The petitioner challenged the coercive actions taken by the State Tax Department under Section 79 of the Uttar Pradesh Goods and Services Tax Act, 2017 (UPGST Act) before the Allahabad High Court. These actions were initiated to recover tax dues arising from a best judgment assessment passed under Section 62(1) of the Act due to the taxpayer’s failure to file returns on time.

The applicant, as per these assessment orders, submitted all due returns (GSTR-3B) and paid the entire tax dues within the said time period of 60 days from the date of service of the assessment order.

Even after these compliances, the respondent authorities moved to recover ₹4,79,811.55 from the bank account of the applicant and further directed the bank to mark a lien of ₹2,36,32,250 across multiple accounts through orders on 14.07.2025, 15.09.2025, and 19.09.2025, invoking Section 79 of the Act.

The applicant said that after filing the returns and taxes within the said time, the best judgment assessments u/s 62(1) stood “deemed withdrawn” by operation of Section 62(2). Therefore, there was no subsisting demand to explain coercive recovery u/s 79.

Main Issue

Whether recovery proceedings initiated under Section 79 of the UPGST Act can be sustained when the best judgment assessment orders under Section 62(1) stand deemed withdrawn in terms of Section 62(2) after the filing of belated returns and payment of tax by the assessee.

Held that

As per the High Court, when the taxpayer submits the due returns and files the tax within 60 days from the issuance of the best judgment assessment order u/s 62(1), the said order “shall be considered to have been withdrawn” as per Section 62(2). As a result, any demand that arises from this cannot be recovered by citing Section 79.

The court discovered that in the same case, the applicant had duly submitted the returns and filed the taxes in the year 2023-24, whereas the liens on the bank accounts were formed exceeding than a year later, in July and September 2025, which was arbitrary and opposite to the law.

Cout, if any separate or additional demand (e.g., interest or penalty) is not paid, the department can raise this demand by issuing a fresh SCN as per law.

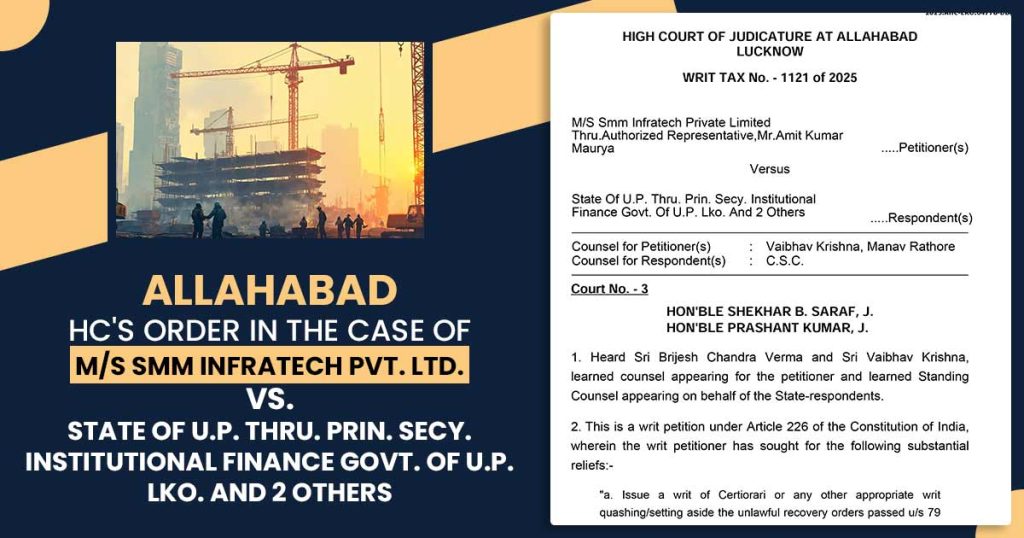

| Case Title | M/s Smm Infratech Pvt. Ltd. V/S State Of U.P. Thru. Prin. Secy. Institutional Finance Govt. Of U.P. Lko. And 2 Others |

| Case No.: | WTAX No. 1121 of 2025 |

| Counsel For Petitioner | Vaibhav Krishna, Manav Rathore |

| Counsel For Respondent | C.S.C. |

| Allahabad High Court | Read Order |