What is GSTR 4?

The GSTR-4 form is an annual return form for those taxpayers who have opted GST Composition scheme in the new indirect tax regime. Under the GST composition scheme, taxpayers will be required to file only one return in every financial year.

Also, the taxpayers will have to file CMP-08 for the payment in every quarter of the year. The due date for each CMP-08 filing is the 18th of every succeeding quarter. Read the CBIC notification.

- Who Should File GSTR 4

- GSTR 4 Form Due Date

- Interest on Late Payment

- GSTR 4 Important Terms

- GSTR 4 Updates on Council Meeting

- Simple Process to File GSTR 4

- GSTR 4 General Queries

- GSTR 4 Filing By Gen GST Software

Latest Update

- The 53rd GST Council updated the GSTR-4 due date from 30th April to 30th June for the FY 2024-25 onwards. View more

Free Demo of GSTR 4 Annual Return Filing Software

Major Points to File GSTR-4 (Annual Return)

- File button is enabled only if:

- No additional cash is required to be paid for liabilities

- You have clicked on the declaration checkbox

- You have selected authorised signatory details from the drop-down list

- The excess amount deposited through GST CMP-08, available in the negative liability statement will also get adjusted towards liabilities if any

- If the available balance in the electronic cash ledger is less than the amount required to offset the liabilities, you can directly create a challan by clicking on the ‘Create Challan‘ button.

- Tax and late fees are auto-drafted in Table-8 but interest is user input. Liabilities can be discharged only through an electronic cash ledger.

- The details of inward supplies (from Table 4B, 4C, and 4D for each tax rate) will be auto-drafted in Table 6 only after the Taxpayer has clicked on the ‘Proceed to file’ button. Before that, the balance will be displayed as ‘0’ (zero)

- Once you enter outward supply details in Table 6 and click the “Proceed to file” button, liability on the RCM basis is auto-populated from details entered in Tables 4B,4C, and 4D. Thereafter, Table 6 shows your total tax liability

- The details of outward supplies in Table 6 (Row 12-16) of GSTR-4 have to be entered manually by the taxpayer.

- The summary of self-assessed liability is auto-populated in Table-5 of the GSTR-4 Annual Return on the basis of filed Form CMP-08 & is non-editable.

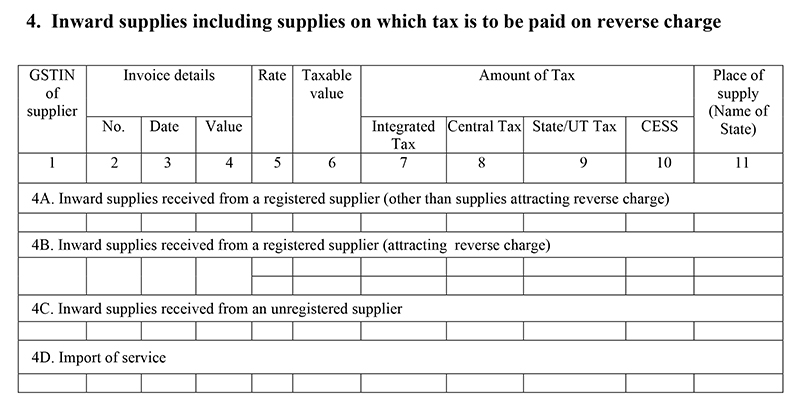

- The tax amounts in Table-4 of GSTR-4 are auto-calculated on the basis of the values entered in the Taxable Value and Tax Rate fields. However, the tax amount is editable. The CESS is to be entered by the taxpayer.

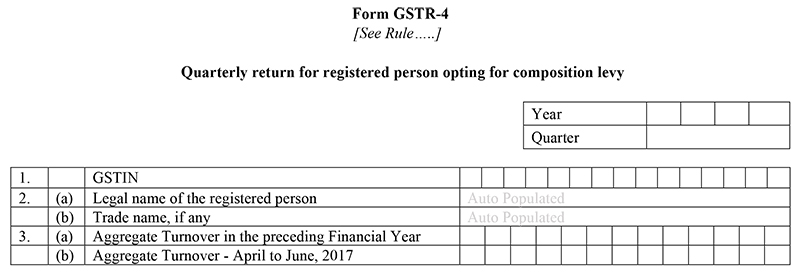

- The aggregate turnover is required to be entered for the last year and if in case the business did nil transactions or turnover in the last FY or not registered it can put ‘0’ zero

- The annual GSTR 4 return filing will get activated once the taxpayer has finished filing of all the quarters of CMP-08 of the given financial year

Annual Return Form GSTR-4 Available on the GST Portal

The government has decided to let the taxpayers, assessees, and businesses file GSTR 4 on an annual basis. This has been done due to the demand of the community. The form is also available on the portal which has further relaxed the assess and taxpayers in finding and filing the form as per their convenience.

