What is GSTR 4?

The GSTR-4 form is an annual return form for those taxpayers who have opted GST Composition scheme in the new indirect tax regime. Under the GST composition scheme, taxpayers will be required to file only one return in every financial year.

Also, the taxpayers will have to file CMP-08 for the payment in every quarter of the year. The due date for each CMP-08 filing is the 18th of every succeeding quarter. Read the CBIC notification.

- Who Should File GSTR 4

- GSTR 4 Form Due Date

- Interest on Late Payment

- GSTR 4 Important Terms

- GSTR 4 Updates on Council Meeting

- Simple Process to File GSTR 4

- GSTR 4 General Queries

- GSTR 4 Filing By Gen GST Software

Latest Update

- The 53rd GST Council updated the GSTR-4 due date from 30th April to 30th June for the FY 2024-25 onwards. View more

Free Demo of GSTR 4 Annual Return Filing Software

Major Points to File GSTR-4 (Annual Return)

- File button is enabled only if:

- No additional cash is required to be paid for liabilities

- You have clicked on the declaration checkbox

- You have selected authorised signatory details from the drop-down list

- The excess amount deposited through GST CMP-08, available in the negative liability statement will also get adjusted towards liabilities if any

- If the available balance in the electronic cash ledger is less than the amount required to offset the liabilities, you can directly create a challan by clicking on the ‘Create Challan‘ button.

- Tax and late fees are auto-drafted in Table-8 but interest is user input. Liabilities can be discharged only through an electronic cash ledger.

- The details of inward supplies (from Table 4B, 4C, and 4D for each tax rate) will be auto-drafted in Table 6 only after the Taxpayer has clicked on the ‘Proceed to file’ button. Before that, the balance will be displayed as ‘0’ (zero)

- Once you enter outward supply details in Table 6 and click the “Proceed to file” button, liability on the RCM basis is auto-populated from details entered in Tables 4B,4C, and 4D. Thereafter, Table 6 shows your total tax liability

- The details of outward supplies in Table 6 (Row 12-16) of GSTR-4 have to be entered manually by the taxpayer.

- The summary of self-assessed liability is auto-populated in Table-5 of the GSTR-4 Annual Return on the basis of filed Form CMP-08 & is non-editable.

- The tax amounts in Table-4 of GSTR-4 are auto-calculated on the basis of the values entered in the Taxable Value and Tax Rate fields. However, the tax amount is editable. The CESS is to be entered by the taxpayer.

- The aggregate turnover is required to be entered for the last year and if in case the business did nil transactions or turnover in the last FY or not registered it can put ‘0’ zero

- The annual GSTR 4 return filing will get activated once the taxpayer has finished filing of all the quarters of CMP-08 of the given financial year

Annual Return Form GSTR-4 Available on the GST Portal

The government has decided to let the taxpayers, assessees, and businesses file GSTR 4 on an annual basis. This has been done due to the demand of the community. The form is also available on the portal which has further relaxed the assess and taxpayers in finding and filing the form as per their convenience.

Salient Features of GSTR 4 Return Form

- GSTR 4 Returns will be filed on an annual basis for compounding Taxable persons. The last date for filing the GSTR-4 (CMP-08) payment form is the 18th of the month following the quarter. GSTR 4 (CMP-08) returns can be filed on 18th April, 18th July, 18th October, and 18th January and so forth

- GSTR-4 Form is filed by all the taxpayers who registered under the composition scheme

- Business entities registered under the composition scheme will be required to pay taxes at fixed rates quarterly without availing of the input tax credit facility

- The taxpayer will be required to show the total value of supplies made in a specific period and tax paid at the composition rate

- The taxpayer will be required to insert invoice-level purchase details for the purchases from normal taxpayers, which will be automatically updated GSTR 4A Form from the supply invoice uploaded by the opposite party in GSTR 1

Who Should File GSTR 4 Form

All the composite registered taxpayers are required to file the tax return.

