The Gujarat High Court, in an order, has cited that the specified date for providing a tax audit report u/s 44AB of the Income Tax Act, 1961, and the “due date” for filing the income return u/s 139(1) are pertinent to each other and should be treated together.

To extend the audit report due date, the court asked the Central Board of Direct Taxes (CBDT) without extending the corresponding deadline for income tax return filing.

The Income Tax Bar Association and others have submitted the writ petitions under Article 226 of the Constitution. To extend both the cited date for providing tax audit reports and the deadline for filing ITRs for AY 2025-26, the applicant asked for directions.

The counsel of the applicant claimed that the CBDT, through Circular No. 14/2025 dated 25 September 2025, had extended the specified date for delivering the tax audit report u/s 44AB from 30 September 2025 to 31 October 2025.

The board does not provide a related notification to extend the last date u/s 139(1) for filing returns, which comes on 31 October 2025. As per the counsel, the same approach breaches Explanation (ii) to Section 44AB, which describes the “specified date” as one month before the due date for furnishing the return of income.

The counsel of the applicant claims that both provisions are associated by legislative design, so the CBDT cannot extend one without extending the other.

On the earlier decision of the Gujarat High Court, the counsel relied on All Gujarat Federation of Tax Consultants v. Central Board of Direct Taxes (Special Civil Application No. 12656 of 2014, decided on 22 September 2014).

The court in that ruling elaborated that the specified date u/s 44AB and the last date u/s 139(1) are inseparably linked, and the CBDT cannot override the scheme of the Act by extending only one of them.

Regarding the tax audit report, the applicant’s grievances had been partly addressed through the CBDT’s circular; the Division Bench comprising Justice Bhargav D. Karia and Justice Pranav Trivedi cited. The board must explain why there is no simultaneous ITR filing due date extension provided, given that the two due dates imply that to function in harmony, the court stated.

As per the court in the judgement 2014, it had earlier specified that CBDT could not extend the specified date in isolation, as it does not have the regulatory authority to relax section 44B. Instead, any relaxation needs to be arrived at by extending the deadline u/s 139(1) through powers granted under Section 119 of the Income Tax Act.

The court, while observing this inconsistency, issued a notice to the CBDT and the Union of India, asking them to elaborate why a related extension of the filing return deadline has not been issued. On 6 October 2025, the notice was made returnable.

The case shall be listed at the top of the board for an additional hearing.

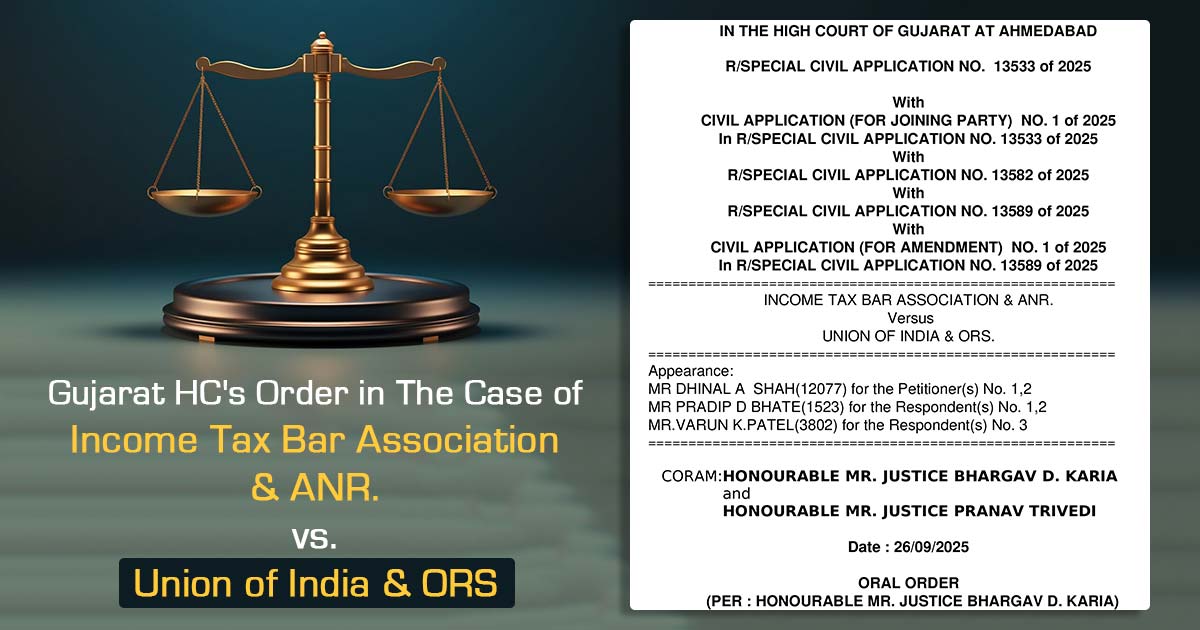

| Case Title | Income Tax Bar Association & ANR. vs. Union of India & ORS |

| Income Tax Appeal No. | NO. 13533 of 2025 |

| For The Petitioner | MR. Dhinal A Shah |

| For The Respondent | MR. Pradip D Bhate, and MR. Varun K.Patel |

| Gujarat High Court | Read Order |