Salient Features of GSTR 4 Return Form

- GSTR 4 Returns will be filed on an annual basis for compounding Taxable persons. The last date for filing the GSTR-4 (CMP-08) payment form is the 18th of the month following the quarter. GSTR 4 (CMP-08) returns can be filed on 18th April, 18th July, 18th October, and 18th January and so forth

- GSTR-4 Form is filed by all the taxpayers who registered under the composition scheme

- Business entities registered under the composition scheme will be required to pay taxes at fixed rates quarterly without availing of the input tax credit facility

- The taxpayer will be required to show the total value of supplies made in a specific period and tax paid at the composition rate

- The taxpayer will be required to insert invoice-level purchase details for the purchases from normal taxpayers, which will be automatically updated GSTR 4A Form from the supply invoice uploaded by the opposite party in GSTR 1

Who Should File GSTR 4 Form

All the composite registered taxpayers are required to file the tax return.

GSTR 4 Annual Filing Due Dates

| Period | Due Date |

|---|---|

| Annual Return FY 2025-26 | 30th June 2026 |

| Annual Return FY 2024-25 | 30th June 2025 | View more |

GSTR 4 Interest on Late Payment

GST Council clearly stated in the acts that if a person has not paid the taxes before the due dates, then the GST Council has strict rules and regulations to accommodate it with an 18 % interest rate per year. The interest rate is applied to the number of days the taxpayer missed out.

If we take the illustration of it, a person missed out on the due date of yesterday, then the taxpayer has to pay 1000*18/100*1/365 = Rs. 0.49 for one day and the calculation varies on payable tax and the total missed out days.

In case if a taxpayer does not file his/her return within the due dates mentioned above, he shall have to pay a late fee of Rs. 50/day i.e. Rs. 25 per day in each CGST and SGST (in case of any tax liability) and Rs. 20/day i.e. Rs. 10/- day in each CGST and SGST (in case of Nil tax liability) subject to a maximum of Rs. 5000/-, from the due date to the date when the returns are actually filed.

GST CMP 08 is a quarterly return form that must be filed by the composition taxpayers after the end of each quarter. The due date for filing the GST CMP 08 return online is the 18th of the month after a particular quarter. GSTR 4 is an annual return form, for which the due date is 30th April after a particular financial year.

Important Terms Frequently Used in GSTR 4

- GSTIN – Goods and Services Taxpayer Identification Number

- UIN – Unique Identification Number

- UQC – Unit Quantity Code

- HSN – Harmonised System of Nomenclature

- SAC – Services Accounting Code

- POS – Place of Supply of Goods and Services

- B2B – From one registered person to another registered person

- B2C – From registered person to unregistered person

HSN: Harmonised System of Nomenclature (HSN code is filled in case of the supply of goods)

- A taxpayer will be required to provide the aggregate turnover of the immediately preceding financial year and the first quarter of the current financial year.

- The taxpayer will be required to furnish all the information only in the first year and it will be automatically updated in the succeeding years.

Let us Understand the Step-by-Step Guide Filing Procedure of GSTR 4

GSTR 4 return form is divided into 13 sections but it is not necessary to fill all these sections. Some of the details of sections in GSTR 4 form are given below:-

Part 1 to Part 3 – General Information

- GSTIN:- Every Taxpayer gets a state-wise PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN) from the Government. It must be noted that the identification of the taxpayer will be automatically filled in at the time of filing the return in the coming future

- Legal Name of the Registered Person and Trade name (if any):- The taxpayer’s name will automatically fill the time of filing the returns at the GSTN portal

- Annual Turnover in the preceding Financial Year:- A taxpayer will be required to fill in all the information only for the first time of filing and after then it will be automatically updated in the succeeding years

Part 4 – Inward supplies, including supplies on which tax is to be paid on a reverse charge

- Inward supplies received from a registered supplier (other than supplies attracting reverse charge), the information will be auto-populated from the provided by the supplier in GSTR-1 and GSTR-5. Inward supplies received from a registered supplier (attracting reverse charge- this information will be automatically filled from the information provided by the supplier in GSTR-1, inward supplies received from an unregistered supplier and Import of service. It must be noted that all inward supplies to the composition will be auto-filled here

Note: FinMin tweeted that the composition taxpayers can leave the purchase invoice details in table number 4, part 4A.

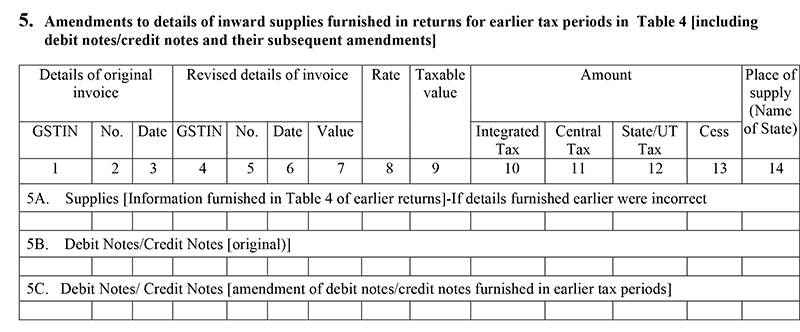

Part 5 – Amendments to details of inward supplies furnished in returns for earlier tax periods in Table 4 [including debit notes/credit notes and their subsequent amendments]

