 206AA of the income tax act, Section 206AB is inserted. It then furnishes TDS deduction at higher rates for people who do not give their Permanent Account Number (PAN). Likewise, after section 206CC of the Income Tax Act section 206CCA for TCS is inserted.

Step-by-Step Process to Calculate Interest & Late Fees Using Gen TDS Software

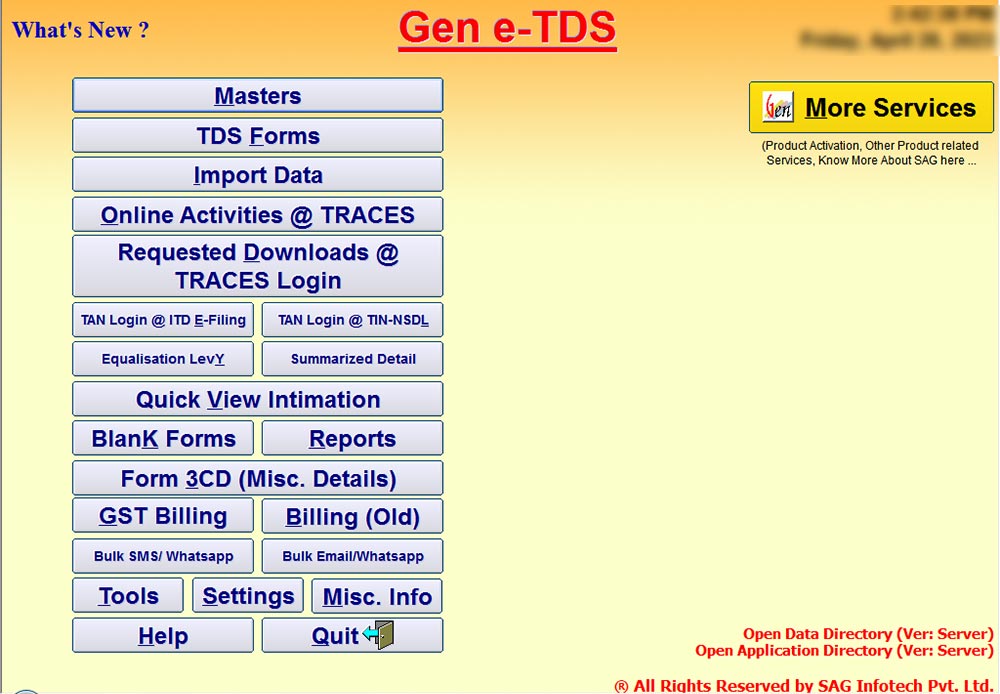

Step 1:- First Install Gen TDS Return Filing Software on your Laptop and PC.