GSTR 4 Annual Filing Due Dates

| Period | Due Date |

|---|---|

| Annual Return FY 2025-26 | 30th June 2026 |

| Annual Return FY 2024-25 | 30th June 2025 | View more |

GSTR 4 Interest on Late Payment

GST Council clearly stated in the acts that if a person has not paid the taxes before the due dates, then the GST Council has strict rules and regulations to accommodate it with an 18 % interest rate per year. The interest rate is applied to the number of days the taxpayer missed out. To look into the act clearly, you can read the information from point 50 of chapter 10 here: https://cbec-gst.gov.in/CGST-bill-e.html

If we take the illustration of it, a person missed out on the due date of yesterday, then the taxpayer has to pay 1000*18/100*1/365 = Rs. 0.49 for one day and the calculation varies on payable tax and the total missed out days.

In case if a taxpayer does not file his/her return within the due dates mentioned above, he shall have to pay a late fee of Rs. 50/day i.e. Rs. 25 per day in each CGST and SGST (in case of any tax liability) and Rs. 20/day i.e. Rs. 10/- day in each CGST and SGST (in case of Nil tax liability) subject to a maximum of Rs. 5000/-, from the due date to the date when the returns are actually filed.

GST CMP 08 is a quarterly return form that must be filed by the composition taxpayers after the end of each quarter. The due date for filing the GST CMP 08 return online is the 18th of the month after a particular quarter. GSTR 4 is an annual return form, for which the due date is 30th April after a particular financial year.

Important Terms Frequently Used in GSTR 4

- GSTIN – Goods and Services Taxpayer Identification Number

- UIN – Unique Identification Number

- UQC – Unit Quantity Code

- HSN – Harmonised System of Nomenclature

- SAC – Services Accounting Code

- POS – Place of Supply of Goods and Services

- B2B – From one registered person to another registered person

- B2C – From registered person to unregistered person

HSN: Harmonised System of Nomenclature (HSN code is filled in case of the supply of goods)

- A taxpayer will be required to provide the aggregate turnover of the immediately preceding financial year and the first quarter of the current financial year.

- The taxpayer will be required to furnish all the information only in the first year and it will be automatically updated in the succeeding years.

Let us Understand the Step-by-Step Guide Filing Procedure of GSTR 4

GSTR 4 return form is divided into 13 sections but it is not necessary to fill all these sections. Some of the details of sections in GSTR 4 form are given below:-

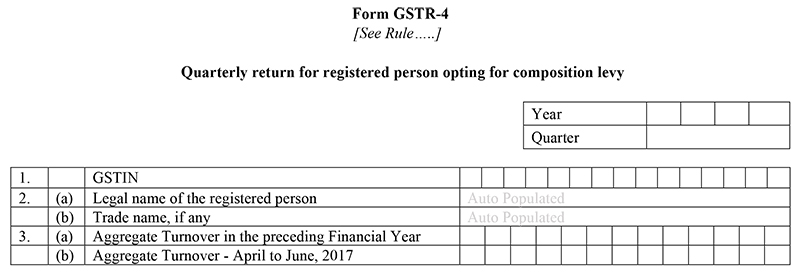

Part 1 to Part 3 – General Information

- GSTIN:- Every Taxpayer gets a state-wise PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN) from the Government. It must be noted that the identification of the taxpayer will be automatically filled in at the time of filing the return in the coming future

- Legal Name of the Registered Person and Trade name (if any):- The taxpayer’s name will automatically fill the time of filing the returns at the GSTN portal

- Annual Turnover in the preceding Financial Year:- A taxpayer will be required to fill in all the information only for the first time of filing and after then it will be automatically updated in the succeeding years

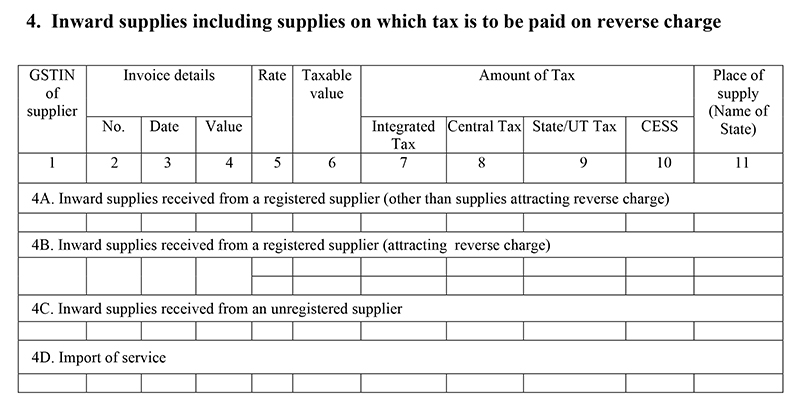

Part 4 – Inward supplies, including supplies on which tax is to be paid on a reverse charge

