The Bombay High Court (Nagpur Bench) held that a three-month gap between the issuance of a GST show cause notice (SCN) and the passing of a final order must be there under section 73 of the CGST Act, 2017.

A writ petition has been submitted by the applicant, A.M. Marketplace Pvt. Ltd concerning whether the time difference of 3 months must be kept between the issuance of notice u/s 73 (2) and passing of final order u/s 73 (10) of the CGST Act.

Section 73(10) of the CGST Act furnishes an outer limit of 3 years for passing of an adjudication order, while section 73(2) of the act delivers that SCN is to be provided at least 3 months before the outer limit of three years for passing an order u/s 73(10) of the CGST Act.

Important: How to Effortlessly Check the Validity of GST SCN & Orders

Anurag Soan, the petitioner’s counsel, argued that the three-month gap between the issuance of the notice and the passing of the final order is significant because it adheres to the principle of natural justice and provides an opportunity to make tax payments. Therefore, this time frame should be strictly followed.

The applicant’s counsel also pointed out that the time allotted to the petitioner was only one month and twenty-four days between the issuance of the notice and the passing of the final order, which does not comply with the provisions of the CGST Act.

Ketki Jaltare Vaidya, the respondent’s counsel, said that subsection (10) of Section 73 of the CGST Act furnishes an outer limit of three years for passing the final order. According to Section 73(2) of the Act, a show cause notice can be issued within three months before the three-year outer limit stipulated u/s 73(10) of the Act.

The counsel for the respondent contended that a 3-month time gap does not apply to notices issued within that period.

Justice Anil L Pansare and JusticeNivedita P Mehta mentioned that the need of time gap between the issuance of notice and passing of the final order is because of various activities to be performed in that duration, like an opportunity for payment of tax and following the principles of natural justice.

Therefore, the court ruled that there should be an obligatory 3-month gap between the issuance of notice and passing the final order under subsection 2, read with subsection 10 of section 73 of the CGST Act.

The court, under facts and situations, permitted the petition partly. The Show Cause Notice (SCN) was quashed, and the final order was set aside by the court.

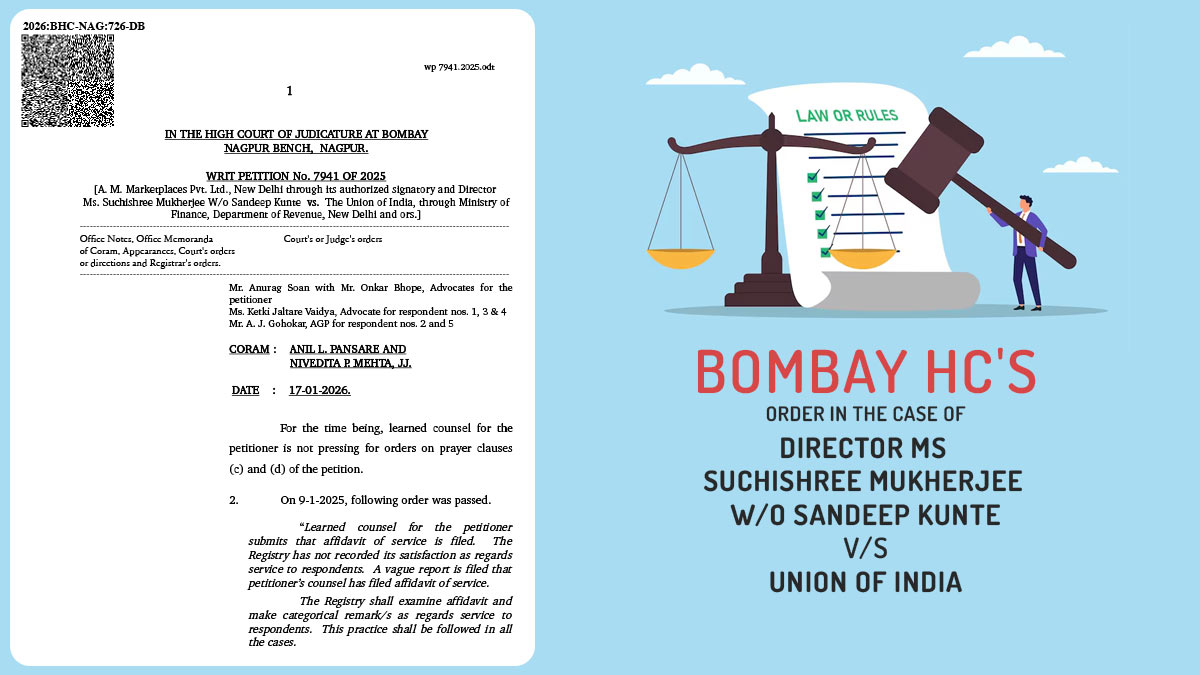

| Case Title | Director Ms Suchishree Mukherjee W/o Sandeep Kunte vs. Union of India |

| Case No. | writ petition no. 7941 of 2025 |

| For the petitioner | Mr Anurag Soan, Mr Onkar Bhope |

| For the Respondents | Ms Ketki Jaltare Vaidya, Mr A. J. Gohokar |

| Bombay High Court | Read Order |