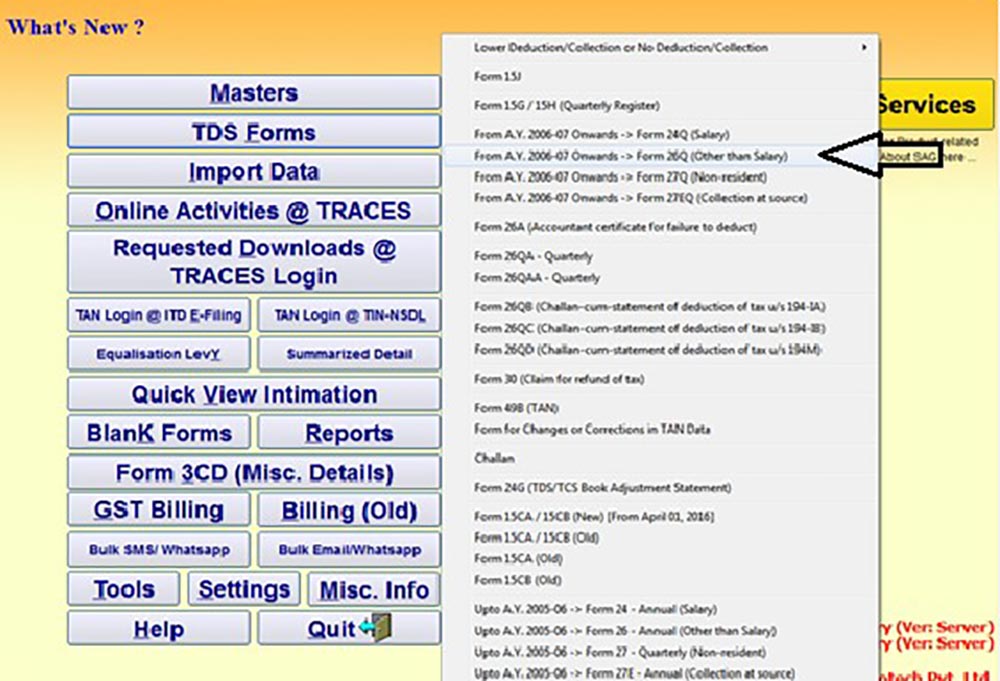

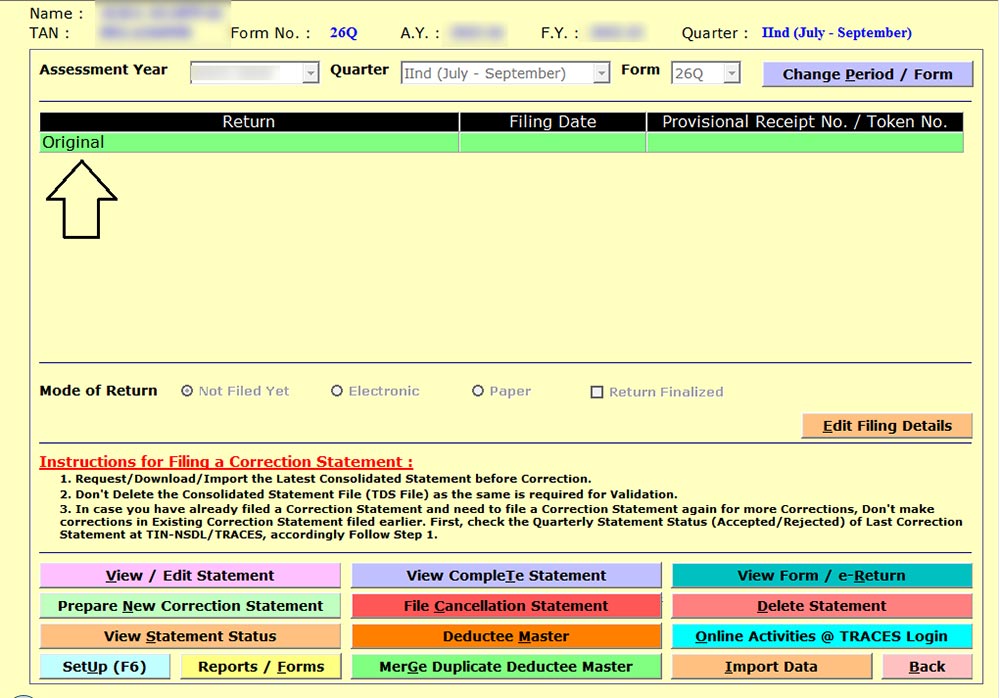

Step 2:- Select the Form like 24Q or 26Q of which you want to check the Interest or Late Fee Payment.