- Inward supplies received from a registered supplier (other than supplies attracting reverse charge), the information will be auto-populated from the provided by the supplier in GSTR-1 and GSTR-5. Inward supplies received from a registered supplier (attracting reverse charge- this information will be automatically filled from the information provided by the supplier in GSTR-1, inward supplies received from an unregistered supplier and Import of service. It must be noted that all inward supplies to the composition will be auto-filled here

Note: FinMin tweeted that the composition taxpayers can leave the purchase invoice details in table number 4, part 4A.

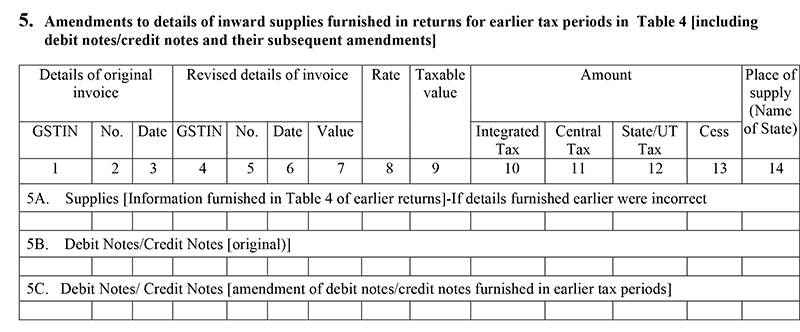

Part 5 – Amendments to details of inward supplies furnished in returns for earlier tax periods in Table 4 [including debit notes/credit notes and their subsequent amendments]

- It will include amendment information mentioned in earlier tax periods and also original amended debit or credit notes received, rate-wise. The place of supply is to be mentioned in case the same is different from the location of the recipient. While providing the information of the original debit /credit note, the details of the invoice must be provided in starting three columns, whereas, providing the revision of the details of the original debit /credit note shall be provided in the first three columns of this Table

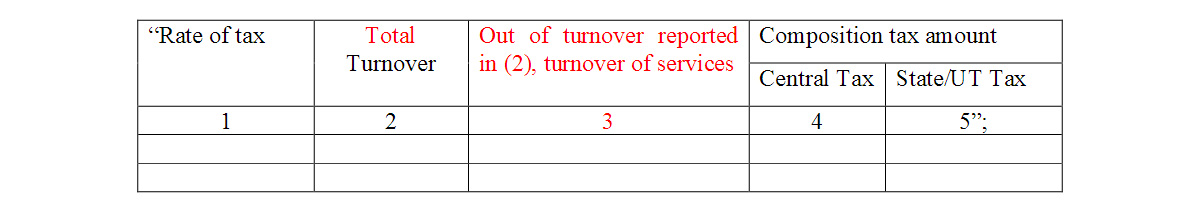

Part 6 – Tax on outward supplies made (Net of advance and goods returned)

- Under this section, you will provide the details of a tax rate, total turnover, out-of-turnover reported and the composition tax amount including both central tax & State/UT tax.

