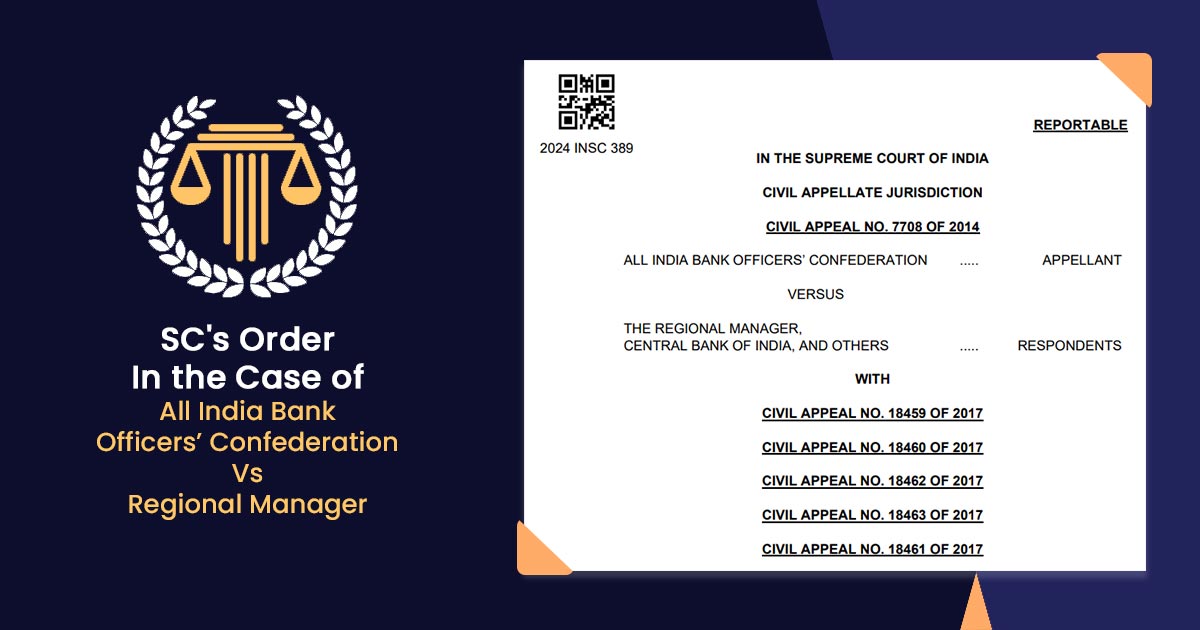

The comprehensive review process of GST laws has been accelerated and now it is particularly focused on rapidly reducing the tax-related offenses and it is aimed at improving business sense and reduce law reports. The Central Government is evaluating the chances and outcome of scrapping Claus into law that empowers Officers to arrest taxpayers on […]