- It will include amendment information mentioned in earlier tax periods and also original amended debit or credit notes received, rate-wise. The place of supply is to be mentioned in case the same is different from the location of the recipient. While providing the information of the original debit /credit note, the details of the invoice must be provided in starting three columns, whereas, providing the revision of the details of the original debit /credit note shall be provided in the first three columns of this Table

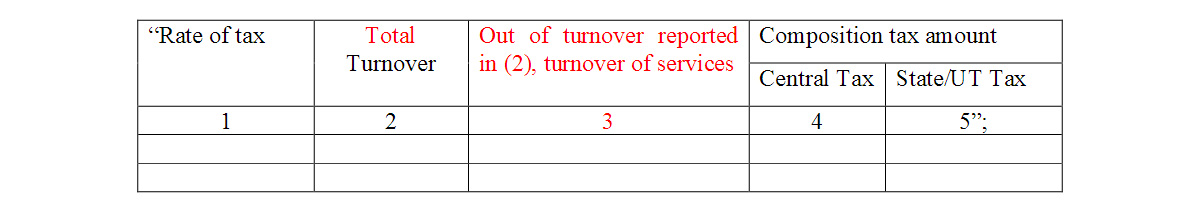

Part 6 – Tax on outward supplies made (Net of advance and goods returned)

- Under this section, you will provide the details of a tax rate, total turnover, out-of-turnover reported and the composition tax amount including both central tax & State/UT tax.

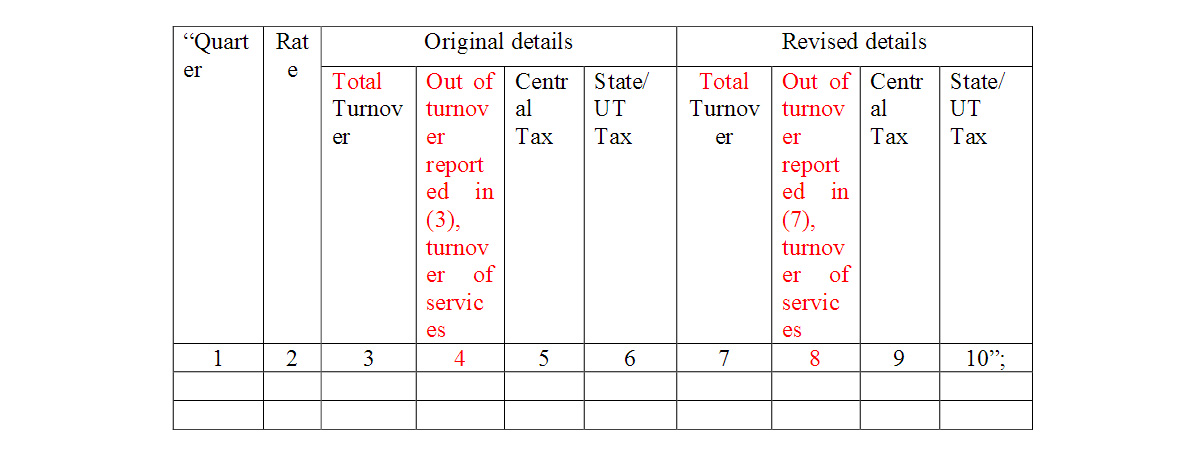

Part 7 – Amendments to Outward Supply details furnished in returns for earlier tax periods in Table No. 6

- Under this section, you will be able to rectify the incorrect details you provided in Table 6 in previous returns, without turnover reported details additionally added.

Note:

- In the GST council meeting, the authorities decided to revise the GSTR 4 filing form with some inclusion of terms in clauses 6 & 7. The revised columns have been added to the final form and are mentioned in red text.

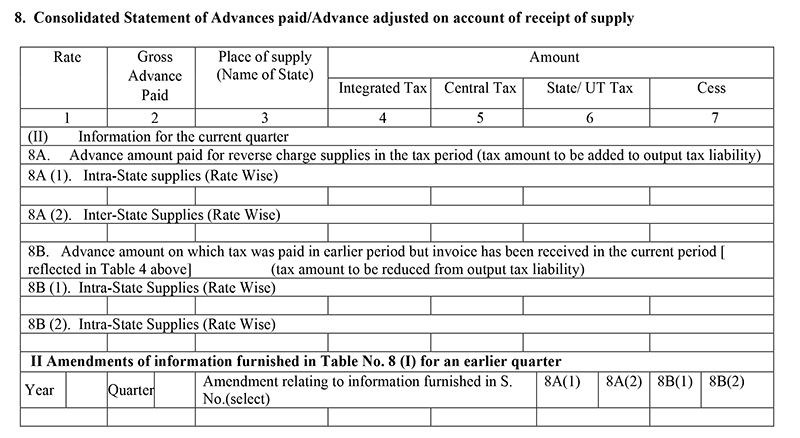

Part 8 – Consolidated Statement of Advances paid/Advance adjusted on account of receipt of supply.

