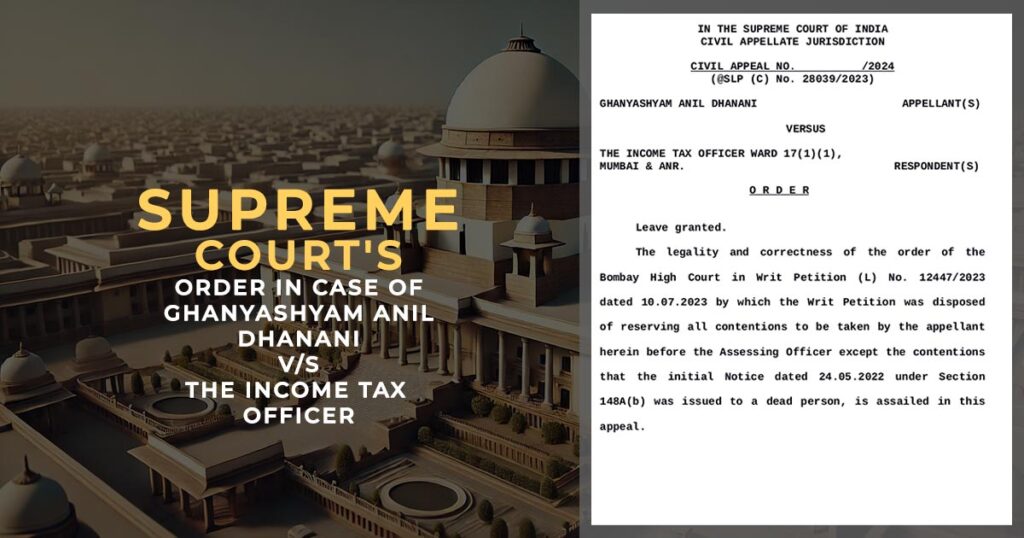

An Order passed by the Bombay High Court regarding the issuance of Notice under Section 148A(b) of the Income Tax Act, 1961 to the legal representatives of a deceased taxpayer has been set aside by the Supreme Court of India.

A Civil Appeal was instituted to the Supreme Court by Ghanyashyam Anil Dhanani concerning a Notice u/s 148A(b) of the Act that had been issued dated 24.05.2022 for the applicant’s late father Anil Pragji Dhanani.

The applicant via his Chartered Accountant has furnished a response before the authorities citing that the implicated Anil Pragji Dhanani had passed away dated 02.09.2016, almost 5 years before the issuance of the Notice.

A response has been furnished by the applicant via his Chartered Accountant before the authorities citing that the implicated Anil Pragji Dhanani had passed away dated 02.09.2016, almost five years before the Notice issuance.

On becoming aware of the Legal Representatives of the late taxpayer, Respondent Income Tax Officer Ward 17(1)(1), Mumbai has furnished an original taxpayer order on 30.07.2022 u/s 148A(d) and another order u/s 148A(d) in the name of the legal representatives of the deceased.

A plea was furnished to the Bombay HC in vain since the HC disposed of the writ petition stating that the legal representatives might take all additional contentions available to them instead of the initial notice having been furnished for a deceased person.

Additional Solicitor General Raghavendra P Shankar, Raj Bahadur Yadav, AOR, Udai Khanna, Sanjay Kumar Yadav, Karan Lahiri, and Navanjay Mahapatra appearing for the Respondents laid reference to the Supreme Court’s decision in Union of India and Ors. vs. Rajeev Bansal (2024) arguing similarity in the discussed problems.

The Petitioner’s representatives Advocates Mihir Naniwadekar, Sreekar Aechuri, Aniket Chauhaan, Arjun Nayyar and AOR Prateek K Chadha furnished that even though the presidential mandates of Rajeev Bansal, the main impediment raised here was that the Bombay High Court had curtailed the Appellants right to invoke a contention – i.e, laying a bar on invoking the contention that the initial notice had been issued for a dead person.

The Division Bench of the Supreme Court included by Justice B.V. Nagarathna and Justice Nongmeikapam Kotiswar Singh marked the reasonable nature of the present petition and allowed the applicant to argue that the impugned Order had been issued in the name of a dead person and considered the order to be defective.

Therefore the Apex court remanded the case to the assessing officer with the reference to regard all the appellants’ contentions on their own merits.

| Case Title | Ghanyashyam Anil Dhanani vs. The Income Tax Officer |

| SLP (C) No. | 28039/2023 |

| Date | 28.11.2024 |

| For Petitioner(s) | Mr. Mihir Naniwadekar, Adv. Mr. Prateek K Chadha, AOR Mr. Sreekar Aechuri, Adv. Mr. Aniket Chauhaan, Adv. Mr. Arjun Nayyar, Adv. |

| For Respondent(s) | Mr. Raghavendra P Shankar, A.S.G. Mr. Raj Bahadur Yadav, AOR Mr. Udai Khanna, Adv. Mr. Sanjay Kumar Yadav, Adv. Mr. Karan Lahiri, Adv. Mr. Navanjay Mahapatra, Adv. |

| Supreme Court Order | Read Order |