The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) reversed an addition of Rs. 9.99 lakh that had been made u/s 69C of the Income Tax Act, 1961.

This addition was related to cash payments made for credit card bills, which were initially classified as unexplained by the tax authorities, citing them as derived from agricultural income. The tribunal’s decision underscores the need for a thorough examination of the sources of income and expenditures in tax assessments.

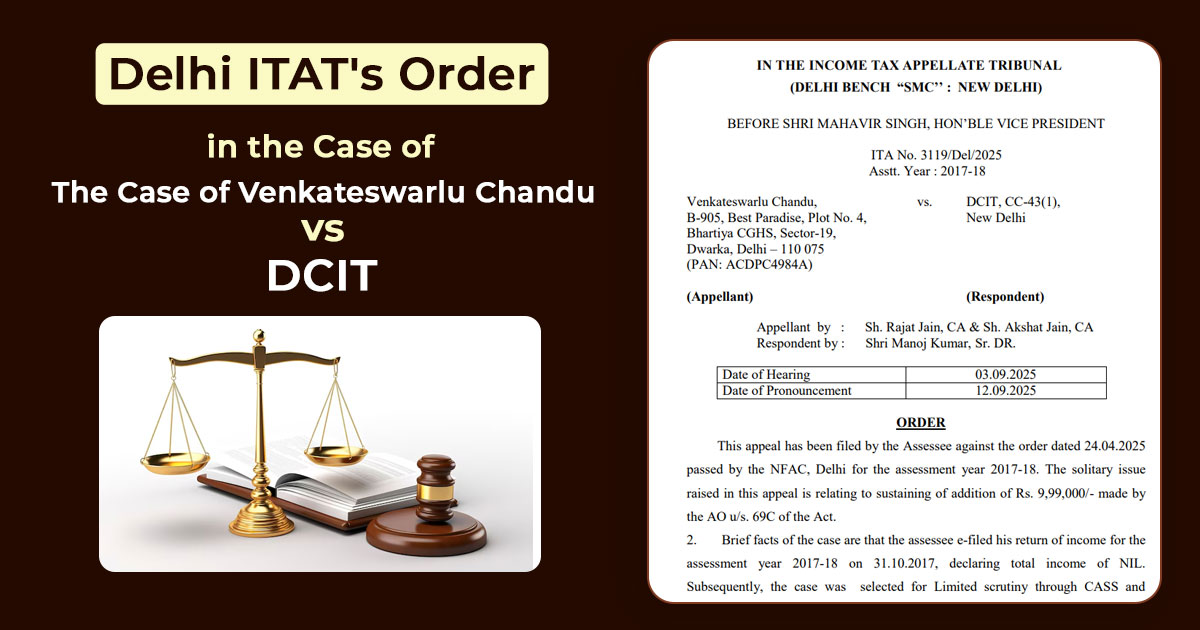

Venkateswarlu Chandu, the appellant-assessee, submitted his income tax return for the Assessment Year 2017-18 on October 31, 2017, reporting NIL income. The case was then selected for limited scrutiny by the Centralised Attribution Selection System (CASS), following which notices were issued.

During the scrutiny proceedings, he claimed to have earned agricultural income amounting to Rs. 23,10,000, which he stated he deposited in cash to settle credit card bills in Delhi.

As per the assessing officer, the income was made in Nellipudi Village, Andhra Pradesh, and the appellant does not furnish a perfect explanation for transporting cash of more than 1800 km to Delhi. Therefore, the cash payments of Rs 9,99,000 for the credit card bills were added to his income under section 69C.

The opinion of the AO has been kept by the Commissioner of Income Tax(Appeals) [CIT(A)], citing that it was improbable for the appellant to carry cash from Nellipudi rather than depositing it locally, and payments were also made in Hyderabad, Vijayawada, Guntur, and Secunderabad. The dissatisfied taxpayer approached the tribunal.

The counsel of the taxpayer, the addition of Rs. 9,90,000/- has been incorrectly validated by the Commissioner of Income-tax (Appeals) as unexplained cash payments of credit card bills u/s 69C, based merely on suspicion and conjecture.

As per him, the explanation of the payment source was rejected without any proof to the contrary. He said that the payments were made via agricultural income, which the AO had earlier accepted in assessment.

The counsel of the department relied on the orders of the lower authorities.

A single-member bench, presided over by Vice President Mahavir Singh, determined that the addition of ₹9,99,000 was founded solely on speculation. The court observed that the reasoning for the cash payments was dismissed without substantial evidence to support the claims.

It said that the payments were from agricultural income made in the year that the AO had accepted in the assessment, and which the CIT(A) has considered. As the payment source was not in dispute and the addition rested on an assumption, the tribunal held that it was unexplained.

As per that, the tribunal removed the addition and permitted the appeal of the taxpayer.

| Case Title | Venkateswarlu Chandu vs. DCIT |

| Case No. | ITA No. 3119/Del/2025 |

| Appellant by | Sh. Rajat Jain, and Sh. Akshat Jain |

| Respondent by | Shri Manoj Kumar |

| Delhi ITAT | Read Order |