Under the GST regime, registration is the foremost and the essential step for existing taxpayers as without registration, they would not get GSTIN number, which is a basic identity number of a taxpayer. Filling the correct details in the registration form is necessary but what if somebody entered the wrong details or missed out some important fields?

To ease the hurdles, Rule 12 and Form GST REG 14 provide a way to correct the information without visiting any government office or centre. An applicant can correct some information and change the particulars without approval from any authority and some fields require approval but editing can be done online in both cases.

The amendments for GST registration are categorised into three, which describe the level of approval and time period to amend the fields. While applying for an amendment in particular fields of a registration form, it is mandatory to mention the “Reasons” for the amendment in GST registration process.

Three Types Of Amendments That Can Be Done:

Change In Core Field: The changes in the Core field includes the legal name of the business, the address of the principal place of business, and any additional place of business. It takes 15 days to get approval from a proper office to amend the Core Fields.

Change In Non-core Field: There are some fields that don’t require any approval from a proper office and amendments in Non-core fields can be easily done online. All the fields except those which are covered under core fields come under a Non-core field.

Change In Email Or Mobile Number: The change in email or mobile number requires a verification by OTP(One-Time Password) after online verification on the common GST portal.

Recommended: All Latest Updates on 32nd GST Council Meeting

Try Free Demo for GST Registration Software

Eligible Applicant To Change The Registration Details:

The taxpayers under the following categories can amend the registration details:

- Normal taxpayers and new applicants

- Changes in TDS/TCS registration for the person having a UIN card and belongs to UN Bodies, Embassies & other notified

- person

- Non-resident foreign taxpayer

- GST practitioner

- Online application and retrieval service provider

The Fields Which Cannot Be Changed:

- Any amendment to the details of the PAN card cannot be done as the GST registration is wholly based on the PAN number

- Change in the constitution of the business cannot be done as it requires a change in the PAN number in the first place

- Modification in place of business from one state to another state cannot be possible as GST registration is state-specific

Apart from this, the primary authorised signatory can also be changed with the condition to add a new primary signatory. If the condition is not fulfilled, then changes in the primary signatory are not possible.

Timeline For Amendment in GST Registration Process

In case of any requirement for any modification in the GST registration, a taxpayer needs to submit the application with the required documents for amendments on the GST portal within 15 days. After the GST REG 14 amendment form approval, the changes will be corrected in form GST REG 06.

The application for amendments of registration can be saved for 15 days. However, if an applicant fails to submit the application for any reason, the application for amendments will be removed automatically.

How To Do Changes In Core Fields?

To change the details of the core fields in a registration form, you need to follow below-mentioned step by step procedure:

- Step 1: Go to the GST home page by clicking www.gst.gov.in

- Step 2: Log in with the provided credentials to the GST portal

- Step 3: Click on the ‘Services’ tab from the main menu, hover the mouse on the ‘Registration’ tab under ‘Services’

- Step 4: Click on ‘Amendment Of Registration Core Fields’ to open the link

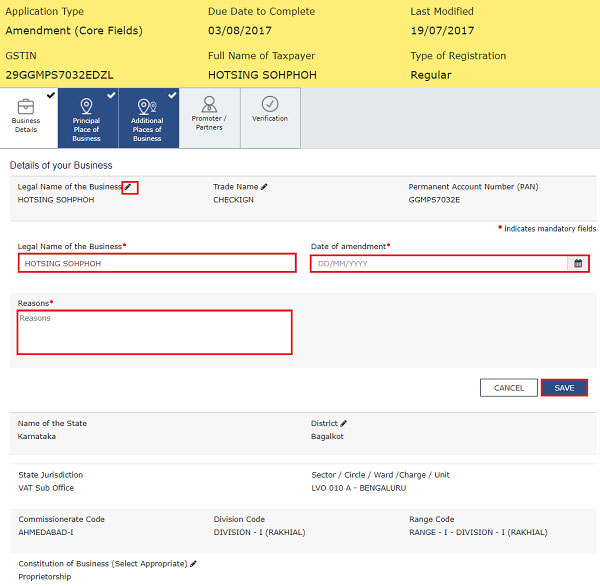

Business Details Tab

Step 5: The “Business Details’ tab appears as a default. Select the field which you want to edit by clicking the Edit icon