- Under this, details of the advance paid relating to reverse charge supplies and if you paid taxes on them, adjustments against invoices issued to be mentioned in Table 8

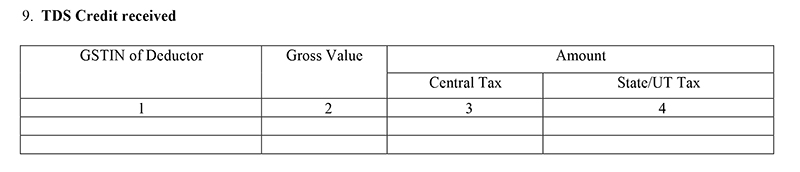

Part 9 – TDS Credit received

- TDS (Tax Deduct at Source will be auto-filled in Table 9

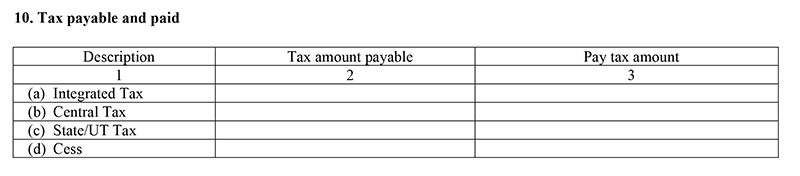

Part 10 – Tax payable and paid

- Under this section, you will be to provide the details of Integrated Tax, Central Tax, State/UT Tax, and cess tax amount payable as well tax amount paid

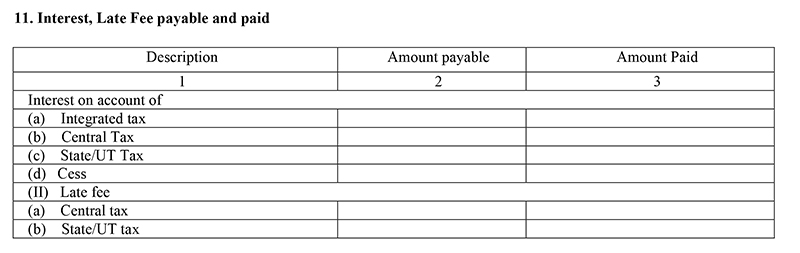

Part 11 – Interest, Late Fee payable and paid

- This section is for those taxpayers who have not paid their taxes timely

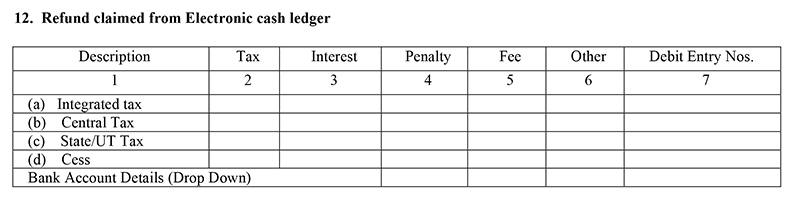

Part 12 – Refund claimed from Electronic cash ledger

- If in case the tax liability of the composition dealer is below the TDS deducted, he can get a refund of the balancing amount. The amount which is available for the refund will be auto-filled under this section

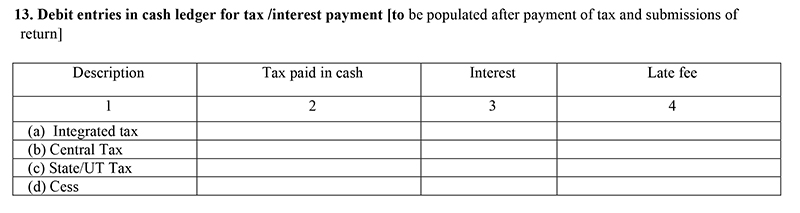

Part 13 – Debit entries in cash ledger for tax /interest payment [to be populated after payment of tax and submissions of return]

GSTR 4 Return Filing General Queries

Q.1 – Who needs to file GSTR 4?

All the assessees who have opted for the composition scheme under the GST Act 2017, are required to file their annual returns in form GSTR 4:

- Who has opted for composition scheme during registration but not opted since registration

- Who have opted for the scheme e before the start of the financial year

- Who have opted for the scheme during the year

Q.2 – What is the last date of filing form GSTR 4?

All the assessees must file the returns under form GSTR 4 till the 30th of the succeeding month after the end of the financial year. The government may extend the date.

Q.3 – Is filing required if my registration cancelled or I opted out of the scheme during a financial year?

Yes, you are required to file the annual returns under form GSTR 4 for the financial year even if your registration is cancelled or you opted out of the scheme.

Q.4 – What are the conditions to file form GSTR 4?

The assessee should be registered under the GST Act 2017 and should have opted for composition scheme. The assessee should also file quarterly returns under form CMP 08. If you do not file quarterly returns under form CMP 08, then you can not file GSTR 4.