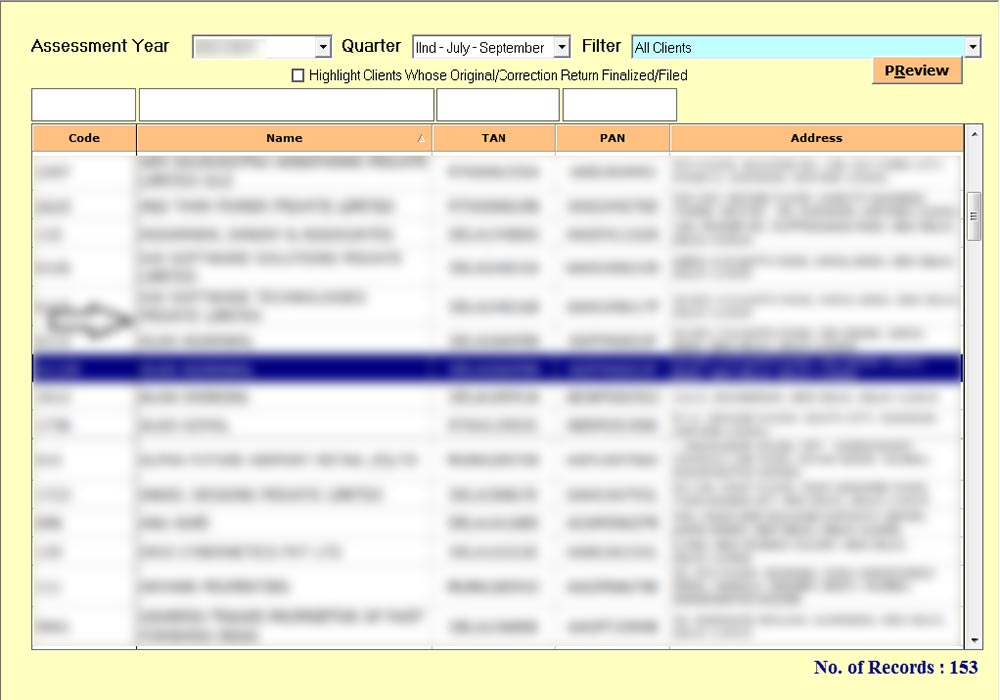

Step 3:- Select the client for which you want to check the Interest and Late Fee Payment.

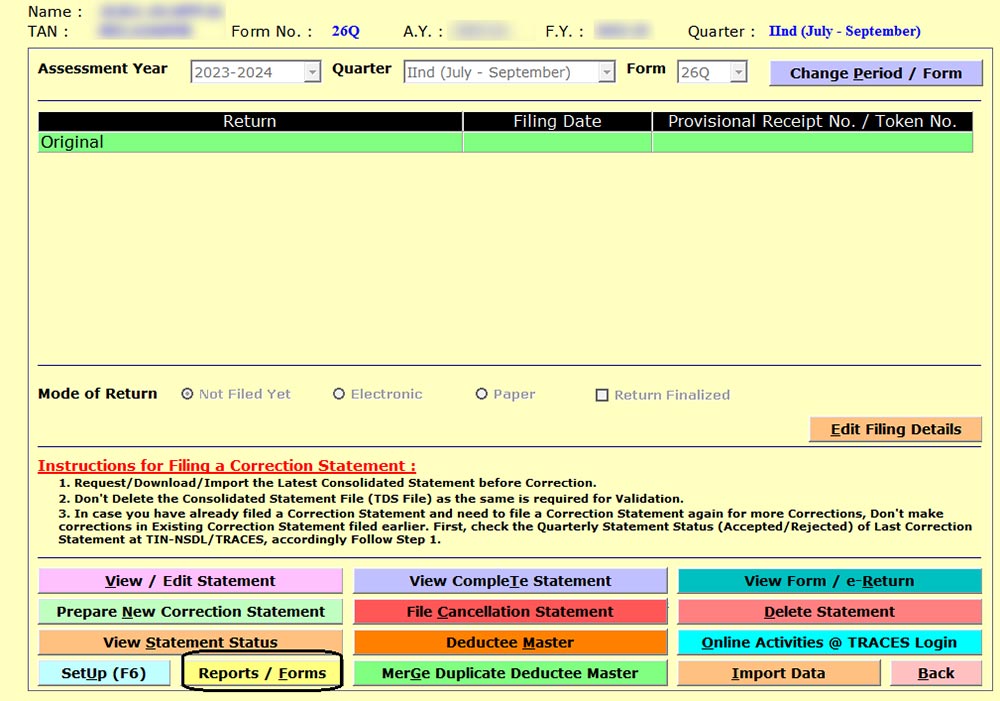

Step 4:- Click on Report/ Forms as shown in the image below.

