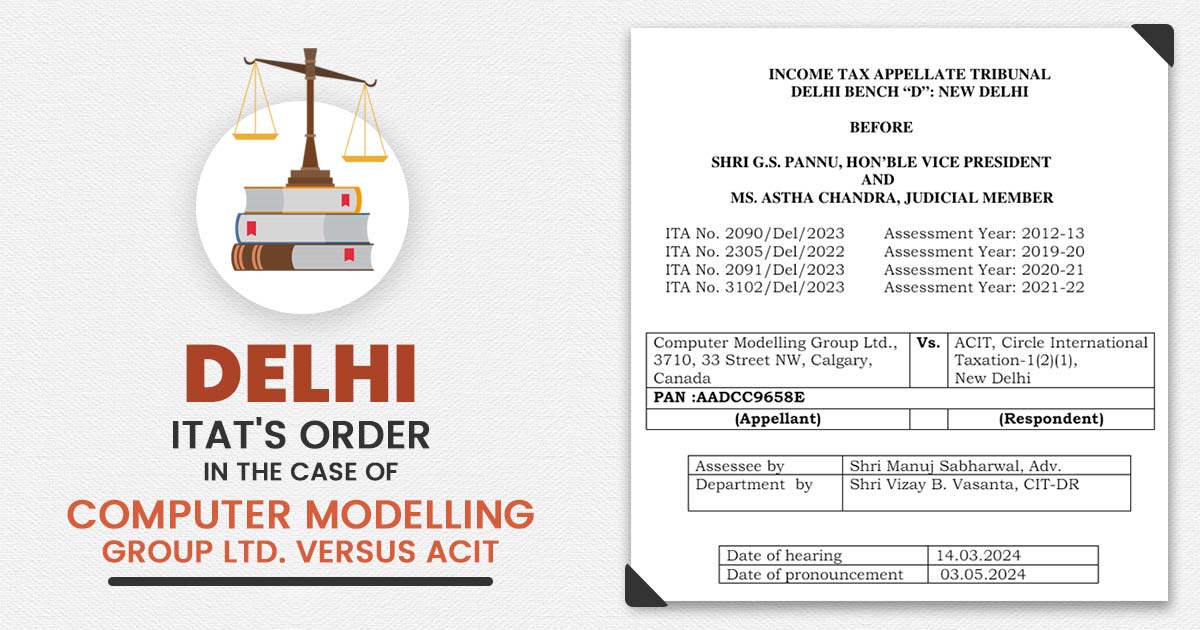

Supreme Court held on the taxation of interest-free/concessional loans to bank employees. This blog furnishes an in-depth analysis of the judgment, analyzing the legal framework, challenges, and implications of the decision. Around the interpretation of Section 17(2)(viii) of the Income Tax Act and Rule 3(7)(i) of the Income Tax Rules, the case is focused on. […]