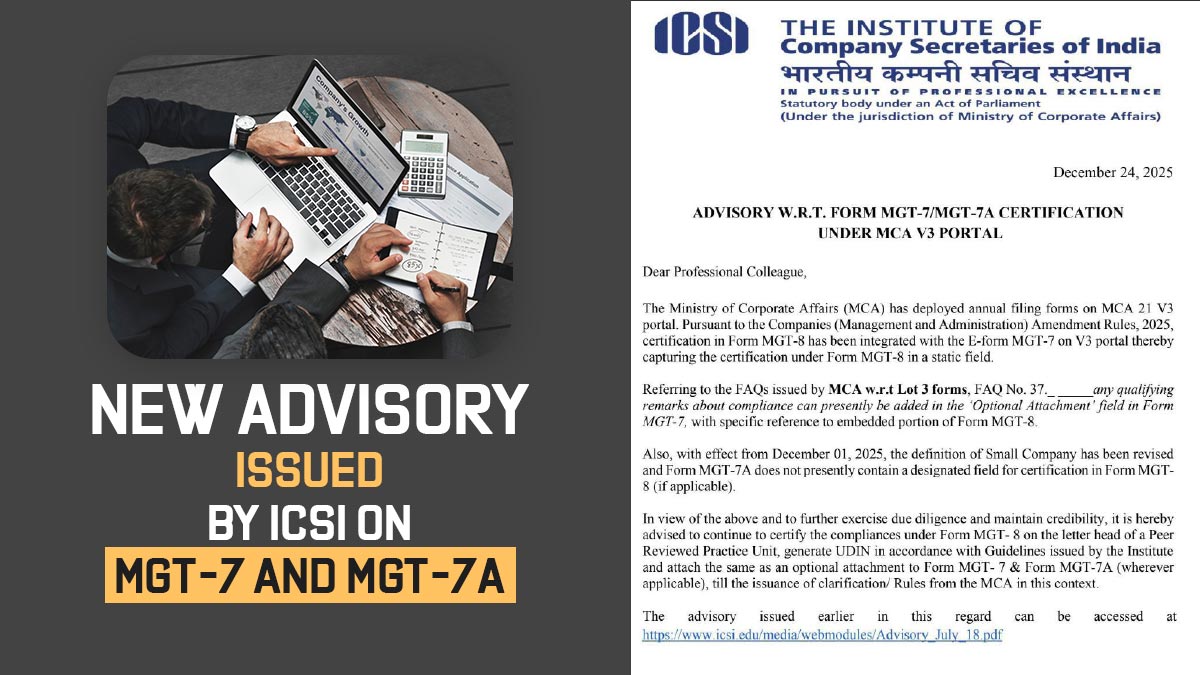

The Institute of Company Secretaries of India (ICSI) has provided guidance about the certification for Form MGT-7/MGT-7A on the new MCA V3 Portal. This is an important update for companies and organisations that need to comply with certain regulations.

The institute has advised to certify the compliance under MGT 8 on the letterhead of a Peer-Reviewed Practice Unit. It is advised to generate UDIN after that, as per the policies issued by the institute. The same should be attached to the optional attachment of the Form MGT-7.

The advisory was released after the Ministry of Corporate Affairs (MCA) rolled out the annual filing forms on the MCA 21 V3 portal and integrated the certification under Form MGT-8 into e-Form MGT-7 as a fixed field, established on the Companies (Management and Administration) Amendment Rules, 2025. A revision has been made to the usual distinct attachment method for MGT-8 certification.

ICSI, in its advisory, referred to the FAQ issued by the ministry, where it was mentioned that “FAQ No. 37. Any qualifying remarks about compliance can presently be added in the ‘Optional Attachment’ field in Form MGT-7, with specific reference to the embedded portion of Form MGT-8.”

ICSI recommended that, since the definition of the Small Company has been revised as of December 1, 2025, and Form MGT-7A does not currently comprise the designated field for certification in the form MGT-8, if applicable.

Read Advisory