Based on a WhatsApp image found on an employee’s mobile phone, and without any corroborative evidence, an addition under Section 69A of the Income Tax Act, 1961, cannot be upheld, the Income Tax Appellate Tribunal (ITAT), Mumbai Bench, ruled. The bench termed it a ‘dumb document’.

The assessee, Rucha Consultancy LLP, filed its return with an income of ₹24.87 crore. AO completed the assessment following a search u/s 132 of the Act by discovering a total income of Rs 47.75 crore. The taxpayer’s claim was the addition of Rs 2.10 crores u/s 69A established on an image retrieved from the phone of Ashish Chhangani, a personal assistant of the promoter group, Prashant Nilawar.

The questioned image, sourced from the smartphone of Chhangani, reflected entries marked as “in” and “out” along with numerical values, which were interpreted as lakhs of rupees.

It was acknowledged by Chhangani that the image was forwarded to him via other employees and was not made by him. He, via an affidavit, retracted his statement. The taxpayer disowned the image and any link with the alleged unaccounted transactions.

The Assessing Officer (AO) proceeded with additions, treating ₹2.10 crore as unexplained money under Section 69A and ₹1.99 crore as unexplained expenditure under Section 69C of the Income Tax Act.

While the Commissioner of Income Tax (Appeals) [CIT(A)] upheld the ₹2.10 crore addition, it deleted the ₹1.99 crore addition, noting that the disbursements were sourced from the same alleged receipts.

However, the bench comprising Anikesh Banerjee (Judicial Member) and B.R. Baskaran (Accountant Member) observed that the image lacked any reference to the taxpayer’s name, contained unclear figures, and used “Kg” as a cryptic abbreviation purportedly representing lakhs.

Chhangani did not prepare the image or own it, and it was forwarded to him. No cash was discovered, and no proof concerning linking the image to the assessee or establishing ownership of any unexplained money was there, the Tribunal said.

Read Also: ITAT Surat: WhatsApp Pics Alone Don’t Prove Income Without Verification

Therefore, the image was held to be a dumb document, a term used in tax jurisprudence to designate documents not having evidentiary value without corroboration.

The bench referred to several precedents, including ITAT rulings in Prashant Nilawar, Shri Manchukonda Shyam, and Shankar Nebhumal Uttamchandani, as well as the Supreme Court’s decision in Common Cause v. Union of India.

It held that vague or unverified documents cannot serve as valid grounds for making additions. The Tribunal further emphasised that for Section 69A of the Income Tax Act to be invoked, the assessee must be shown to possess or own unexplained assets—criteria that were not met in this case.

The order of CIT(A) has been set aside by the Mumbai bench and asked to remove Rs 2.10 crore, keeping that the AO had not explained in making additions grounded only on a WhatsApp image.

Since Rs 1.99 crore of alleged expenditure was arrived from the same Rs 2.10 crore and no grounds were there post-removal of the latter, the tribunal dismissed the appeal of the revenue contesting its removal by CIT(A).

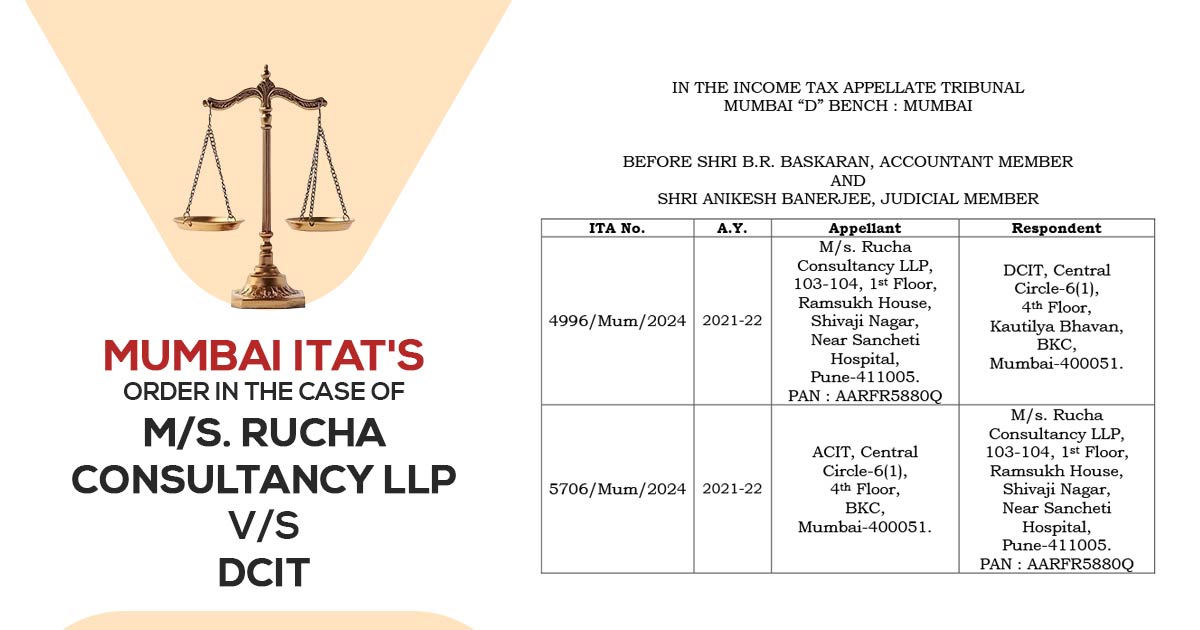

| Case Title | M/s. Rucha Consultancy LLP vs. DCIT |

| Case No. | ITA Nos. 4996/Mum/2024 & 5706/Mum/2024 |

| For The Petitioner | Shri Nishit Gandhi, Ms. Aadnya Bhandari |

| For The Respondents | Smt. Sanyogita Nagpal |

| ITAT Mumbai | Read Order |