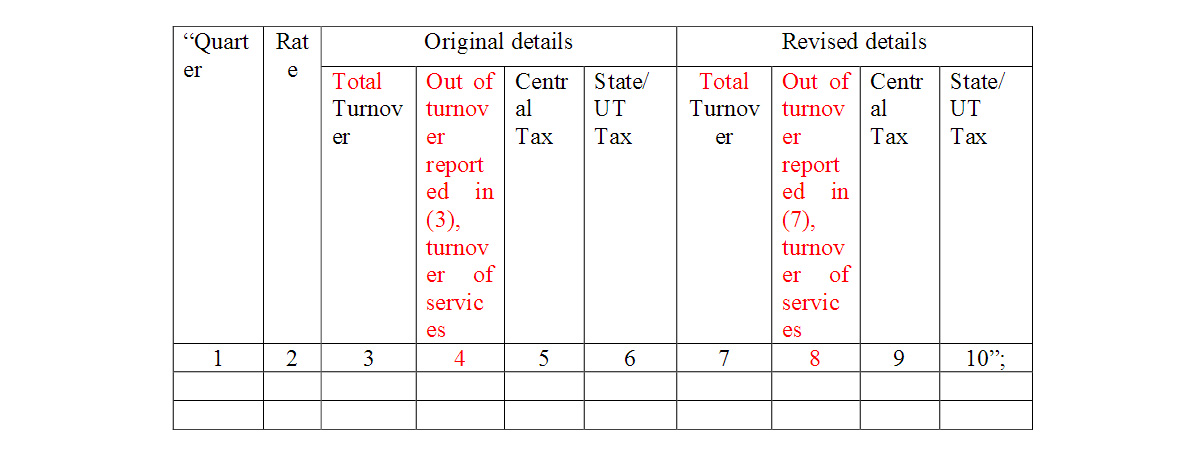

Part 7 – Amendments to Outward Supply details furnished in returns for earlier tax periods in Table No. 6

- Under this section, you will be able to rectify the incorrect details you provided in Table 6 in previous returns, without turnover reported details additionally added.

Note:

- In the GST council meeting, the authorities decided to revise the GSTR 4 filing form with some inclusion of terms in clauses 6 & 7. The revised columns have been added to the final form and are mentioned in red text.

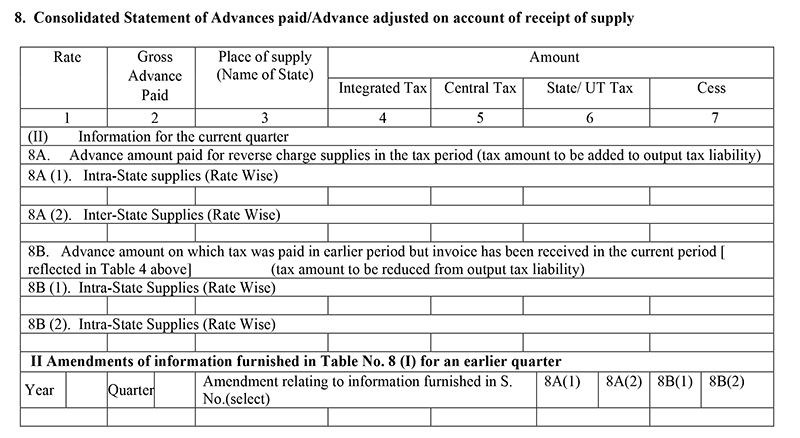

Part 8 – Consolidated Statement of Advances paid/Advance adjusted on account of receipt of supply.

- Under this, details of the advance paid relating to reverse charge supplies and if you paid taxes on them, adjustments against invoices issued to be mentioned in Table 8

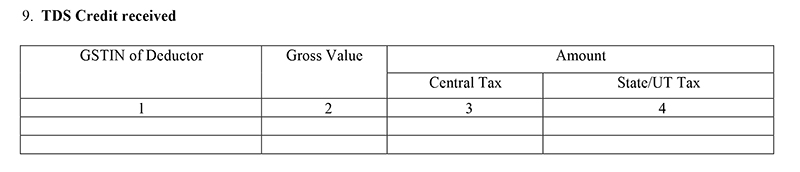

Part 9 – TDS Credit received

- TDS (Tax Deduct at Source will be auto-filled in Table 9

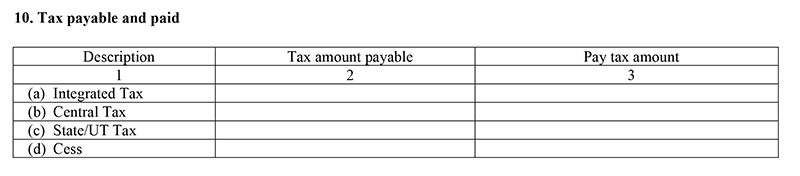

Part 10 – Tax payable and paid

- Under this section, you will be to provide the details of Integrated Tax, Central Tax, State/UT Tax, and cess tax amount payable as well tax amount paid

