The Madras High Court in a ruling carried that the filed amount in excess of the admitted tax obligations can be adjusted against the pre-deposit need for a final hearing chance in Goods and Services Tax (GST) disputes.

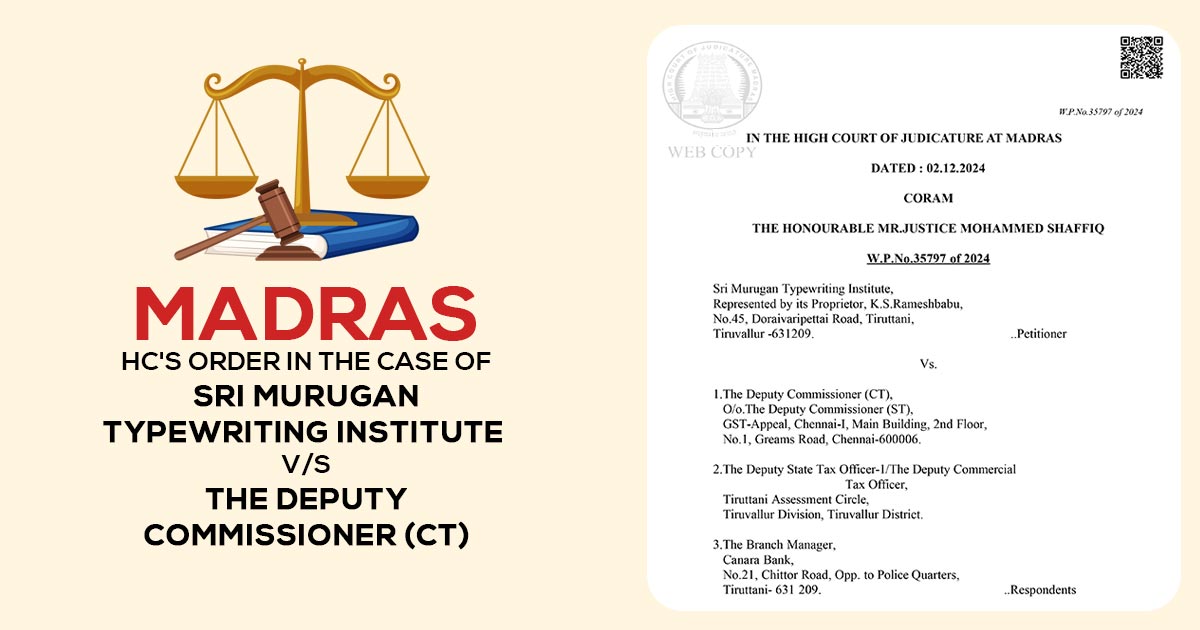

The applicant, Sri Murugan Typewriting Institute, is in teaching typewriting services and registered under the GST Act, 2017, contested an assessment order dated October 27, 2023, regarding the financial year 2019-2020.

From discrepancies between GSTR-1 and GSTR-3B returns, the order came to pass directing to the issuance of notice under Forms ASMT-10 and GST DRC-01. The applicant even after reminding neither furnished a response nor filed the disputed tax culminating in the impugned order.

It was claimed that the notices and the orders were merely uploaded on the GST portal and not served via registered after or personal tendering making them inaccessible. The same absence of access makes participation deprived in adjudication proceedings.

Indeed it was argued by the applicant that beyond 10% which was filed to the appellant authority an excess amount of Rs 10 lakh filed beyond the admitted tax obligation can be adjusted against the 25% Pre-deposit needed for filing objections.

Justice Mohammed Shaffiq, marking that the quoted precedent of M/s. K. Balakrishnan, Balu Cables vs. O/o. the Assistant Commissioner of GST & Central Excise (W.P.(MD) No. 11924 of 2024), set aside the impugned order and asked the applicant to deposit 25% of the disputed tax within 4 weeks.

The respondent authority considering the applicant’s request was asked to acknowledge the excess tax payment on computing the 25% requirement.

The Madras High Court ordered the immediate lifting of bank account attachments levied as part of recovery proceedings, laid on compliance with the pre-deposit directive. Negligence to satisfy the said conditions shall directed in the restoration of the impugned order.

| Case Title | Sri Murugan Typewriting Institute vs. The Deputy Commissioner (CT) |

| Citation | W.P.No.35797 of 2024 |

| Date | 02.12.2024 |

| For Petitioner | Mr.P.Suresh Babu |

| For Respondents | Mr.G.Nanmaran |

| Madras High Court | Read Order |