- Edit the particular detail you wish to edit

- Select the ‘Date Of Amendment’ by clicking on the calendar icon

- Provide the reason for the amendment in GST registration process online under “Reasons” tab

- Click the ‘Save’ button given at the bottom of the page

- After verifying all the “Business details”, press the “Continue” button at the bottom of the page

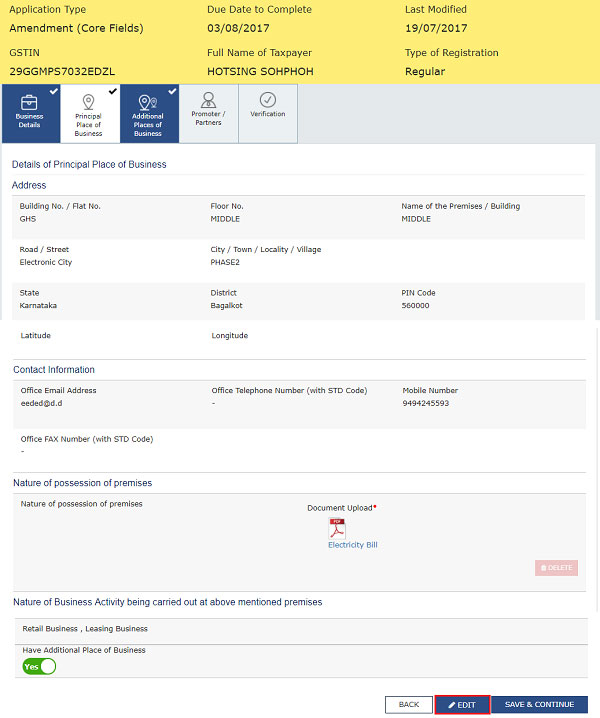

Principal Place of Business Tab

Step 6: Click on “Principal Place of business” provided in the main menu, after that select the “EDIT” button provided at the bottom of the page, if there is need to edit something

- Edit the required details and then follow the same procedure of entering “Reasons”, and “Date Of Amendment”

- Click on “Save” button at the bottom of the page.

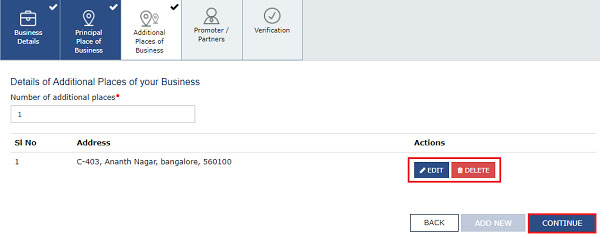

Additional Places of Business Tab

Step 7: Click on the “Additional Places of Business” Tab provided in the main menu, after that enter the details about “Number of additional places”, this field requires filling by values

- Click on the “Add New” button

- Edit the desired details in the relevant field

- After that, follow the same “Reasons” field and “Date Of Amendment”

- Click on the “Save & Continue” and “Save” button at the bottom of the page.

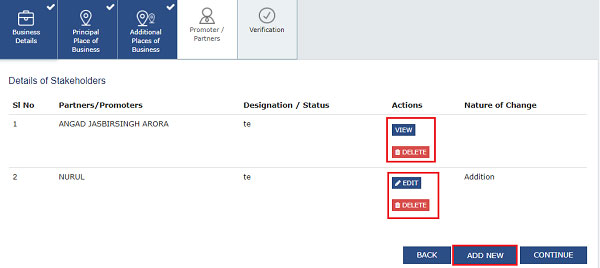

Note: To VIEW, DELETE, and EDIT promoter or partner details, click on the respective button

Promoter / Partners tab

Step 8: Select the “Promoter / Partners” tab, provided in the main menu

- Click on the “ADD NEW” button to add promoter/partners’ details

- Enter the details and upload the relevant documents as an identity proof

- After that, follow the same “Reasons” field and “Date of Amendment”

- Click on the “Save” & “Continue” button at the bottom of the page.