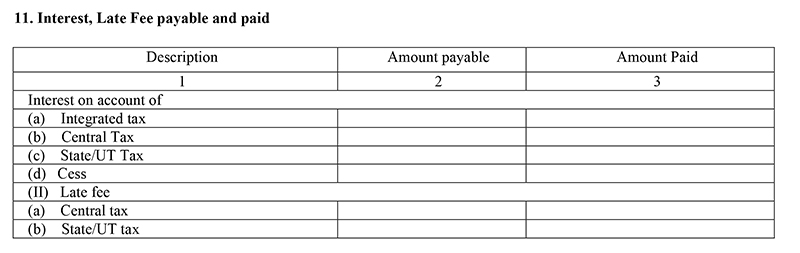

Part 11 – Interest, Late Fee payable and paid

- This section is for those taxpayers who have not paid their taxes timely

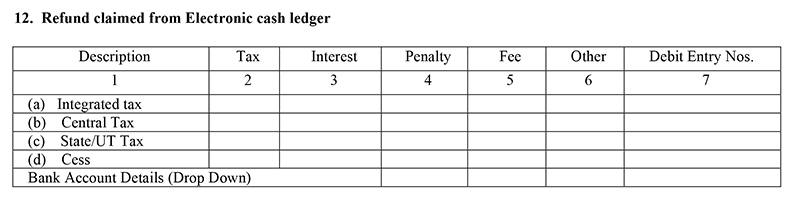

Part 12 – Refund claimed from Electronic cash ledger

- If in case the tax liability of the composition dealer is below the TDS deducted, he can get a refund of the balancing amount. The amount which is available for the refund will be auto-filled under this section

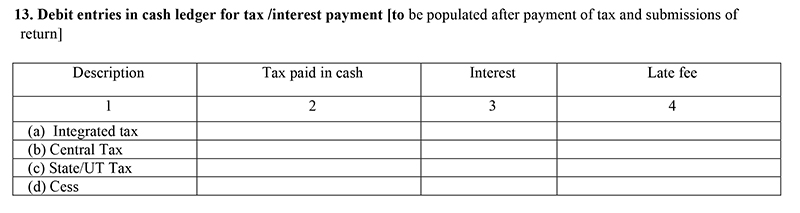

Part 13 – Debit entries in cash ledger for tax /interest payment [to be populated after payment of tax and submissions of return]

GSTR 4 Return Filing General Queries

Q.1 – Who needs to file GSTR 4?

All the assessees who have opted for the composition scheme under the GST Act 2017, are required to file their annual returns in form GSTR 4:

- Who has opted for composition scheme during registration but not opted since registration

- Who have opted for the scheme e before the start of the financial year

- Who have opted for the scheme during the year

Q.2 – What is the last date of filing form GSTR 4?

All the assessees must file the returns under form GSTR 4 till the 30th of the succeeding month after the end of the financial year. The government may extend the date.

Q.3 – Is filing required if my registration cancelled or I opted out of the scheme during a financial year?

Yes, you are required to file the annual returns under form GSTR 4 for the financial year even if your registration is cancelled or you opted out of the scheme.

Q.4 – What are the conditions to file form GSTR 4?

The assessee should be registered under the GST Act 2017 and should have opted for composition scheme. The assessee should also file quarterly returns under form CMP 08. If you do not file quarterly returns under form CMP 08, then you can not file GSTR 4.

Q.5 – Who can file NIL returns in form GSTR 4?

Any assessee can file NIUL return in GSTR 4 if:

- NOT made any outward supply

- NOT received any goods/services

- Have NO other liability to report

- Have filed all Form CMP-08 as Nil

- There is no late fee to be paid for Form GSTR-4

Q.6 – Where can I file GSTR 4?

Visit the GST portal then:

- Login

- Services

- Return

- Annual Returns

- File the return

Q.7 – What are the tables in form GSTR 4?

