The decision of the Commissioner of Income Tax(Appeals)[CIT(A)] has been carried by the Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) permitting the tax deducted at Source (TDS) credit of ₹168.61 crore, noting discrepancies in 26AS form due to late payment of TDS and revised filings, and asked the AO to verify the credit.

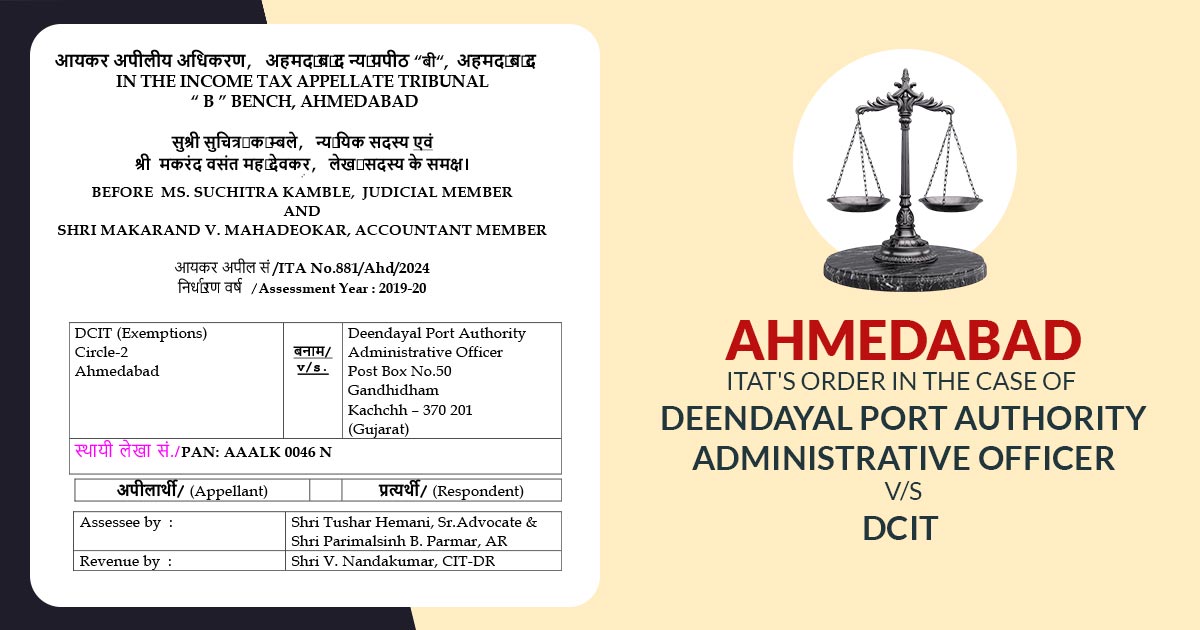

On March 31, 2024, a revenue appeal was made regarding the tax assessment for the financial year 2019-20. This appeal was directed against a prior decision by the authorities, specifically about a claim made by the Deendayal Port Authority, which is the party involved in this case.

The authority initially reported that it should receive a credit of ₹165.66 crore for taxes that had already been deducted from its earnings. However, a subsequent update showed a higher amount of ₹167.86 crore listed in their tax records.

A rectification application has been filed u/s 154, which the AO rejected dated 11.08.2022, restricting the credit to the original amount.

CIT(A) on plea has permitted the surged credit of Rs 168.61 crore marking the discrepancy that emerged from the late TDS payments and amended Form 26AQ filings by the Port users and asked the AO to validate and allow the credit as per that.

The departmental Representative (DR) in the hearing accepted the TDS credit determined via CIT(A) and urged the case to be sent to the AO for verification and compliance. The representative of the taxpayer validated that the pertinent revenue had been proposed earlier for taxation.

The bench comprising Suchitra Kamble (Judicial Member) and Makarand V.Mahadeokar (Accountant Member) carried the order of CIT(A) permitting the TDS credit based on the updated Form 26AS and asking the AO to validate and grant the credit.

It cited that the TDS credit must be authorized when the related revenue is proposed to tax, within the verification. The tribunal requested the authorities of the revenue to prevent unwanted pleas in these matters, suggesting resolution via AO-level verification.

The appeal of the revenue has been dismissed as infructuous by the tribunal, and the Assessing Officer (AO) was asked to validate Form 26AS and grant the TDS credit of Rs 168.61 crore, ensuring the related revenue was composed of the total income.

| Case Title | Deendayal Port Authority Administrative Officer vs. DCIT |

| Citation | ITA No.881/Ahd/2024 |

| Date | 13.12.2024 |

| Assessee by | Shri Tushar Hemani, and Shri Parimalsinh B. Parmar |

| Revenue by | Shri V. Nandakumar |

| Ahmedabad ITAT | Read Order |