Q.5 – Who can file NIL returns in form GSTR 4?

Any assessee can file NIUL return in GSTR 4 if:

- NOT made any outward supply

- NOT received any goods/services

- Have NO other liability to report

- Have filed all Form CMP-08 as Nil

- There is no late fee to be paid for Form GSTR-4

Q.6 – Where can I file GSTR 4?

Visit the GST portal then:

- Login

- Services

- Return

- Annual Returns

- File the return

Q.7 – What are the tables in form GSTR 4?

Form GSTR 4has the following tables:

- 4A. Inward supplies from the registered supplier (other than reverse charge): To add details of inward supplies received from a registered supplier (other than reverse charge)

- 4B. Inward supplies from the registered supplier (reverse charge): To add details of inward supplies received from a registered supplier (reverse charge)

- 4C. Inward supplies from unregistered supplier: To add details of inward supplies received from an unregistered supplier

- 4D. Import of Service: To add details of import of service

- 5. Summary of CMP-08: To view auto-drafted details provided in filed Form CMP-08 for the financial year

- 6. Tax rate wise inward and outward supplies: To enter tax rate wise details of outward supplies/ inward supplies attracting reverse charge during the financial year

- 7. TDS/TCS credit received: To view details related to TDS/TCS credit received

Q.8 – Does the amount in tax fields auto-populate based on values entered in taxable value field?

Yes, the amount in tax fields gets auto-populated based on values entered in taxable value field but the CESS field is not.

Q.9 – How can I add values in Outward supplies details in table 6?

Any assessee can add values in outward supplies manually, as they are not auto-filled like the inward supplies.

Q.10 – How to download the summary of Form GSTR 4?

You can download the summary of GSTR 4 by visiting the GST portal and:

- Services

- Returns

- Annual Return

- Form GSTR-4 (PREPARE ONLINE)

- DOWNLOAD GSTR-4 SUMMARY (PDF)/ DOWNLOAD GSTR-4 (EXCEL)

Q.11 – Can I file the returns after the due date without paying late fees?

No, you can not file the returns post the last date without paying the late fees. Although, the government may forgive the late fees.

Q.12 – Where can I find tax, late fee and interest for my return?

Tax, interest and late fees can be found in table 8, as tax and late fee are auto-drafted, while the Interest is user input.

Q.13 – How to offset the liabilities?

Any assessee can offset the liabilities after deducting the amount already paid on form CMP 08 by paying through electronic cash ledger. If the amount in the ledger is less then that required to offset, then you can make a part payment and create a challan for the rest or you can offset through the excess amount paid in CMP 08 if any.

Q.14 – What should I do if I receive a warning message of processing or processed with error?

If the warning is of under processing then wait for the processing to complete and if the waring is of processed with an error then go back to GSTR 4 and rectify the error.

Q.15 – When does file GSTR 4 button enables?

File button gets enabled only if you have-

- No ‘Additional cash (which) is required’ to pay for late fees, if any

- Clicked on declaration checkbox and have selected authorized signatory details from the drop-down list

Q.16 – Can I file GSTR 4 through an offline tool?

There is an offline tool present for GSTR 4 form but filing return for GSTR 4 can only be done online through the GST portal.

Q.17 – How many modes are there to sign form GSTR 4?

You can file form GSTR 4 through a DSC or EVC.

- Digital Signature Certificate (DSC)- DSC is an electronic certificate that proves an individual’s identity. You can generate a DSC from the certifying authorities. http://www.cca.gov.in/cca/?q=licensed_ca.html.

- Electronic Verification Code (EVC)- EVC can authenticate the identity of the assessee through an OTP sent to the mobile number registered under GST.

Q.18 – Can I preview form GSTR 4 before filing?

Yes you can preview form GSTR 4 before filing in PDF and Excel format by clicking on ‘DOWNLOAD GSTR-4 (PDF)’ and ‘DOWNLOAD GSTR-4 (EXCEL)’ button on the portal.

Q.19 – Can I revise form GSTR 4 after filing?

No, you can not revise form GSTR 4 post-filing.

Q.20 – What happen after the successful filing of Form GSTR 4?

After the successful filing of form GSTR 4:

- ARN is generated

- The assessee is intimidated through SMS and email

- Electronic Cash Ledger gets updated

Start GSTR 4 Return Filing by Gen GST Software

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."

Facing problem in filing in GSTR 4

Error showing in uploaded file

What is the error?

Sir, I am a composition dealer. I have received a debit note from my supplier containing multiple tax rate. I have entered the same twice in the sheet 5B with bifurcation. Total no. of DN appears 13 instead of 12 and also the total amount of debit note is increased by the same amount. Same is in case of invoice but while totalling bifurcated part is ignored. In case of DN bifurcated part is treated as the separate entry. How do I file my gstr4 for Jan-dec

If you are filing through Excel utility for GSTR-4, then you need to specify same values for total invoice value and invoice number in the excel sheet. on the generation of JSON file, it will be treated as a single entry. if you are filing through offline utility or uploading values directly online, then a single entry for different rates is required to be made.