Form GSTR 4has the following tables:

- 4A. Inward supplies from the registered supplier (other than reverse charge): To add details of inward supplies received from a registered supplier (other than reverse charge)

- 4B. Inward supplies from the registered supplier (reverse charge): To add details of inward supplies received from a registered supplier (reverse charge)

- 4C. Inward supplies from unregistered supplier: To add details of inward supplies received from an unregistered supplier

- 4D. Import of Service: To add details of import of service

- 5. Summary of CMP-08: To view auto-drafted details provided in filed Form CMP-08 for the financial year

- 6. Tax rate wise inward and outward supplies: To enter tax rate wise details of outward supplies/ inward supplies attracting reverse charge during the financial year

- 7. TDS/TCS credit received: To view details related to TDS/TCS credit received

Q.8 – Does the amount in tax fields auto-populate based on values entered in taxable value field?

Yes, the amount in tax fields gets auto-populated based on values entered in taxable value field but the CESS field is not.

Q.9 – How can I add values in Outward supplies details in table 6?

Any assessee can add values in outward supplies manually, as they are not auto-filled like the inward supplies.

Q.10 – How to download the summary of Form GSTR 4?

You can download the summary of GSTR 4 by visiting the GST portal and:

- Services

- Returns

- Annual Return

- Form GSTR-4 (PREPARE ONLINE)

- DOWNLOAD GSTR-4 SUMMARY (PDF)/ DOWNLOAD GSTR-4 (EXCEL)

Q.11 – Can I file the returns after the due date without paying late fees?

No, you can not file the returns post the last date without paying the late fees. Although, the government may forgive the late fees.

Q.12 – Where can I find tax, late fee and interest for my return?

Tax, interest and late fees can be found in table 8, as tax and late fee are auto-drafted, while the Interest is user input.

Q.13 – How to offset the liabilities?

Any assessee can offset the liabilities after deducting the amount already paid on form CMP 08 by paying through electronic cash ledger. If the amount in the ledger is less then that required to offset, then you can make a part payment and create a challan for the rest or you can offset through the excess amount paid in CMP 08 if any.

Q.14 – What should I do if I receive a warning message of processing or processed with error?

If the warning is of under processing then wait for the processing to complete and if the waring is of processed with an error then go back to GSTR 4 and rectify the error.

Q.15 – When does file GSTR 4 button enables?

File button gets enabled only if you have-

- No ‘Additional cash (which) is required’ to pay for late fees, if any

- Clicked on declaration checkbox and have selected authorized signatory details from the drop-down list

Q.16 – Can I file GSTR 4 through an offline tool?

There is an offline tool present for GSTR 4 form but filing return for GSTR 4 can only be done online through the GST portal.

Q.17 – How many modes are there to sign form GSTR 4?

You can file form GSTR 4 through a DSC or EVC.

- Digital Signature Certificate (DSC)- DSC is an electronic certificate that proves an individual’s identity. You can generate a DSC from the certifying authorities. http://www.cca.gov.in/cca/?q=licensed_ca.html.

- Electronic Verification Code (EVC)- EVC can authenticate the identity of the assessee through an OTP sent to the mobile number registered under GST.

Q.18 – Can I preview form GSTR 4 before filing?

Yes you can preview form GSTR 4 before filing in PDF and Excel format by clicking on ‘DOWNLOAD GSTR-4 (PDF)’ and ‘DOWNLOAD GSTR-4 (EXCEL)’ button on the portal.

Q.19 – Can I revise form GSTR 4 after filing?

No, you can not revise form GSTR 4 post-filing.

Q.20 – What happen after the successful filing of Form GSTR 4?

After the successful filing of form GSTR 4:

- ARN is generated

- The assessee is intimidated through SMS and email

- Electronic Cash Ledger gets updated

Start GSTR 4 Return Filing by Gen GST Software

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."

I have filed GSTR 4 for FY 20-21. However, on verification of the filed form, I came to notice that the Table 6 Outward supplies were not updated. Now, the unadjusted payment of sales as per Table 6 is not set off, thereby on filing the CMP-08 for quarter Jun’21 unable to make new payment as the same is getting set off against PREVIOUS YEAR payments. Kindly let me know the way for rectification

Once GSTR 4 filed, it can not be rectified

Is it compulsory to fill 4A (inward supplies from registered supplier) in Annual Return GSTR- 4 for FY 2020-21.

