Short Brief About Advance Tax

Advance Tax is a part of your tax payment that must be made before the end of the year. The tax should be paid in the same year as the income is received. Therefore, it is a popular name called a pay-as-you-earn scheme.

Who is Required to Pay Advance Tax Payment?

When the tax liability for a year after subtracting TDS exceeds INR 10,000, an individual must pay an advance tax payment. In short, an individual is responsible for paying an advance tax payment when his or her complete tax liability minus TDS exceeds INR 10K in a year.

How to Calculate Advance Tax Payment?

Calculate your total revenue from all sources between April 1 and March 31. Add up all tax-deductible, expenses and investments. Calculate the tax due on such income. Taxes paid through TDS/TCS can be reduced.

Due Date to Submit Advance Tax Payment

According to the timeline, taxpayers must deposit advance tax payments in four instalments:

- First Instalments on 15th June for 15%

- Second Instalments on 15th September for 45%

- Third Instalments on 15th December for 75%

- Fourth Instalments on 15th March for 100%

Taxes can be paid through net banking in authorized banks using the e-payment method.

Steps to Calculate an Advance Tax Payment via Genius Software

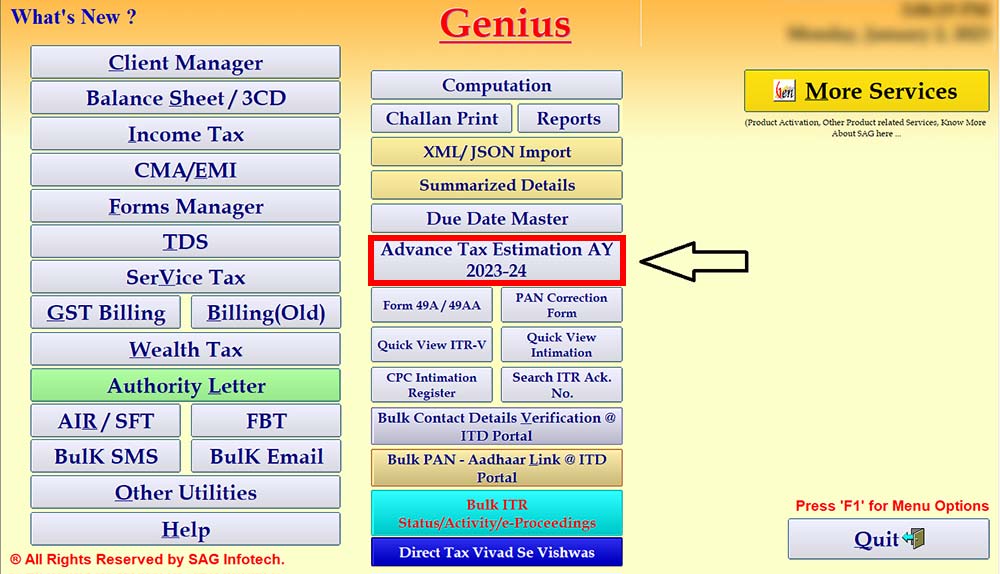

Step 1:- Open the Genius Software – Go to Income Tax and then click on Advance Tax Estimation AY 2023-24.

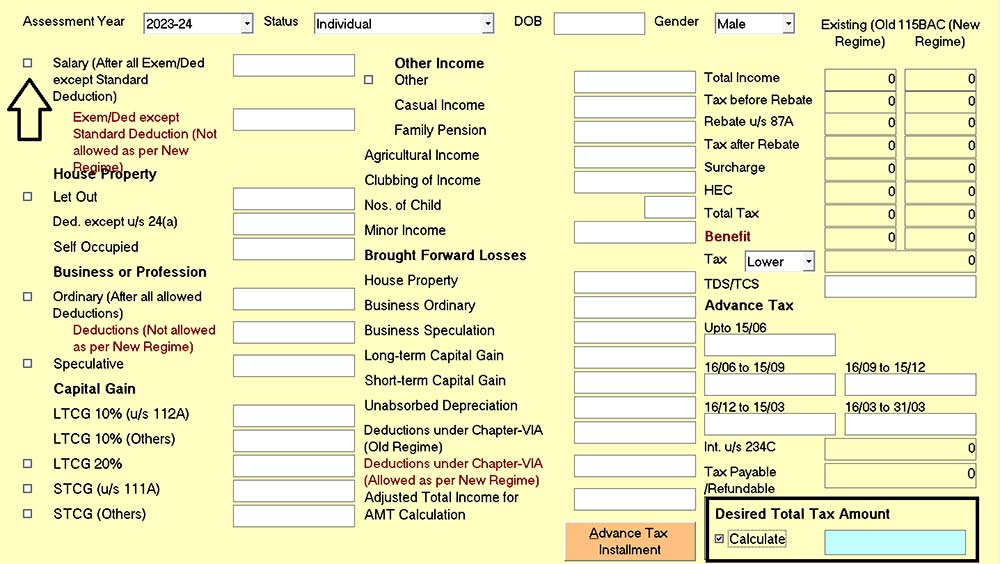

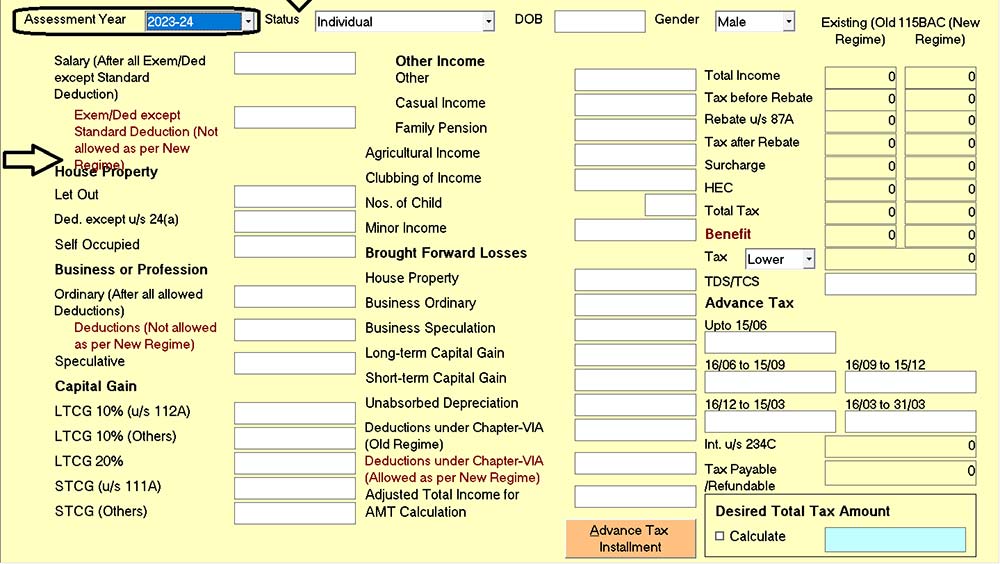

Step 2:- Select the Assessment year for which you want to calculate the Advance Tax then fill in the status, DOB and Gender. Fill in the estimated Income like salary, House property, Capital Gain, Other Income etc and press enter. Tax as per Old Regime and New Regime will get calculated. You can also check the Advance Tax Instalments by clicking on Advance Tax instalment.

Step 3:- If you know the Desired Total Tax amount then you can fill in the Total Tax Amount and click on the head of Income of which you want the estimated income and click on Calculate button