The Hyderabad Bench of the Income Tax Appellate Tribunal (ITAT) ruled that the refusal of exemption u/s 11 and 12 of the Income Tax Act on the basis of late filing Form 10B was unexplained, as the report was available with the CPC before passing the order.

Seva Bharathi, the taxpayer, a trust registered u/s 12A of the Income Tax Act, filed its income return for the Assessment Year (AY) 2022-23 on November 2, 2022, declaring a total income. The taxpayer submitted the required Tax Audit Report in Form 10B on the same date, including the return.

September 30, 2022, was the original deadline for filing Form 10B and was subsequently extended by the CBDT up to October 7, 2022. As the taxpayer submitted the same dated November 2, 2022, there was a delay.

The return was processed by the Central Processing Centre (CPC), Bengaluru, and an order was passed dated March 28, 2023. The benefit of Sections 11 and 12 to the trust has been refused by the CPC, quoting the delay in filing the audit report in Form 10B.

Also Read: Full Details About e-filing 10B Form via Gen I-T Software

The taxpayer is not pleased with the order of CPC, submits a plea to the ITAT. The taxpayer’s counsel claimed that when the audit report in Form 10B was present with the CPC, then, having been submitted along with the income return, the delay of 25 days cannot be a foundation for refusing the exemption.

The taxpayer said that submitting Form 10B is directory, not mandatory, and the substantive benefit must not be withdrawn because of a minor procedural delay.

The two-member bench, Vijay Pal Rao (Vice President) and Madhusudan Sawdia (Accountant Member), acknowledged the submissions and cited that the audit report was submitted, including the income return, and was available with the CPC when the return was processed dated March 28, 2023.

Read Also: Orissa HC: Section 12A Exemption Can’t Be Denied Solely for Delay in Submitting Audit Report

Consistent judicial precedents from various High Courts, along with the Gujarat High Court, which held that the benefit of exemption must not be refused due to a delay in filing the report in Form 10B, the Tribunal stated. While filing an audit report is a need, the mode and phase of the filing is procedural or directory.

It was concluded by the tribunal that, as the Form 10B was submitted, including the income return, and within the deadline of submitting the income return, the late filing of Form 10B could not be a reason for the refusal of the exemptions under Sections 11 and 12 of the Income Tax Act, 1961. Subsequently, the taxpayer’s appeal was permitted, which contested the refusal of the exemption.

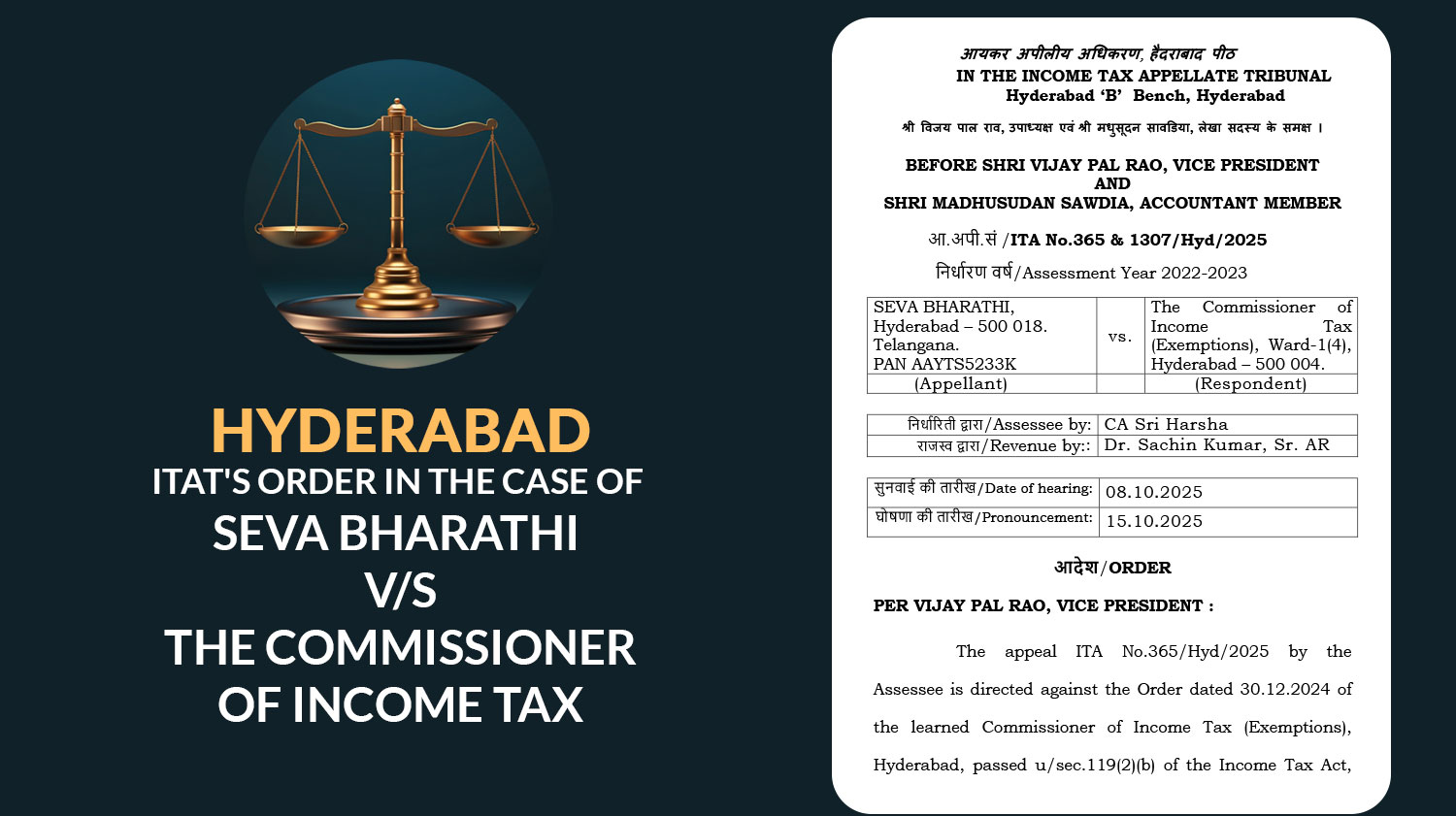

| Case Title | Seva Bharathi vs. The Commissioner of Income Tax |

| Case No. | ITA No.365 & 1307/Hyd/2025 |

| Assessee by | CA Sri Harsha |

| Revenue by | Dr Sachin Kumar, Sr. AR |

| Hyderabad High Court | Read Order |