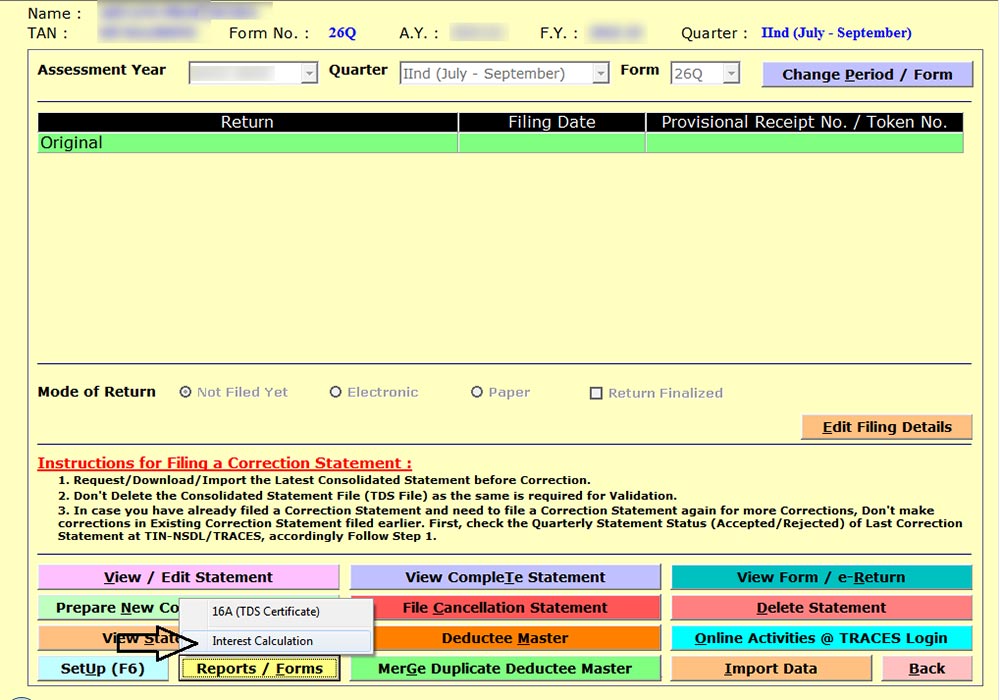

Step 5:- Click on the Interest Calculation tab to check the interest calculation.

