For Indian taxpayers looking to utilise the GST Amnesty Scheme before the June 30, 2025, deadline, the GSTN has clarified the conditions. According to Section 128A, a full waiver of pending interest and penalty is applicable only if the eligible taxpayer has already paid the disputed tax amount on or before March 31, 2025.

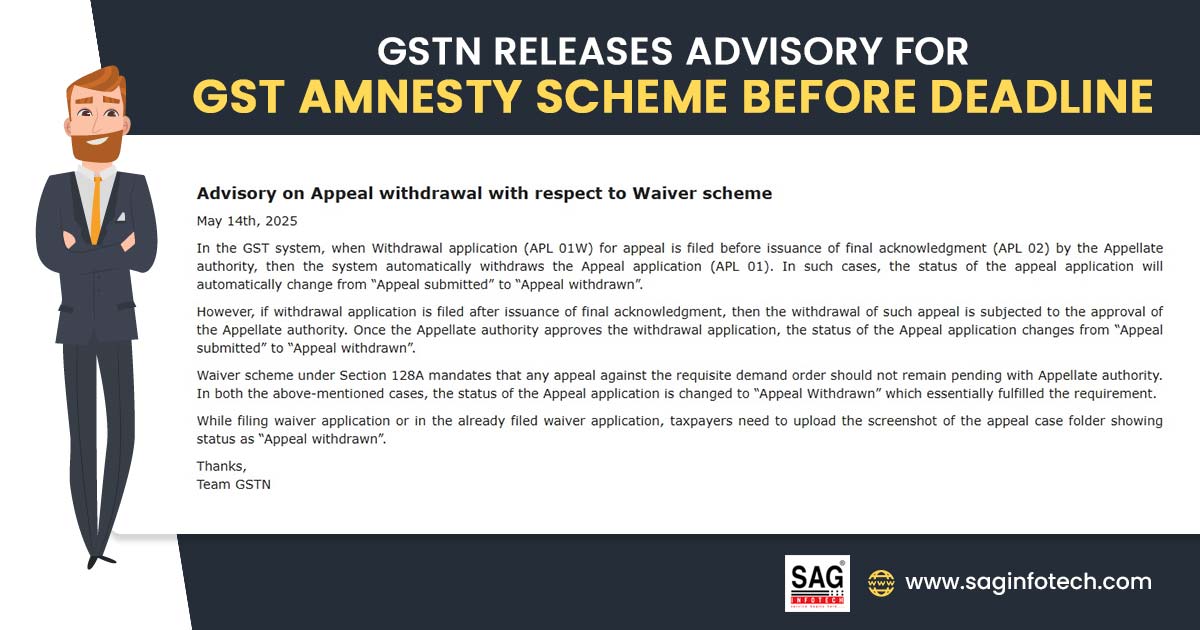

On May 14, 2025, GST mentioned that the qualified taxpayer who filed the GST tax on or before March 31, 2025, would be required to upload the screenshot of the appeal case folder, which specified the status as ‘Appeal withdrawn’.

It must be done when filing a waiver applicable or if the application is furnished before then, by editing the already submitted exempted application.

As per the experts, the GST amnesty scheme applies to taxpayers who will be supported by the GSTN without looking towards the due litigation case to be withdrawn officially by the court or the appellate authority registrar.

The very step is effective as multiple times the court and the appellate authority consume months, if not weeks, to enrol the withdrawal of the case requests by the taxpayers.

Before the GSTN initiative, the taxpayer needed to wait for months or weeks till the pending GST case was withdrawn officially by the courts or the appellate authority.

Read Also: Latest Official Updates Under GST by the Indian Government

Now, only the submission of a screenshot of the withdrawal application is enough to show that a taxpayer has applied to withdraw the case; no withdrawal request submission proof is required to be submitted to be honoured by the courts or the appellate authority.

Whenever the courts or the appellate authority accepts the withdrawal request, then the taxpayers would be required to attach the withdrawal order within 1 month in the GST portal under rule 164(7) of the CGST rules.

The same GSTN initiative supports taxpayers in applying the GST Amnesty scheme by not waiting for their pending litigation case to be withdrawn by the court or the appellate authority registrar.