No

Hi,

I registered my retail pharmacy under the composition scheme. Accidently I paid 2% instead of 1%, so I tried to get the refund for excess tax paid and GST portal is throwing an error. Below are the steps I took:

Paid and filed until FY2020-21/July-Sep.

Filed annual return until FY2019-20.

Paid excessively and filed FY2020-21/July-Sep.

Tried to apply for a refund under “Excess payment of tax” by selecting FY: 2020-21 and month: Sep.

When I click create refund application getting an error:

Error: Refund cannot be claimed as the Return(GSTR3B/GSTR4/GSTR5) has not been filed up to March 2019-20.

Please advise me whether I miss anything?

Thanks in advance!

Composite dealer GST return from CMP-08 column no.3 point 1. outward supplies(include exempted supplies). This column taxable value only or taxable value+exempted supplies composite tax applicable.

You have to show taxable+exempt supplies in this column. The tax has to be paid on total turnover including exempt supplies.

There is no procedure to file Annual return for Composition taxable dealer-GSTR4 Annual return. for the year 19-20 due date 31st oct 2020.

What you want to ask?

Composite scheme dealer Annual return f.y.-19-20 filed compulsory or exempt

Dealer in ward details(purchases) invoices uploading compulsory from registered dealers purchases

Dealer gstr-4 and gstr9a both returns filed compulsory

Yes, it is compulsory

Gst sec 10 of CGST act introduced by finance act 2019 composite dealer are exempted from pay composite tax below 40 lacs turnover.

Composite scheme dealer (new composite scheme 6% tax not applicable dealer) April to June 2019 quarter gstr4 or cmp-08 return filed.

CMP 08 has to be filed for the qtr Apr-June 2019 on or before 18th of July 2019. GSTR-4 will now be annually filed for the whole FY 2019-20 after March 2020.

We are filing GSTR-4 return for our compositional Dealer (Supply of Goods only) from 2017 to till date and we are declaring only Outward sales & 1% GST Tax in the respected column and paying taxes. But we have paid freight to local transporter and intrastate transporter and Column 4B is not auto-populating the freight details, hence we are paying GST on sales only. But our freight paid bills are too many, hence I didn’t enter data in column no.4B and even it is not possible to setoff liability on RCM. And I have enquired many auditors and tax practitioners, they are all just filing GSTR-4 by declaring total sales and paying 1% GST on it, but not giving much concentration over freight paid to the transporter and on which tax liability arises through RCM.

Even I have filed GSTR-4 for the Jan-19 to Mar-19 Qtr and we would like to pay taxes through RCM for freight paid. Please advice me how to pay the GST on freight paid from July-2017 to Mar-2019

Sir, Due to network problem my GSTR 4 for the Q2 of 2017-18 filed nil but I had deposited the due tax, and now return is not getting revised for this period. Have any solution for the same to edit or revise the return for this period. b’coz system is showing msg no invoice is entered for the said period. What should I do?

There is no option in GST to revise the return. Only you can do corrections or amendment in next period return for previous return.

For December 2018 Quarter for Composition registered person: Is it mandatory to provide purchase details in GSTR-4. If no then kindly provide the notification details.

There is no notification in this regard. It has been posted by the finance minister on twitter only.

notification 60/2018 dated 30 oct —-rules amendment 4a details not required ( point no . 6 in the notification )

Trying to nil returns for Oct-Dec 2019, getting an error please mark all questions even though I marked all the questions, please help

Please contact GSTN helpdesk for the same.

Error: Proceed to File is in progress in GSTR 4. What is a problem?

I want to return file gst

You can file GSTR 4 return through our GEN GST software

Error: Proceed to File is in progress in GSTR 4. What is a problem?

There is error pertaining on the portal from some days. Please contact GST helpdesk for the same.

Composite dealer purchases bills upload mandatory July to September 2018-19. Only sales turnover return filed.

As per recent tweet today by Finance Minister, it is not mandatory to file purchase bills in table 4A of GSTR-4 i.e. B2B inward supplies. Other reverse charge inward supplies need to be mentioned.

Is it mandatory to provide invoice details of suppliers in GSTR 4 July-September return for a composite dealer?

Yes, invoice wise details need to be filed of purchase made from suppliers.

Sir, How to file gstr4 in updated version?? Kindly help me out..

Our support team will contact you as soon as possible.