I am unable to generate the JSON file while trying to file the GSTR 4, an error message flashing saying, “this key is already associated with an element of this collection”.

Please guide,

File it with the latest version of offline utility available at the portal.

As I filing GSTR 4 returns using offline utility v 2.2. Sir, I am facing a problem on filling column 6 which is Tax on Outwards supply made. Kindly clear my doubt what should I choose on Rate of Tax and what turnover should be filled. Sir my purchase through Jan – Mar session is ( Invoice Value is 485022.00 & taxable value is 485902.00 & CGST and SGST are 13135.00). What amount of tax, I should be paid on total turnover ie. 485902.00.

Kindly help in this regards. As I am filing the late return.

If you are a manufacturer or trader, then tax under composition would be paid at 1% of turnover (0.5% CGST & 0.5% SGST). In case of restaurants, tax is paid at 5% of turnover (2.5% CGST & 2.5% SGST).

Sir, when we tried to file GSTR 4. We have received a ‘system failure’ from GST portal. What is the solution to the problem?

It might be a website issue. Try filing again after some time or contact department’s helpdesk.

Sir

I have gone step by step to file return i.e I filled form b2b validated no error, I generated JSON file no error but when I went to upload JSON file on GST portal error occurs there occurs processed with an error. I am unable to understand please verify.

Please clarify your query.

How to show inward supply from an unregistered dealer as RCM is suspended and we have not created any invoice how to mention its detail in 4C of GSTR 4.

As RCM provisions for purchase from an unregistered dealer are being withheld so it will be treated as a normal supply and wouldn’t be taxable.

4C of GSTR 4 mandatorily demands invoices no. and date. If we don’t fill the detail of purchases from an unregistered dealer as RCM on it is suspended then whether it will have any consequences in the future.

Section 4A details of GSTR-4 has been deferred as of now. However, it is mandatory to fill details in section 4C of GSTR-4, non-compliance of which can have penal consequences at the time of return verification.

I HAVE TAKEN COMPOSITION GST NO. IN JAN18. BUT IN THIS QUARTER I HAVE NO PURCHASE BILL. HOW SHOULD I PROCEED TO FILE GSTR 4. I HAVE TURNOVER OF ABOUT RS. 900000.00 LAST YEAR AND HAVE STOCK OF ABOUT RS. 2 LAKH. I HAVE TAKEN NO. ONLY DUE TO THE REASON THAT I HAVE TO PURCHASE GOODS FRO OTHER STATE AND THEY HAVE INSISTED ME TO TAKE NO. FOR SUPPLY OF GOODS. PLEASE GUIDE ME.

As per recent clarification by dept., you do not need to enter details regarding purchases from registered dealers in column 4A of GSTR-4.

ONE LOCAL CA ADVISED THAT AS YOU HAVE NO PURCHASE IN THIS QUARTER AND THIS IS YOUR FIRST RETURN. SO I SHOULD FILE NIL RETURN, OTHER IS SAYING THAT YOU CAN NOT SHOW PREVIOUS STOCK, SO ADD SOME PURCHASE FROM UNREGISTERED. DEALER THEN SHOW SALES WHICH IS ABOUT RS.95000. PLEASE GUIDE ME HOW TO FILE RETURN?

You need to mention sales irrespective of purchases made or not during the given tax period.

Hi Sir,

There is a mismatch with the data in offline tool and Preview before submitting.

The online preview is showing only the No.of Records and values as 0

I have entered 9 records for 4A Reverse charge = ‘No’

Please advise, why the preview is not showing the total value of inward supply.

*Preview*

4A,4B – Inward supplies received from a registered supplier (including supplies attracting reverse charge)*

———————————————————————————————————————————————————-

No. of Records | Total Invoice value | Total Taxable value | Total Integrated Tax | Total Central Tax | Total State/UT Tax | Total Cess

9 | 0 | 0 | 0 | 0 | 0 | 0

I got it – Thanks

*The invoice value, taxable value and tax amounts in these tables is shown only for invoices/notes attracting the reverse charge.

Yes agreed

As that part will be auto-populated, so all these figures are not reflecting in summary file.

As per yesterday press release, so now it is not required to fill the details of inward supplies from the registered person.

Yes agreed

Only purchases liable to be reverse charge has to be entered in GSTR-4

Sir, Do we have to give details of purchases made from the unregistered dealer also in GSTR 4?

Yes, details of purchases from an unregistered dealer have to be furnished in GSTR-4.

I AM A COMPOSITION DEALER. I PURCHASE GOODS ONLY FROM REGISTERED DEALERS. THEN AS PER NEW FORMAT IS IT REQUIRED TO FEED ALL THE PURCHASES IN TABLE 4?

yes, details of all inward supplies from the registered dealer (including supplies attracting reverse charge) has to be filled in GSTR-4

IN NEW OFFLINE UTILITY DETAILS OF PURCHASE WILL BE AUTO POPULATED OR WHAT. AS SUPPLIERS WILL UPLOAD DETAILS IN GSTR 1 BUT the LAST DATE OF GSTR 4 IS 18 APRIL.

