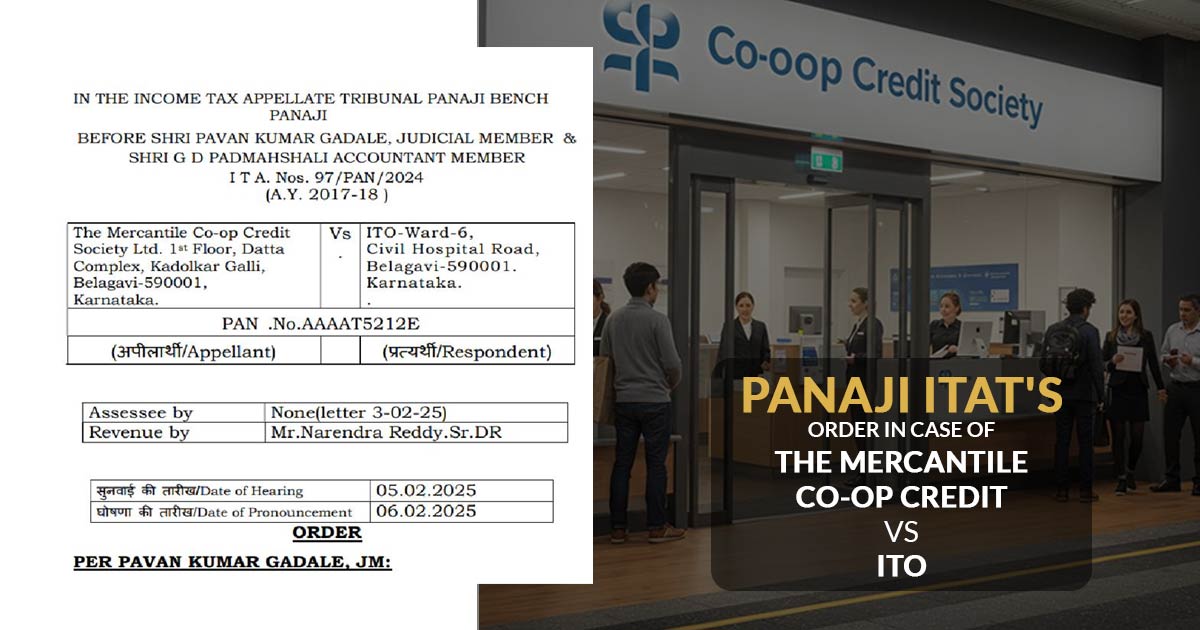

The Income Tax Appellate Tribunal (ITAT) 30h has set aside an ex parte order against The Mercantile Co-op Credit Society Ltd., asking the Commissioner of Income Tax (Appeals) [CIT(A)] to re-examine the refusal of Rs.1.1 crore deduction u/s 80P of the Income Tax Act, 1961. The Panaji bench ruled that the cooperative society will be given another opportunity to present its case, outlining principles of natural justice.

For assessment year 2017-18, the Belagavi-based credit society had submitted its return showing Nil income post claiming Rs 1.10 crore tax deduction under section 80P, which furnishes tax relief before cooperative societies. In scrutiny, the claim has been rejected by the Assessing officer, adding Rs 80.33 lakh as unexplained cash credits u/s 68, resulting in a total evaluated income of Rs 1.91 crore. Via an ex parte order, the CIT(A) then kept the partial additions after the society was unable to answer multiple hearing notices.

ITAT, CIT(A) has issued appropriate notices, but the society may not appear due to some specific conditions. Pavan Kumar Gadale ( Judicial Member) and GD Padmashali (Accountant Member) said that the case merits warranted reconsideration for the section 80P deduction eligibility and Section 68 additions. A 359-day delay in filing the appeal is been considered by the Tribunal, accepting the society’s affidavit elaborating the reasons.

The ITAT has sent the case back to the CIT(A) with instructions to provide the cooperative society an opportunity for a fresh hearing. The bench emphasised that the society must actively engage in the proceedings and submit the necessary proof to ensure a prompt resolution. The appeal was granted for “statistical purposes,” indicating that the case will be reconsidered without bias toward either party.

Also Read: ITAT Upholds Income Tax Section 80P, Affirming Its Role in Promoting Co-Operative Societies

Relief is been furnished to the credit society under the ruling, which now has a chance to confirm its tax claims before the appellate authority. The interruption of ITAT shows the role of the judiciary in ensuring a fair hearing chance even in cases of procedural lapses for taxpayers. The fresh proceedings analyse whether the society is entitled to section 80P advantages and the validity of the cash credit addition made in the original assessment.

| Case Title | The Mercantile Co-op Credit Vs. ITO-Ward-6 |

| Citation | I T A. Nos. 97/PAN/2024 |

| Counsel For Respondent | Mr.Narendra Reddy.Sr.DR |

| ITAT Panaji | Read Order |