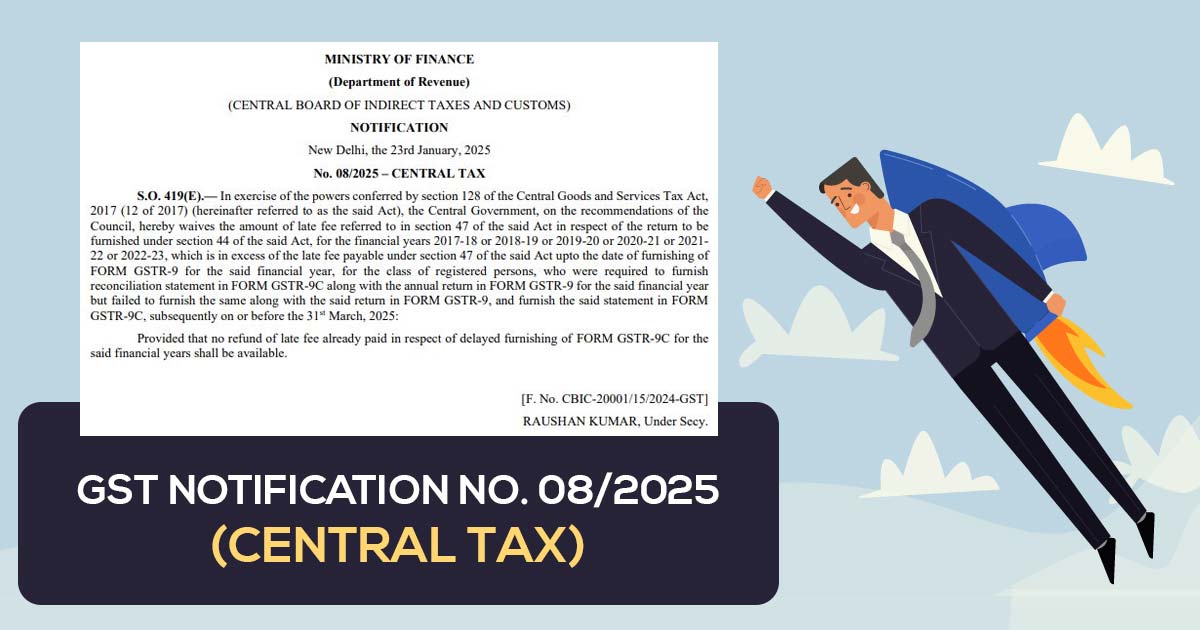

The Ministry of Finance in relief for the taxpayer has issued a Notification No. 08/2025 – Central Tax, dated January 23, 2025, exempting late fees u/s 47 of the Central Goods and Services Tax Act, 2017. The same exemption applies to the registered persons who were needed to submit the FORM GSTR-9C (reconciliation statement) along with their annual return in FORM GSTR-9 but failed to perform it within the stipulated timelines for financial years 2017-18 to 2022-23.

Notification highlights

- Applicability: This applies for the financial years 2017-18, 2018-19, 2019-20, 2020-21, 2021-22, and 2022-23.

- No Refund: The taxpayers who have filed the late fee earlier shall not be qualified for any refund.

- Late Fee Waiver: the late fees of surpassing the amount liable to get paid under section 47 of the CGST Act have been exempted for taxpayers who file their pending FORM GSTR-9C by March 31, 2025.

Due Date of GST Compliance

It is advised to the taxpayer to file their due FORM GSTR-9C reconciliation statements on or before March 31, 2025, to benefit from this waiver.

The same notification has the motive to simplify the compliance load and motivate the timely filing of the due reconciliation statements. The taxpayers are asked to take the benefit of the same relief to prevent the additional penalties and ensure the GST statutory compliance.

“Who have filed same with fine shall not be eligible for refund”.

Indirectly it is punishment to late filer and gift to non filers…what a ……..no word’s to say….