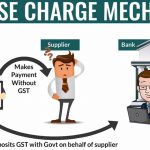

In a meeting held of the finance ministers of various Indian states for reviewing of the GST reverse charge mechanism, it has been recommended that section 9(4) of the CGST Act, 2017 should be deleted.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

In a meeting held of the finance ministers of various Indian states for reviewing of the GST reverse charge mechanism, it has been recommended that section 9(4) of the CGST Act, 2017 should be deleted.

Infosys is now geared up to release a new GSTR filing form in order to simplify the IT return form for the business units as ordered by the GSTN Group of Ministers (GoM).

Group of Ministers are expected to hold a meeting on 8th July for final discussions over reverse charge mechanism and tax discount on the digital payments under GST.

The group of ministers under the Bihar deputy chief minister Sushil Kumar Modi led ministerial panel will be looking into incentivising the digital payments under goods and services tax on May 11.

In a bid to curb tax evasion, the government has finally decided to take a step ahead in the direction of implementing reverse charge mechanism provision. For this, there will be a meeting of a group of ministers GoM scheduled on 16 April.

The Group of Ministers (GoM) Committee has suggested some changes to make the composition scheme more attractive and by lowering taxes with a flat 1% tax on restaurants.

To address the issues relating to the technical glitches faced by taxpayers in the implementation of goods and services tax (GST), a five member Group of Ministers (GoM) has been constituted by the Finance Minister Arun Jaitley.

The Goods and Services Tax Council, led by Finance Minister Nirmala Sitharaman, is likely to roll out new tax slabs for goods by September 22, according to information from government sources shared with NDTV. On August 15, Prime Minister Narendra Modi announced that bring next-generation GST reforms that will facilitate tax load on the country. […]

The Yamunanagar plywood manufacturers have requested the Haryana Government to reduce GST on plywood from 18% to 5%, stating that such a move will strengthen the state’s economy and generate employment opportunities. JK Bihani, the President of the Haryana Plywood Manufacturers Association, had written a letter to Chief Minister Nayab Singh Saini, which it was […]