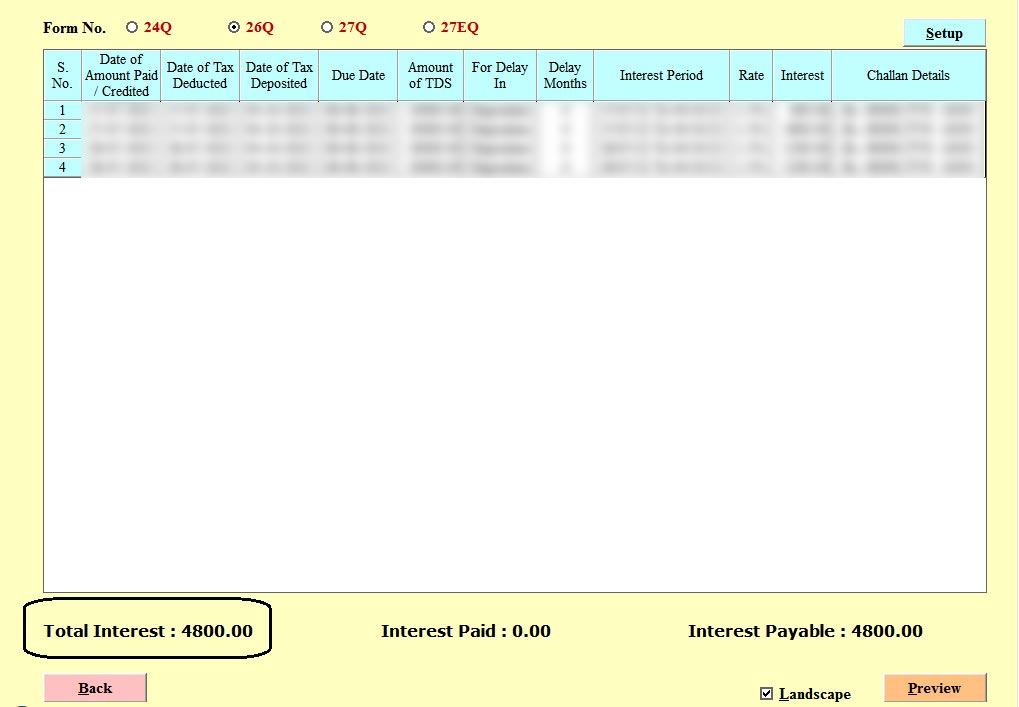

Step 6:- Interest Calculation will get shown in this tab.

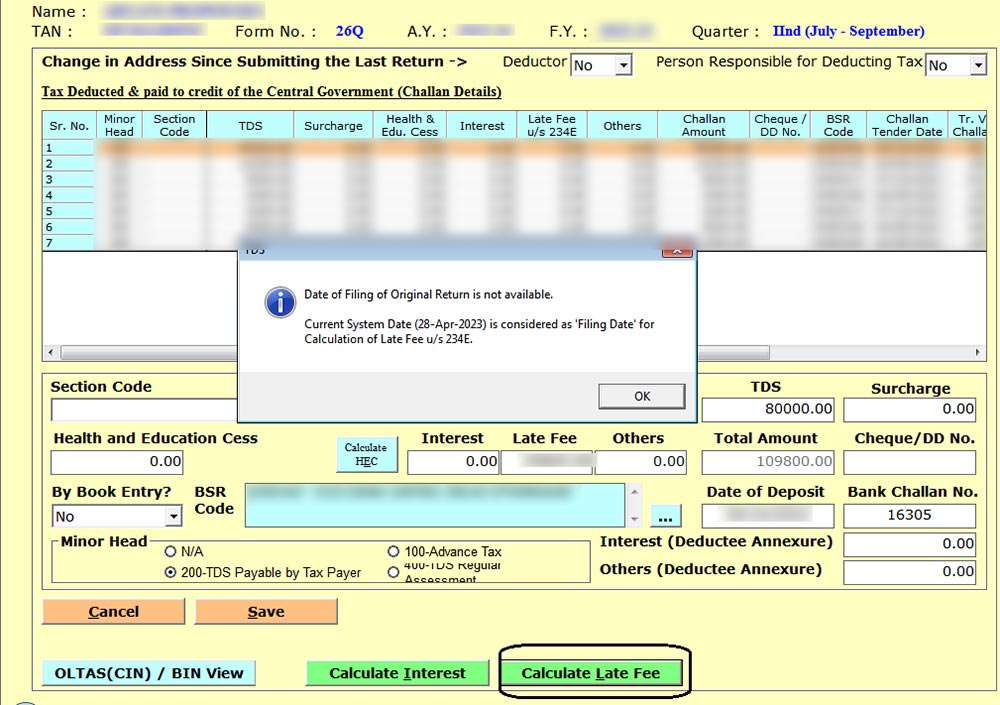

Step 7:- For Late Fee Calculation double click on Original Statement.

Step 8:- Click on Modify Challan and then click on Calculate Late Fee to calculate the Late Fee.