ERROR! CASH VALIDATION FAILED IN GSTR 4. HOW TO FILE NIL RETURN IN GSTR4?

In the case of nil return, there is no need for offset from cash or a type of validation is required. you can directly file the return by attaching EVC/DSC. if the error persists then contact to GST helpline for its redressal.

“liability details are not matching in the given details” in GSTR 4. what is the problem?

Please contact the helpdesk for the portal issue.

Dear Sir,

1.help me explaining that gstr4 3.0version new for offline as well as online is available now-where there are a lot of new columns such as col.6-txos (included now 0%)-does this represent for nil rated or exempt supply ,if so the exempted or nil rated supply not shown in already filed returns of GSTR-4 wef-1.1.2018-31.3.2018,1.4.2018-30.6.2018 can be put in amendment col. of July -sept-2018of GSTR-4 by amendment col of past returns when these columns were not available at GST common portal?

2.Please clearyfy about col.4c (purchass from unregistered dealers )when section 9(4)is suspended &it becomes exempt or 0% taxable how can we make self invoicing of exempt goods&enter in details in this part since there is no coloumn to report exempt/nil rated inward supply or else we have to show 0%rate in this coloumn giving bill no-of urd.

Respected Sir, I am registered dealer of stationery of books there is the book is not taxable but I am paid tax on total sale turnover (Books + Stationery) Sir please provide guidelines for me.

VIDEO IN HINDI.

GSTR-4 ONLINE RETURN FILING.

How to preview GSTR-4 before submission (Like GSTR-3B, GSTR-1).

A summary is generated for GSTR-4 before filing in pdf format. You can find this option above the filing tab.

PURCHASE DETAIL IS REQUIRE TO SHOW IN GSTR-4 FOR 1 QTR OF 18-19

Is purchase from registered person detail is mandatory for Q1 18-19

As of now, there is no such circular issued in this regard, so you need to give details of purchases in GSTR-4.

Dear sir,

I wrongly entered tax rate as 5 % in table-6 and filled. How should I amend it in next period? i.e. let say my turnover is 4,00,000 for the period of Apr-Jun and instead of entering this value in 1% tax rate, I entered it in 5% row and paid full liability.

Now, in next period (Jul-Sep), if my turnover is 4,50,000. I should enter 4,50,000 in table-6 and 4,00,000 in table 7?

Will it provide me the instant refund of excess payment in cash ledgers?

Hi Sir? Madam,

very useful queries have been solved & helped by your kind office for which I am obliged to your office.

1. Kindly clarify if a composite dealer registered in Oct-2017 & in registration details he is a manufacturer as well as trader of particular product or raw material of that product which is taxable as well as nil rated or exempted than he is liable to pay 1% composition GST tax on taxable turnover on aggregate turnover comprising taxable as well as nil rated supply

2. where to show exempted turnover (outward supply in gstr-4-or aggregate turnover have to be shown in annual return i.e.9C where the classification of turnover is provided for exempted/nil rates supply also.

many thanks in advance.

1) As per the notification issued on 01/01/2018, for traders, composition rate will only be applied on taxable turnover.

2) As specific column for exempted supplies mentioned in GSTR-4 so you have to show it in GSTR-9A.

By mistake, I registered a manufacturing firm under Composition scheme instead of the normal scheme under GST. Now I have to file GSTR4 for last year but the part 4 to 9 is not showing at the time of filing of return only part 10 to 13 of form is showing. If anyone can help me how to file GSTR4 and how to convert it to the normal scheme so that I can avail input tax credit and file under the normal scheme. It is a New Firm registered on 07-02-2018 and only machines and few raw materials have been purchased and no sales have been made in F.Y. 2017-18. Neither did we applied for composition scheme for F.Y. 2018-19. Need Help.

Thanking You

For the columns not showing in GSTR-4, you need to contact to GSTN and for conversion from composition scheme to regular you need to file GST CMP-04 and then for claiming ITC on stock on the date of conversion, you need to file ITC-01.

I am a composition dealer while filing the invoice details, each invoice contains various tax rate items, how to fill in the sheet, e.g.certain invoices contain 5%,12% and also 18% items with same invoice np.

Please clarify.