You have to manually insert the details of purchase bills in GSTR-4 for the given tax period.

Whether composition dealer to fill details of purchases in GSTR 4 or these are auto-populated. where to verify these.

In the case of intra-state supplies, details will be auto-populated.

For the period Jan-Mar the new offline Gstr 4 utility has a sheet named 4A in which details of inward supply to be given. But these details are supposed to be auto-populated then is it required to fill these details or should fill the only details of outward turnover.

I have opted composition scheme when I registered under GST. but my dashboard showed GSTR 1 option and treated me as a regular taxpayer. After I complained in help desk waited for some time there was no change in my dashboard so I filed all month returns and late fees up to December from January 2018 my dashboard changed for composition scheme. Now how to file my return (should I file GSTR 4 (Jan to Mar) return )?

I am a trader. I was purchased a goods from the registered person then where I was entered details B to B or B to B(A)

No such detail to be filled in GSTR-1 And GSTR-3B unless under reverse charge purchases. However, ITC can be availed in GSTR-3B of the same under eligibility ITC tab.

I Have registered for GST composition scheme on this March. When should I start to file GST returns?

As you have registered under March, you need to file returns from Jan-Mar qtr.

Sir, a buyer is registered under composition scheme in Mar 2018. The supplier by mistakenly mentioned the buyer’s GSTIN in Jan & Feb 2018 month return also. Now when the buyer is getting an error as ‘invoice date cannot be prior to registration date’. How the buyer rectify the error and file return?

Do not mention the invoices with a date prior to registration date. Delete those invoices and them file the return.

I am GST Composition scheme taxpayer, in GSTR-4 for the period oct-dec file submitted without updating a sales & purchase details and I updated only Aggregate Turnover in the preceding financial year & Aggregate Turnover – April to June 2017.in status showing in GSTR -4 Submitted. (not yet filed GSTR-4 -OCT-DEC -17). What I should do now please guide me?

You can show the invoices in next qtr’s return under the amendment in previously filed return column of GSTR-4.

mai ak trader hu aur mai purchase regesterd deeler se karta hu aur purchase taxable goods aur exmpted goods dono ki karta hu kya mujhe gstr4 me sirf taxble amountt ki detail dal sakte h ya total sale. mujhe tax kis sale par pay karna chahiye ? aur inward suply kis column me fill karni hogi maine sep qtr aur dec. qtr ka gstr4 me sirf taxble outward par tax pay kiya h aur kuch nhi fill kiya h mujhe kya karna chahiye plz tell me.

You can only show taxable purchases from registered dealer under GSTR-4 at column 4A and for tax payment purpose turnover will include both taxable and exempt supplies by you.

After submitting the return can payment be made later on.

As per section 27 (3) of GST Law, if a person filed GST returns without making GST tax payment against such GST returns is treated as void return filing.

I HAVE FILLED GSTR 4 THROUGH JSON. I HAVE UPLOADED JSON ALSO SUBMITTED BUT NOT YET PAID TAX AND FILLED I HAVE TAX OF RS 36000 BUT BY MISTAKE IN SHOWS 88000 CAN I MAKE CHANGES?

No, you cannot make any changes in the return after submitting GSTR-4.

Now I am composition dealer. On 18 January 2018 I have submitted GSTR 4 return for the period Oct 2017 to Dec 2017 by mentioning only previous year’s ( April 2016 to March 2017 ) sales turnover of Rs 5,81,877=00 & sales for April 2017 to June 2017 Rs3,37,988=00 , directly by clicking “INITIATE FILING ” without knowing that it had to be submitted through “PREPARE OFFLINE” & upload it . I have a sales turnover of Rs.1,19,694=00 for the above mentioned period (OCT 17 to DEC 17).Now I am confused how to show the sales for this 3rd quarter, please guide me how to cancel the SUBMITTED & proceed in a fresh manner.Please do the needful as late filing fine on every day is being accumulated. Thank you

You cannot cancel or revise the submitted return under GST, you can only make changes while the return for the subsequent quarter.

I have a few questions:

I have submitted GSTR 4 Composition Return but I have a mistake in making GSTR 4. After submitting the same liability is not utilized and not filed the return. Kindly advice me on how to reset GSTR 4 after submitted before filed and offset the liability.

Reset option is not available in GSTR-4.

I am running a business of provisional store, my monthly turnover is Rs.450000/-, should I have to update purchase bills in GSTR-4. We are purchased from unregistered & registered dealer also.

Please guide me.

You have to show all the purchase bills under Column 4 of GSTR-4.

I am registered under composition dealer. How should the Tax amount be calculated?

GST rate of 1% or 5% (as the case may be) would be applied on total taxable turnover for the concerned quarter.