Verification Tab

Step 9: Select the “Verification” tab and click on the Verification checkbox

- In the “Name of Authorised Signatory” field, choose the authorized signatory by the drop-down list

- Enter the name of the place in the “Place” field

- After successfully amending the field under “Amendment Of Registration Core Fields”, digitally sign the form by using Digital Signature Certificate (DSC)/ E-Signature or EVC.

After successful completion of the amendment in the GST registration process online, the acknowledgement message will be sent automatically to registered Email and mobile no. in the next 15 minutes. Again, the message of application approval or rejection by a tax authority will be sent by SMS and email to the registered email ID and mobile number.

How To Do Changes In Non-Core Fields?

To change the details of the core fields for a registration form, you need to follow below-mentioned step by step procedure:

- Go to the GST home page by clicking www.gst.gov.in

- Login with the provided credentials to the GST portal

- Click on the ‘Services’ tab from the main menu, hover the mouse on ‘Registration’ tab under services

- Click on ‘Amendment Of Registration Non-Core Fields’ to open the link

- The Non-Core fields are shown in editable format, edit the details in the respective fields and tabs

- Select the “Verification” checkbox under the “Verification” tab

- In the “Name of Authorised Signatory” field, choose the authorised signatory by the drop-down list

- Enter the name of the place in the “Place” field

- After successfully amending the field under “Amendment Of Registration Core Fields”, digitally sign the form by using Digital Signature Certificate (DSC)/ E-Signature or EVC.

After successful completion of the amendment in the GST registration process, the acknowledgement message will be sent automatically to the registered Email and mobile no. in the next 15 minutes. The modification done in the Non-core fields doesn’t require any approval by the Tax Official.

If i want to get GST registration certificate as trader (laboratory chemicals suppliers), address proof as rent agreement will it be acceptable?

Later on can i change the address.

Yes, provided the authenticity of the document is totally dependent upon department’s discretion

How to add items more then five in GST portal.

Can I change the user name in GST

no, you can change the password

Amendment for core fields change for Address. ARN Number Generated. Reply for Query You are directed to submit your reply by 10/05/2022 . But am not see the query But document not upload ARN Number Experied . how to again i filed submitted.

“Please contact to GST portal for the same”

6 years back I have taken the GST number on my Residencial address.

But I was operating my business from a rental shop and dint applied for additional place of business.

I got the gst audit notice from gst department.

Now they are saying all ur ITC will not b considered

I have by mistake registered myself as Tax Collector (E-commerce Operator) for GST registration. GST Certificate has been issued 5 days ago on 2nd July. I have not done any transaction or collected any tax till date. How can It be changed from Tax Collector to Regular Tax payer GST registration?

You need to cancel the TCS GST registration first then apply for fresh Regular GST registration

Thankyou very much for your response. I made attempts to cancel TCS registration on the portal but it denied Access to me. Kindly help how to go about it.

You may need to file the pending returns first to cancel the GST registration.

Hello, I am facing the same problem. Please let me know if your issue is resolved and how did you fix it.

I applied for adding an additional place of business. it’s been more than 15 days(20 days in fact). still, it’s showing ‘pending for processing’. aren’t they bound to take action within the prescribed time?

Please contact the concerned department

I have done registration and and receive gstin. But I’m unable to change contact details there is no option to edit details in non core fields.

