The Central Board of Direct Taxes (CBDT) has issued Notification No. 40/2025, dated April 29, 2025, which announces the Income-tax (Twelfth Amendment) Rules, 2025. These modifications to the Income-tax Rules of 1962 will take effect on April 1, 2025. The modifications will affect the Income Tax Return (ITR) filing for the Assessment Year 2025-26.

Top Takeaways

- Updated ITR-1 (Sahaj) and ITR-4 (Sugam) Forms Released

For AY 2025-26, the revised ITR-1 and ITR-4 forms are now applicable

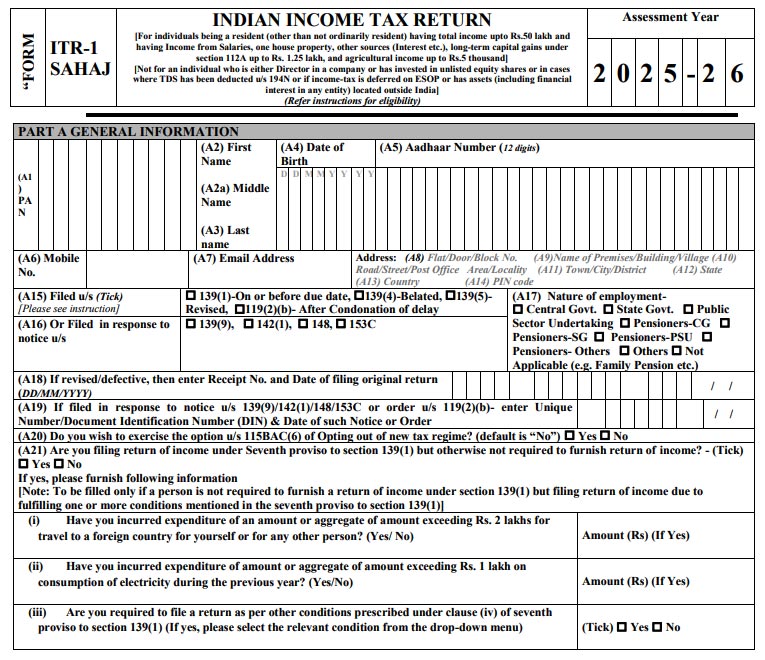

ITR-1 is for resident individuals (excluding normally resident) with a combined income of up to Rs 50 lakh. This includes salary income, one residential property, additional sources (such as interest), and long-term capital gains of up to Rs 1.25 lakh under section 112A.

