The Surat Bench of Income Tax Appellate Tribunal (ITAT) carried out that the cash deposits made in the demonetization of business income could not be regarded as unexplained cash deposits. Even after that, the tribunal maintained that 20% of the additions were not true as the taxpayer could not verify the source.

The taxpayer Yogesh Kumar Chandrakant an individual who is in the manufacturing of textiles and grey cloth, submitted his Income tax return for the AY 2017-2018 declaring a total income of Rs. 3,63,060. The Assessing Officer (AO) discovered that the taxpayer made a cash deposit of Rs. 26,09,000 in Prime Co-Op Bank Ltd.

The entire cash deposit has been considered unexplained by the AO and levied to tax it u/s 115BBE of the Income Tax Act.

The taxpayer dissatisfied with the AO order furnished a plea to the commissioner of income tax CIT (A). The CIT (A) dismissed the appeal filed by the taxpayer. Dissatisfied with the CIT(A) order the taxpayer submitted a plea to ITAT.

The taxpayer’s counsel furnished that the taxpayer is in the business and has income from manufacturing textile goods during the relevant financial year. He too stressed that the taxpayer has no opportunity but to deposit the cash in the bank account during demonetization.

The taxpayers’ counsel claimed that the taxpayer previously included the cash as profit in his income hence making the same addition shall amount to double taxation. The taxpayers’ counsel relied on various matters and claimed that the cash deposits made from the businesses could not levied to tax u/s 115BBE of the Income Tax Act.

It was claimed by the revenue counsel that the taxpayer was not able to elaborate on the cash deposit source and was just notified that the cash was obtained from an unknown person. It was argued by the counsel that the cash book was self-serving proof.

As per a single bench member comprising Pawan Singh (Judicial member) the cash sales in the business of the taxpayer is normal practice and regarding the facts of the matter the whole cash deposits cannot be treated as unexplained cash deposits.

The tribunal mentioned that the taxpayer could not confirm the cash deposit source, hence 20% of the deposit shall be a reasonable addition to prevent the leakage of the revenue and remove the left addition.

It was said by the tribunal that the income incurred from the business could not be levied to tax u/s 115BBE of the Income Tax Act and asked for tax at a normal rate. The taxpayer’s appeal was partly permitted.

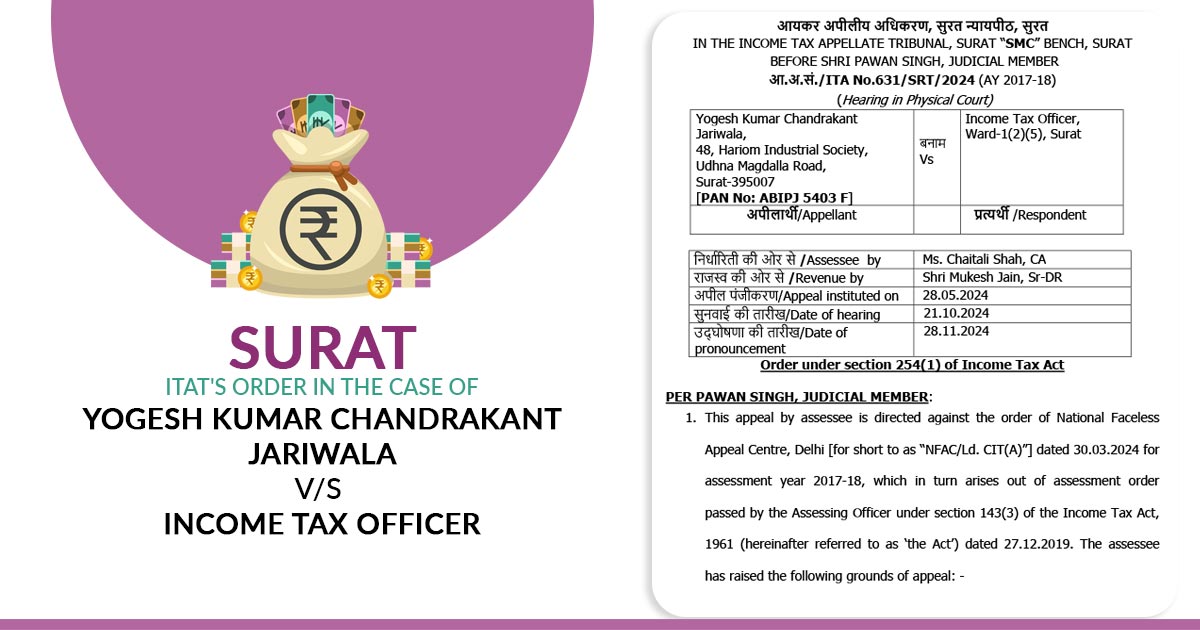

| Case Title | Yogesh Kumar Chandrakant Jariwala vs. Income Tax Officer |

| Citation | ITA No.631/SRT/2024 (AY 2017-18) |

| Date | 28.11.2024 |

| Assessee by | Ms. Chaitali Shah |

| Revenue by | Shri Mukesh Jain |

| Surat ITAT | Read Order |