“Please contact to GST portal for the same”

I have changed Proprietor photo in GST portal (non-Core filed) and ARN also approved, but new photo is not reflecting while downloading GST registration Certificate. Please guide me

Please wait for some time, it will be updated on the GST portal

1. MY PAN IS OF HUF

2. BUT BY MISTAKE I HAVE PUT PROPRIETOR SHIP IN TYPE OF CONSTITUTION

3. CAN I AMEND THE TYPE OF CONSTITUTION TO HUF INSTEAD OF PROPRIETOR

No, If there is any mistake in the constitution of business (like proprietor to partnership). Then, the applicant will have no other option except to file a fresh registration using the Form GST REG-01.

Sir, my Gst registration is as retailer but i need to change as manufacture.

It it possible?

You can check in amendments in Core fields if it allows, you can

I have to change my spelling from MINA to MEENA in GST registration and on GST portal. I have proprietorship. So how can I change it.

You have to amend the Core filed for the same on GST portal under registration

I have to be changed principal place of address with other district. But during the filing jurisdication address is invisible. how to change

Please amend the Non-core field for the same

I have changed the principal place of busimess via amending the core field and got approval from the department. But when i downloaded the registration certificate its still showing the previous address. Is there anything else I have to do to change the address in certificate also

Dear sir, please wait for some time, it may be a portal issue to update the same

How to change Taxpayer Type

Input Service Distributor (ISD) to Regular.

You need to cancel the old registration first, then apply for the new one

Hi, Our application for APOB core fields on GST portal has been rejected. We can’t see the reason why it was rejected. Please tell what should we do. We need that for Amazon FBA

We have changed the email id of the authorised signatory by otp received on the new email id & registered mobile number. A form GEN-14 is also saved for non-core fields, but we are not able to submit form GEN-14 by evc method. The email id also has not changed. Please advise how to do it

“Please raise complaint ticket on GST portal for the same”

After approved I downloaded GST certificate but there is empty in GST certificate

Name empty

Designation empty

Jurisdictional office empty

What is reason to blank ?

What is next process?

Please contact to GST practitioner for the same

Sir my arn number generated for the core field amendment is AA070521024507I. It has been 11 working days (excluding Saturday) so far. Kindly tell me when do I expect to get approved. Waiting for your reply.

Sir,

I add an additional place of business how many days it approves

Sir, I have added one godown (GST REG-14 ) in our GST today, it is showing status showing is pending for processing, I didn’t receive any ARN. how to print my filled application for adding Branch

Please contact to GST portal

gst portal

service-user service- view my submission to download your application

What will the amendment date…when add a director? Is it the date of GST amendment or the actual date of joining of the Director in that company?

The actual joining date of Director in that company

Which document needs to upload as proof to add a new director? Is it DIR 12?

You have an online option for making amendments in the GST registration certificate. You can remove the details of the previous director and enter the details of a new director,

PAN card and address proof of all directors of the Company.

Sir, how to change the JURISDICTION range

Can I change the trade name in GST registration and if yes then what are the documents that are required to be uploaded.

It is not possible to change the Trade name

Yes you can change trade name in GST

Required Documents- Any legal documents confirming the validity of your name. like- Rent agreement (showing Trade Name), Sales/purchase invoices, Banking proof etc.

dear sir,

came the letter from the GST office of cancellation of a registration due to not suitable of the business place.

what I do.

my work only trading

We can not help in this matter kindly contact to the concerned department

मेरी trade name में कुछ spelling mistakes हो गई है इसका समाधान बताए जी

Kindly do update the amendment in core filed on the GST portal

Sir, I have added one godown (GST REG-14 ) in our GST two days back, still showing status showing is pending for processing, how much time to take get an approval?

Approximately 15 days it will take

I am having GST registration in (Mumbai) Maharashtra, now I want to add my branch address & it is of Gujarat. So please let me know am I able to do that ?? If yes, what are the documentation required and other formality to make it done? Our major business is exported only.