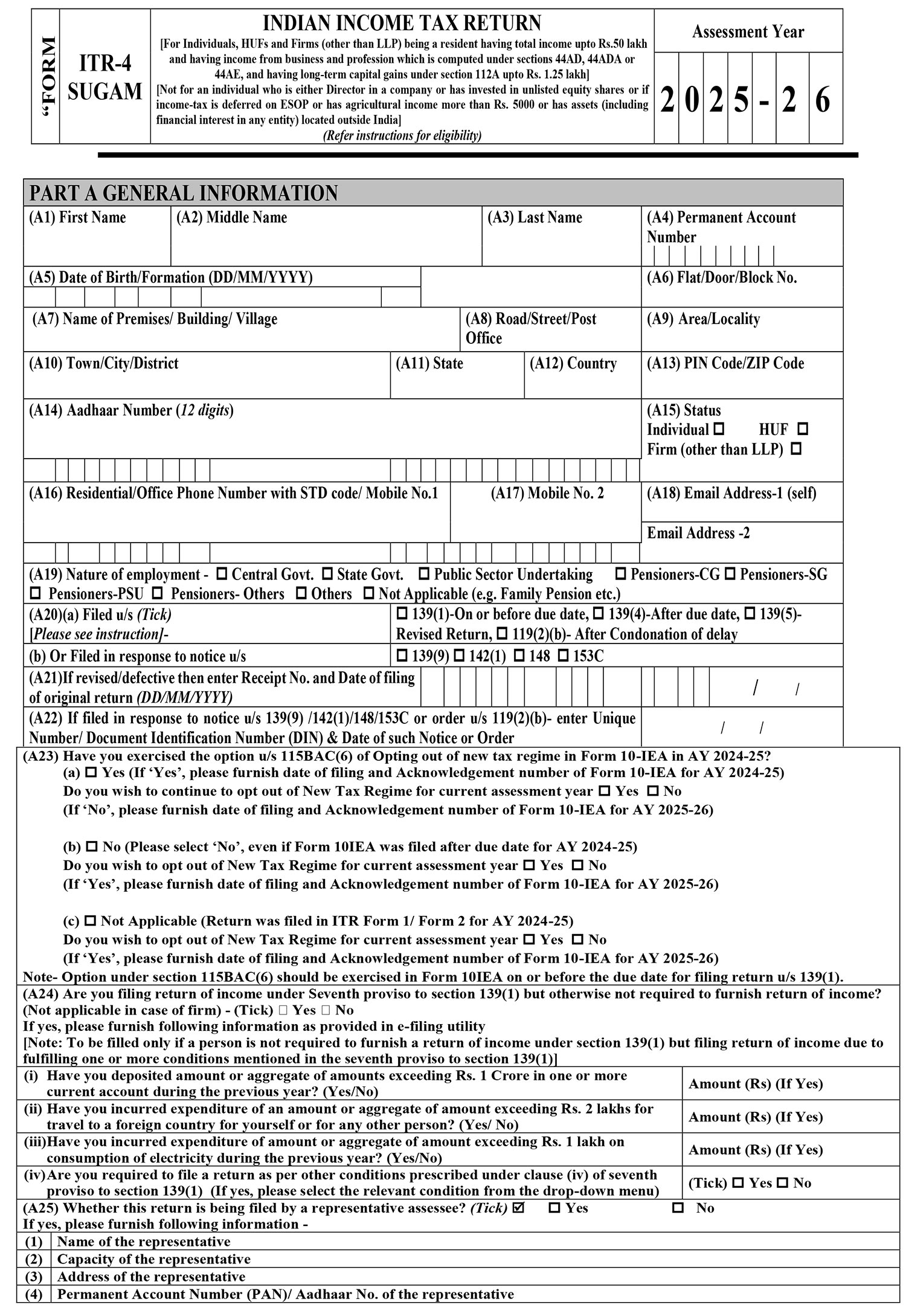

Likewise, ITR-4 applies to resident persons, Hindu Undivided Families (HUFs), and corporations (excluding LLPs) with a total income of up to Rs 50 lakh from business or profession u/s 44ADA, 44AD or 44AE.

- Transparency on Reporting of Capital Gains

The new forms comprise a provision u/s 112A to report the long-term capital gains up to Rs 1.25 lakh, mentioning the eligibility for the easier return filing even when these gains are present.

- Amendment in Rule 12 and Reporting Formats

For non-residents, the amendments in Rule 12 clarify the tax filing requirements and specify the return forms applicable for business income, capital gains, and other specific situations. Additionally, references to outdated assessment years have been updated to reflect the current year.

- Enhanced Disclosure Prerequisites

The taxpayers under Section 115BAC(6) choosing the old regime are mandated to file Form-10-IEA by the deadline u/s 139(1). Also, Schedule particulars for advance tax, TDS, TCS, and established financial transactions have been standardized for precision.

- Understanding Reporting Requirements Under Clause 139(1)(7)

A person who is not obligated to submit the return, though fulfilling specific criteria (e.g., high-value transactions like foreign travel expenses surpassing Rs 2 lakh or electricity consumption over Rs 1 lakh), should file the return and reveal the transaction information.

- Simplifying ITR E-filing and Pre-validation

The forms comprise enhanced sections for e-verification and bank account details to ensure easier refund processing. Accurate IFSC code, account number, and bank selection for refund credit are been outlined.

Read Also: CBDT Releases Excel-Based Utility and JSON Schema for ITR-1 to ITR-7 Forms

What It Means for Taxpayers

Under the notification, assurance of alignment with current fiscal provisions is there, and it also enhances compliance transparency. Precise income classification and deductions at the time of choosing the correct ITR form should be ensured by the taxpayers. Easying e-filing with fewer errors in refund claims has been the objective of the CBDT.

How and Where to File Your Returns

On the Income Tax e-Filing portal, the updated ITR forms can be accessed. Concerning complex income or switching between old and new tax regimes, the taxpayers must learn the guidelines and consult professionals.