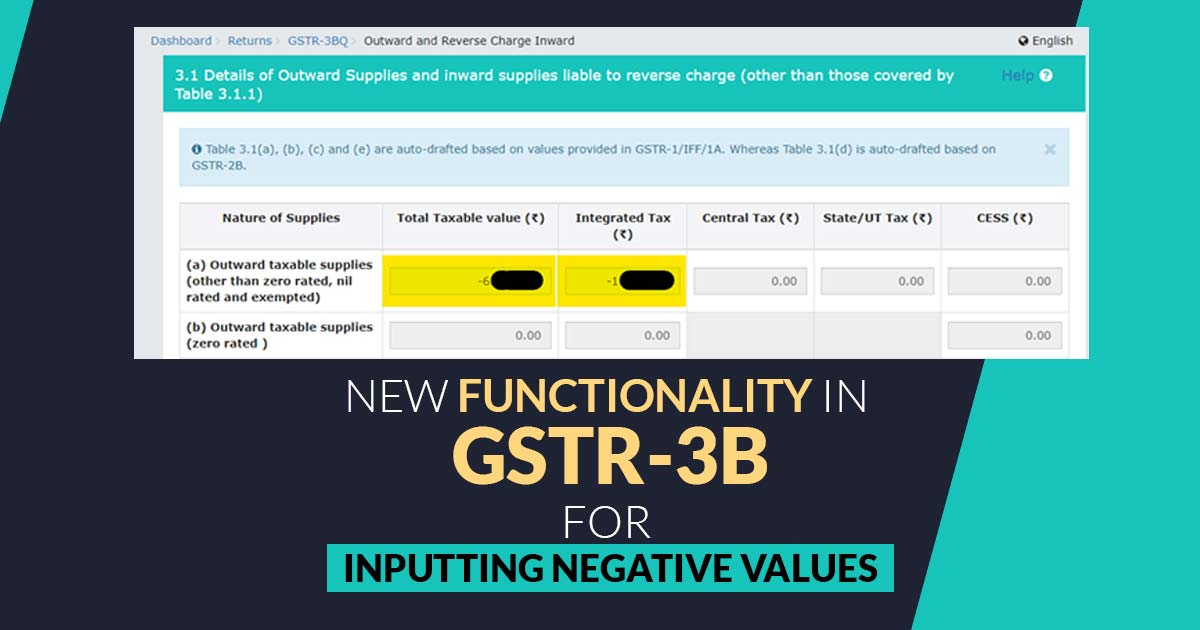

The Goods and Services Tax Network ( GSTN ) in an update to the GST portal has made the functionality to input the negative values in GST return GSTR-3B, permitting the taxpayers to show the precise numbers in the months where there were just the sales return transactions and no sales transactions.

The latest update is set to solve the problems of negative liability in the cases where there were just the sale return transactions in a precise month and no sale transactions, simplifying the compliance to the taxpayers and professionals.

In the tax community, the latest update is been welcomed by all professionals as it was raised as a bigger concern in the decision held before on social media platform X.

Certain seasoned tax professionals also express the late implementation of the basic functionality.

Key Advantages of Allowing Negative Values in GSTR-3B Forms for Businesses

Easier Corrections: If a business witnesses that it has made a mistake in its earlier GST returns then entering a negative value shall make it easier to rectify those errors. The same renders that they can rectify any over-reported amounts without holding to proceed through the tough procedure or submit the additional forms.

Better Precision: The same updated feature supports the businesses precisely showing the amendments in their tax claims or sales numbers. Effective GST filings shall emerge from the option to adjust the values.

Enhanced Tax Compliance: Through making it simpler to make the required adjustments the same revision can motivate the businesses to comply with the tax regulations. The same could assist in lessening the mistakes in reporting the sales or taxes owed, which may otherwise result in fines.

In summary, permitting the negative values in the tax reports could assist the businesses to rectify the mistakes more precisely and ensure that they are reporting their taxes appropriately.