You can add the new branch under the amendment in none core filed on GST portal

Not allowed because if your branch/ Additional place of business is in a different state from the Principal place of business. Then you are required to apply a new GSTIN against the branch address you want to add.

conclusion- If you want to run a business from Gujarat state then you need to register yourself with a new GSTIN in Gujarat.

One has to apply for New Registration, as the new branch is not in the same state… Fresh registration is required for Gujarat. The branch cannot be added in Maharashtra

In case Place of Business changed 6 months ago but not changed on the GST portal, is any penalty charged from the GST department?

And What is the time limit for changing on the portal?

No such idea, please contact to GST practitioner

Ours is a Proprietary firm. The registered principal place of business in GST registration was the residence of the sole proprietor. On the sale of the residence by the proprietor the address in the GST registration certificate is to be changed. Can it be done online? and what is the procedure?

Yes, it can be done online, amending the Non-core field in registration

In our GST Certificate (Form GST REG-06) Details of Proprietor, there should view Proprietor’s Photo but wrongly Electricity bill shows. Then what is the procedure to change that photo?

It can be changed in Amendment in Core field section

Got a notice to upload photo and aadhaar in portal. I do not know where it has to be uploaded.

Sir, please click on the registration page, there you will get the place where you can upload Photo & Aadhaar

hi, I have added 4 branches in my GSTin its approved also, but the branches not reflected in my certificate. can you please give me a solution for this…

Please contact to GST portal for this

SIR, WE HAVE EXECUTED RETIREMENT PARTNERSHIP DEED ON 27/07/2020 TODAY(i.e.ON 28/09/2020) I AM GOING TO FILE AMENDMENT IN CORE FIELD. WILL PORTAL ACCEPT?

We have the principal place of business and GST in Karnataka. Now we want to open an additional godown in Maharashtra. Do we need a separate registration? How much time does it take normally to get a new GST number?

Yes, after Aadhaar Authentication hardly it will take 3 days

Sir, Can a proprietary firm change nature of the business also name of the proprietor to his wife’s name.

Can we work with different service or do different types of business in the same state under one GSTIN?

No

In PAN data of a Proprietor, the father’s name has been amended. But in the GST portal, being a Proprietary Firm, old PAN details of the proprietor are registered.

So now while requesting for adding the additional place of business, it gives an error that “Name as per PAN data and GST data differs”.How to resolve the matter. How to update PAN records on the GST portal?

First, amend the core detail of existing registration and update the PAN detail there, once it is completed then you can proceed further

We have amended the Principal Place of Business, the new place is now reflected on the portal however the GST Certificate still shows our old place of business. How / What needs to be done for making the new place of business reflected in GST CERTIFICATE.

Thanks

Please raise queries on GST portal for the same

Can I change my state jurisdiction in GST?

“You cannot change the state jurisdiction as GST registration is a state specific. In case you are shifting your business to some other state then you have to close the existing registration and get freshly a fresh registration in another state.”

Our principal place of business manufacturing unit is closed down in West Bengal. We have 2 more units in the said State. Now, We want to change the principal place of business from the closed unit to another manufacturing unit and remove the unit which is closed from the GST registration certificate. Please suggest/advice.

Please do change the address under Amendment in core field on GST portal

How can i add more items in GST?

You can add more product Through ‘Amendment Of Registration Core Fields’ on GST portal

I HAVE SUBMITTED APPLICATION WITH REASON FOR APPLICATION AS VOLUNTARY BUT AFTER APPLICATION THRESHOLD CROSSED WITHIN 2 DAYS. HOW TO AMEND THE REASON BEFORE MY APPLICATION IS APPROVED. IT IS STILL IN PROCESS PENDING FOR ORDER

You have to wait until the process of pending order complete, after that, you can amend the same if editable.

I amend firm name in 5/2/20 but the amend is not clarify till date

so what can I do

Please contact to the portal