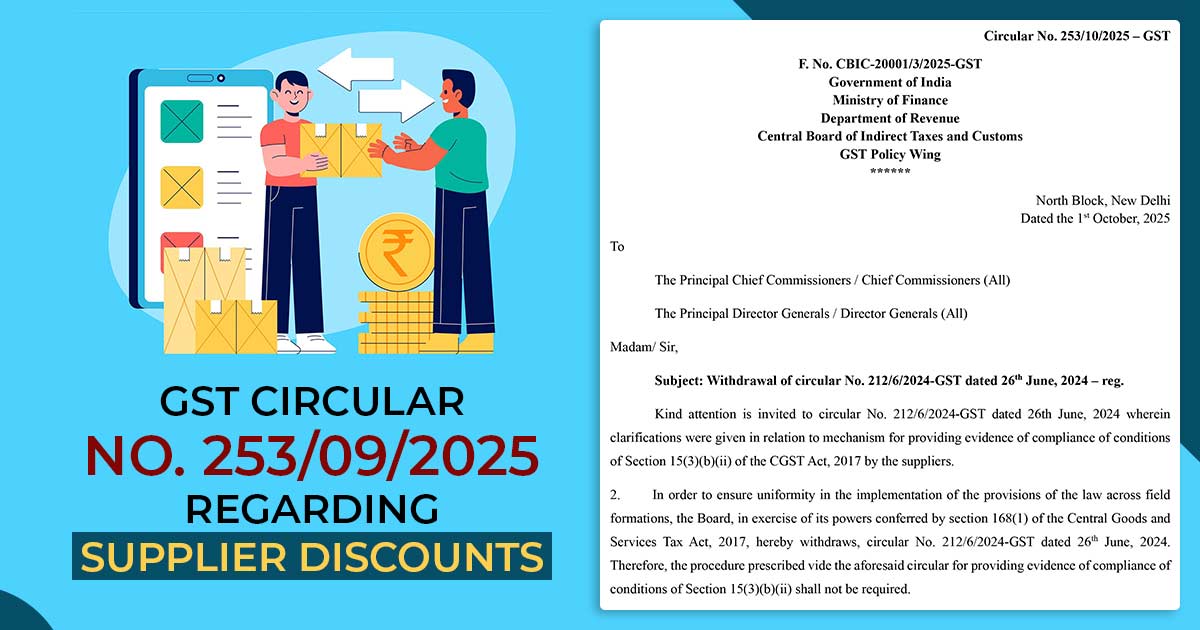

The CBIC released a new announcement, through Circular No. 253/10/2025-GST, on October 1, 2025. This new circular is meant to withdraw an earlier one, Circular No. 212/6/2024-GST, which was issued on June 26, 2024. Essentially, the new circular updates or changes the information provided in the previous one.

Norms have been furnished under the withdrawn circular for the procedure for suppliers to provide proof of compliance with pre-requisites mentioned u/s 15(3)(b)(ii) of the Central Goods and Services Tax (CGST) Act, 2017, specifically for the post-supply discounts.

Suppliers through the same withdrawal shall no longer be needed to comply with the procedure specified in the earlier circular for furnishing this proof. CBIC mentioned that the same step has been opted for to ensure uniformity in the GST provisions execution in field formations.

All Chief Commissioners and Director Generals are advised by the board to issue the relevant trade notices for wider dissemination of the same revisions. Businesses, along with the taxpayers, are motivated to acknowledge this development, since it facilitates the conditions of compliance for the suppliers proposing discounts.

The documentation burden might be lessened under the same decision, and provide clarity in the treatment of discounts under GST.

Read GST Circular No. 253/2025