I have filed GSTR 4 wrongly for the Sep qtr, the purchase was entered on reverse charge column, the actual tax liability should have been 9000/- but due to reverse purchase entry the total liability was 40000/-, I have only submitted. I did not pay the tax.

I also did not file Dec qtr return. What should I do, Please do the needful?

You can make modification in Dec qtr return under column 5 of GSTR-4.

I am registered dealer under GST and I have issued GST taxable sales invoice to non-GST registered person. How I can treat it while filling GSTR 3B & GSTR 1?

You have to show it under “outward taxable supplies” column under GSTR-3B and in column 5 of GSTR-1 (if supplied interstate and value exceeding Rs. 250000/-) or in column 7 (in all other cases).

Online return for composition dealer portal show only tax payment amount without any turnover detail. GSTR-4 shall submit through offline or online mode?

You have to fill data in column 8 of GSTR-4.

I have updated the Inward supply made sheet (4B). But Why am I getting the Inward supply made(4B B2B) is zero in the GSTR-4 Invoice detail preview (pdf) even after the successful validation of offline tool upload with error report as NA.

Please clarify your query.

if we upload wrong JSON file in gstr4 return filing option and wrong tax liability occurs then may we can reset that JSON file uploading system… please help me

Tax should be not more than 12000/- but it is shown in tax liability =199268/-which is the very huge amount.

You can reset your data only before the filing of GSTR 4 by choosing “reset data” option.

How to solve GSTR 4 validation?

Its a technical error from GSTN, either you have to wait or contact to GSTN helpdesk.

when we have paid tax on inward supply, why the portal shows me tax liability for the same amount. Please suggest

Please clarify the issue.

Tax period in GSTR-4 Offline utility is displaying only “Jul-Sep”. Unable to prepare for “Oct-Dec”. How to prepare for “Oct-Dec” as the due date is 18th Jan 2018?

“Lagta hai GST ke naam pe Joke hi chal rha hai”

Utility for Oct-Dec return is still not released by the department. Contact to the department for further assistance.

Poor response from Department. They also don’t know when the offline utility for Oct-Dec will be available…

you please download a fresh GSTR-4 offline utility from the GST portal today, you can find Oct-Dec period.

As you mentioned that previous quarter turnover (July-Sept -17) missed out data in column no 7 wherein offline tool or online, kindly suggest.

Column 7 is for amendments in invoices related to previous tax periods. Previous quarter turnover details need not be mention anywhere.

I have filled GSTR 4 for July-Sept 17 in the month of Nov-17, and by oversite I have filled only aggregate turn over for April to June-17, and last year total turnover, and as per the offline sheet I have paid tax of Rs 11000/- but offline date sheet information is not displayed in the preview returned, is there way to amend the or filled up July to sept -data again in oct-dec 17 GSTR 4 now, kindly suggest me the steps and procedures.

You can make changes in invoices filed in previous quarter return, in next quarter’s return under column 7 of GSTR-4.

Sir, I am a migrated composition dealer on September, I am completed GSTR 1 and 3b of September, I have retail pharmacy, I have around 100 purchase bills, there is no time to enter system, I would like to show present turnover and 2016-17, is it possible in GSTR 4 for this quarter,

As you have migrated in September month, so liability for filing GSTR-4 will arise from the next month i.e. from October. So you have to only enter the data from October month onwards in GSTR 4.

Sir, I have wrongly filed GSTR-4 as Nil return for the previous period (July-Sept) but I paid tax for that period correctly. Now I don’t know how to add the turnover of previous period in the current period(Oct-Dec) Return. Please inform me in which column I may add the said omitted turnover.

Thanking you

D Natarajan

You have to enter data in column 7 of GSTR 4.

Tax period in GSTR-4 Offline utility is displaying only “Jul-Sep”. Unable to prepare for “Oct-Dec”.

Utility for the same is still to be provided by the department.

Check whether the composition scheme has been cancelled. Sometimes the portal may not be updated. For such case, you can wait. Due date is 18th Jan. Mail the constraints to helpdesk or contact customer care.

Dear Sir, I am a trader & opted composition scheme, as per gst tax slab I have to pay 1% tax on total sale value. Does it mean 1% cgst & 1% sgst or 0.5% cgst & 0.5% sgst…

It is .5% CGST and .5% SGST.

.5 cgst

.5 sgst

I HAVE GOT GST REGISTRATION ON 25-09-2017.BUT NO FACILITY ON PORTAL TO FILE GSTR 4 FOR THE PERIOD JULY -SEPT. NOW, HOW CAN I FILE RETURN.

Both online and offline facility has been provided by the department for filing returns.

Hence you have opted composition scheme in the month of Sep, You are supposed to file GSTR 3B for the months of July, Aug and Sep. You are eligible for composite in next quarter.

Sir, My client is registered under composition scheme and he purchases goods which are ‘Nil’ rated….is he required to pay the tax on output at 2% even if he is supplying nil rate goods..?

Since the assesse has obtained registration under composition scheme, he has to pay tax at the applicable composition rate and not at the rate applicable on the particular product.